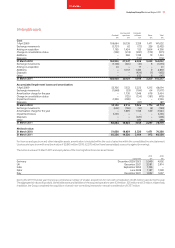

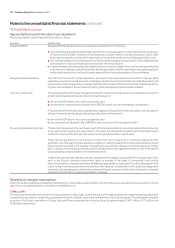

Vodafone 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Vodafone Group Plc Annual Report 2011

Notes to the consolidated nancial statements continued

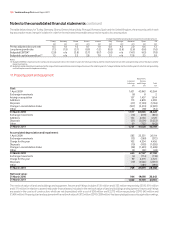

10. Impairment

Impairment losses

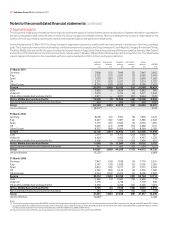

The net impairment losses recognised in the consolidated income statement, as a separate line item within operating profit, in respect of goodwill and

licences and spectrum fees are as follows:

2011(1) 2010 2009

Cash generating unit Reportable segment £m £m £m

Italy Italy 1,050 – –

Spain Spain 2,950 – 3,400

Greece Other Europe(2) 800 – –

Ireland Other Europe(2) 1,000 – –

Portugal Other Europe(2) 350 – –

Turkey Other Europe – (200) 2,250

India India – 2,300 –

Ghana Other Africa, Middle East and Asia Pacific – – 250

6,150 2,100 5,900

Notes:

(1) Impairment charges for the year ended 31 March 2011 relate solely to goodwill.

(2) Total impairment losses in the Other Europe segment were £2,150 million in the year ended 31 March 2011.

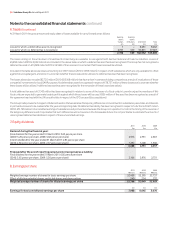

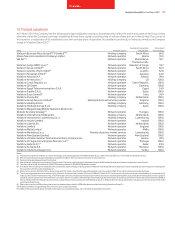

Year ended 31 March 2011

The impairment losses were based on value in use calculations. The pre-tax adjusted discount rates used in the most recent value in use calculation in the

year ended 31 March 2011 are as follows:

Pre-tax adjusted

discount rate

Italy 11.9%

Spain 11.5%

Greece 14.0%

Ireland 14.5%

Portugal 14.0%

During the year ended 31 March 2011 the goodwill in relation to the Group’s investments in Italy, Spain, Greece, Ireland and Portugal was impaired by

£1,050 million, £2,950 million, £800 million, £1,000 million and £350 million, respectively. The impairment charges were primarily driven by increased

discount rates as a result of increases in government bond rates. In addition, business valuations were negatively impacted by lower cash flows within

business plans, reflecting weaker country-level macro economic environments.

The pre-tax risk adjusted discount rates used in the previous value in use calculations at 31 March 2010 are disclosed below.

Year ended 31 March 2010

The net impairment losses were based on value in use calculations. The pre-tax adjusted discount rates used in the value in use calculation in the year

ended 31 March 2010 were as follows:

Pre-tax adjusted

discount rate

India 13.8%

Turkey 17.6%