Vodafone 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84 Vodafone Group Plc Annual Report 2011

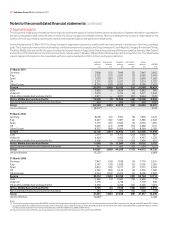

Notes to the consolidated nancial statements

1. Basis of preparation

The consolidated financial statements are prepared in accordance with IFRS

as issued by the IASB. The consolidated financial statements are also

prepared in accordance with IFRS adopted by the European Union (‘EU’), the

Companies Act 2006 and Article 4 of the EU IAS Regulations.

The preparation of financial statements in conformity with IFRS requires

management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts

of revenue and expenses during the reporting period. For a discussion on

the Group’s critical accounting estimates see “Critical accounting estimates”

on pages 77 and 78. Actual results could differ from those estimates. The

estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which

the estimate is revised if the revision affects only that period or in the period

of the revision and future periods if the revision affects both current and

future periods.

Amounts in the consolidated financial statements are stated in

pounds sterling.

Vodafone Group Plc is registered in England (No. 1833679).

2. Signicant accounting policies

Accounting convention

The consolidated financial statements are prepared on a historical cost basis

except for certain financial and equity instruments that have been measured

at fair value.

New accounting pronouncements adopted

IFRS 3 (Revised) “Business Combinations”

The Group adopted IFRS 3 (Revised) on 1 April 2010. The revised standard

introduces changes in the accounting for business combinations that

impacts the amount of goodwill recognised, the reported results in the

period that a business combination occurs and future reported results. The

adoption of this standard is likely to have a significant impact on the Group’s

accounting for future business combinations.

Amendment to IAS 27 “Consolidated and Separate Financial

Statements”

The Group adopted the amendment to IAS 27 on 1 April 2010. The

amendment requires that when a transaction occurs with non-controlling

interests in Group entities that do not result in a change in control, the

difference between the consideration paid or received and the recorded

non-controlling interest should be recognised in equity. In cases where

control is lost, any retained interest should be remeasured to fair value with

the difference between fair value and the previous carrying value being

recognised immediately in the income statement. The adoption of this

standard may have a significant impact on the Group’s accounting for future

transactions involving non-controlling interests.

The adoption of this standard has resulted in a change in presentation within

the statement of cash flows of amounts paid to acquire non-controlling

interests in Group entities that do not result in a change in control. In the year

ended 31 March 2011 £137 million related to such transactions was

classified as “Other transactions with non-controlling shareholders in

subsidiaries” within “Net cash flows from financing activities”, whereas these

amounts would have previously been recorded in “Purchase of interests in

subsidiaries and joint ventures, net of cash acquired” within “Cash flows from

investing activities”. There is no material impact in the comparative period.

New accounting pronouncements not yet adopted

Phase I of IFRS 9 “Financial Instruments” was issued in November 2009 and

is effective for annual periods beginning on or after 1 January 2013. This

standard has not yet been endorsed for use in the EU. The standard

introduces changes to the classification and measurement of financial

assets and the requirements relating to financial liabilities in relation to the

presentation of changes in fair value due to credit risks and the removal of

an exemption from measuring certain derivative liabilities at fair value. The

Group is currently assessing the impact of the standard on its results,

financial position and cash flows.

The Group has not adopted the following pronouncements, which have

been issued by the IASB or the IFRIC. These pronouncements have been

endorsed for use in the EU, unless otherwise stated. The Group does not

currently believe the adoption of these pronouncements will have a

material impact on the consolidated results, financial position or cash flows

of the Group.

■ Amendments to IFRS 1, “Severe hyperinflation and removal of fixed dates

for first-timer adopters”, effective for annual periods beginning on or after

1 July 2011. This standard has not yet been endorsed for use in the EU.

■ Amendments to IFRS 7, “Financial Instruments: Disclosure”, effective for

annual periods beginning on or after 1 July 2011. This standard has not

yet been endorsed for use in the EU.

■ “Improvements to IFRSs”, effective over a range of dates, with the earliest

being for annual periods beginning on or after 1 January 2011.

■ Amendment to IFRS 1, “Limited Exemption from Comparative IFRS 7

disclosures for first time adopters”, effective for annual periods beginning

on or after 1 July 2010.

■ Amendment to IAS 12, “Deferred tax: Recovery of Underlying Assets”,

effective for annual periods beginning on or after 1 January 2012. This

standard has not yet been endorsed for use in the EU.

■Amendment to IAS 24, “Related Party Disclosures – State-controlled

Entities and the Definition of a Related Party”, effective for annual periods

beginning on or after 1 January 2011.

■ Amendment to IFRIC 14, “Prepayments on a Minimum Funding

Requirement”, effective for annual periods beginning on or after

1 January 2011.

■ IFRIC 19, “Extinguishing Financial Liabilities with Equity Instruments”,

effective annual periods beginning on or after 1 July 2010 with early

adoption permitted.

The Group has also not adopted the following pronouncements, all of which

were issued by the IASB on 12 May 2011 and which are effective for annual

periods beginning on or after 1 January 2013. These pronouncements have

not yet been endorsed for use in the EU. The Group has not completed its

assessment of the impact of these pronouncements on the consolidated

results, financial position or cash flows of the Group. However, the Group

currently expects that IFRS 11, “Joint Arrangements”, will have a material

impact on the presentation of the Group’s interests in its joint ventures

owing to the Group’s significant investments in joint ventures as discussed

in note 13.

■IFRS 10, ‘Consolidated Financial Statements’, which replaces parts of IAS

27, ‘Consolidated and Separate Financial Statements and all of SIC-12,

‘Consolidation – Special Purpose Entities’, builds on existing principles by

identifying the concept of control as the determining factor in whether an

entity should be included within the consolidated financial statements of

the parent company. The remainder of IAS 27, ‘Separate Financial

Statements’, now contains accounting and disclosure requirements for

investments in subsidiaries, joint ventures and associates only when an

entity prepares separate financial statements and is therefore not

applicable in the Group’s consolidated financial statements.

■IFRS 11, ‘Joint Arrangements’, which replaces IAS 31, ‘Interests in Joint

Ventures’ and SIC-13, ‘Jointly Controlled Entities – Non-monetary

Contributions by Venturers’, requires a single method, known as the

equity method, to account for interests in jointly controlled entities which

is consistent with the accounting treatment currently applied to

investments in associates. The proportionate consolidation method

currently applied to the Group’s interests in joint ventures is prohibited.

IAS 28, ‘Investments in Associates and Joint Ventures’, was amended as a

consequence of the issuance of IFRS 11. In addition to prescribing the

accounting for investment in associates, it now sets out the requirements

for the application of the equity method when accounting for joint

ventures. The application of the equity method has not changed as a

result of this amendment.

■IFRS 12, ‘Disclosure of Interest in Other Entities’, is a new and

comprehensive standard on disclosure requirements for all forms of

interests in other entities, including joint arrangements, associates,

special purpose vehicles and other off balance sheet vehicles. The