Vodafone 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 Vodafone Group Plc Annual Report 2011

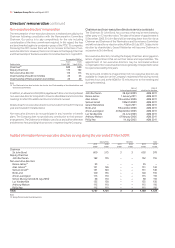

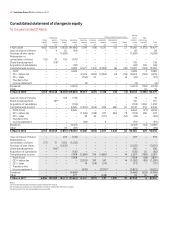

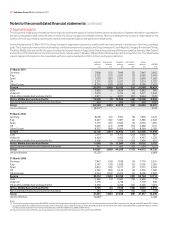

for the years ended 31 March

Equity

Additional Other comprehensive income share- Non-

Share paid-in Treasury Retained Currency Pensions Investment Revaluation holders’ controlling

capital capital(1) shares losses reserve reserve reserve surplus Other funds interests Total

£m £m £m £m £m £m £m £m £m £m £m £m

1 April 2008 4,182 153,139 (7,856) (81,980) 5,974 (96) 4,531 112 37 78,043 (1,572) 76,471

Issue or reissue of shares 3 4 65 (44) – – – – – 28 – 28

Purchase of own shares – – (1,000) – – – – – – (1,000) – (1,000)

Redemption or

cancellation of shares (32) 47 755 (770) – – – – – – – –

Share-based payment – 158(2) – – – – – – – 158 – 158

Acquisition of subsidiaries – – – (87) – – – – – (87) 436 349

Comprehensive income – – – 3,078 12,477 (163) (2,383) 68 (40) 13,037 (103) 12,934

Profit – – – 3,078 – – – – – 3,078 2 3,080

OCI – before tax – – – – 12,614 (220) (2,383) 68 (56) 10,023 (105) 9,918

OCI – taxes – – – – (134) 57 – – 16 (61) – (61)

Transfer to the

income statement – – – – (3) – – – – (3) – (3)

Dividends – – – (4,017) – – – – – (4,017) (162) (4,179)

Other – – – – – – – – – – 16 16

31 March 2009 4,153 153,348 (8,036) (83,820) 18,451 (259) 2,148 180 (3) 86,162 (1,385) 84,777

Issue or reissue of shares – – 189 (119) – – – – – 70 – 70

Share-based payment – 161(2) – – – – – – – 161 – 161

Acquisition of subsidiaries – – – (133) – – – – – (133) 1,636 1,503

Comprehensive income – – – 8,645 (1,365) (104) 209 860 67 8,312 233 8,545

Profit/(loss) – – – 8,645 – – – – – 8,645 (27) 8,618

OCI – before tax – – – – (1,320) (149) 377 860 79 (153) 260 107

OCI – taxes – – – – 39 45 (171) – (12) (99) – (99)

Transfer to the

income statement – – – – (84) – 3 – – (81) – (81)

Dividends – – – (4,131) – – – – – (4,131) (56) (4,187)

Other – – 37 (97) – – – – – (60) 1 (59)

31 March 2010 4,153 153,509 (7,810) (79,655) 17,086 (363) 2,357 1,040 64 90,381 429 90,810

Issue or reissue of shares – – 232 (125) – – – – – 107 – 107

Redemption or

cancellation of shares (71) 71 1,532 (1,532) – – – – – – – –

Purchase of own shares – – (2,125) – – – – – – (2,125) – (2,125)

Share-based payment – 180(2) – – – – – – – 180 – 180

Acquisition of subsidiaries – – – (120) – – – – – (120) 35 (85)

Comprehensive income – – – 7,968 (2,669) 136 (1,882) – 14 3,567 (186) 3,381

Profit/(loss) – – – 7,968 – – – – – 7,968 (98) 7,870

OCI – before tax – – – – (2,053) 190 347 – 14 (1,502) (88) (1,590)

OCI – taxes – – – – 14 (54) (37) – – (77) – (77)

Transfer to the

income statement – – – – (630) – (2,192)(3) – – (2,822) – (2,822)

Dividends – – – (4,468) – – – – – (4,468) (328) (4,796)

Other – – – 271 – – (238) – – 33 56 89

31 March 2011 4,082 153,760 (8,171) (77,661) 14,417 (227) 237 1,040 78 87,555 6 87,561

Notes:

(1) Includes share premium and the capital redemption reserve.

(2) Includes a £24 million tax credit (2010: £11 million credit, 2009: £9 million charge).

(3) Amount for 2011 includes a £208 million tax credit.

Consolidated statement of changes in equity