Vodafone 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Vodafone Group Plc Annual Report 2011

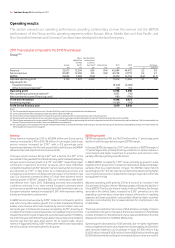

Operating results

This section presents our operating performance, providing commentary on how the revenue and the EBITDA

performance of the Group and its operating segments within Europe, Africa, Middle East and Asia Pacic, and

Non-Controlled Interests and Common Functions have developed in the last three years.

2011 nancial year compared to the 2010 nancial year

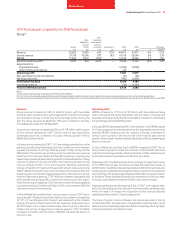

Group(1)(2)

Africa, Non-Controlled

Middle East Interests and

and Asia Common

Europe Pacific Functions(3) Eliminations 2011 2010 % change

£m £m £m £m £m £m £ Organic(4)

Revenue 32,015 13,304 659 (94) 45,884 44,472 3.2 2.8

Service revenue 30,097 12,292 412 (63) 42,738 41,719 2.4 2.1

EBITDA 10,823 3,999 (152) – 14,670 14,735 (0.4) (0.7)

Adjusted operating profit 5,726 1,272 4,820 – 11,818 11,466 3.1 1.8

Adjustments for:

Impairment losses (6,150) (2,100)

Other income and expense(5) (72) 114

Operating profit 5,596 9,480

Non-operating income and expense(6) 3,022 (10)

Net investment income/(financing costs) 880 (796)

Profit before taxation 9,498 8,674

Income tax expense (1,628) (56)

Profit for the financial year 7,870 8,618

Notes:

(1) The Group revised its segment structure on 1 October 2010. See note 3 to the consolidated financial statements.

(2) Current period results reflect average exchange rates of £1:€1.18 and £1:US$1.56.

(3) Common Functions primarily represent the results of the partner markets and the net result of unallocated central Group costs.

(4) Organic growth includes Vodacom at the current level of ownership but excludes Australia following the merger with Hutchison 3G Australia on 9 June 2009.

(5) Other income and expense for the year ended 31 March 2011 included £56 million representing the net loss on disposal of certain Alltel investments by Verizon Wireless. This is included within the

line item “Share of results in associates” in the consolidated income statement.

(6) Non-operating income and expense for the year ended 31 March 2011 includes £3,019 million profit arising on the sale of the Group’s 3.2% interest in China Mobile Limited. For further details see

“Other significant transactions” on page 49.

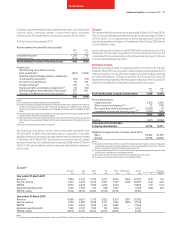

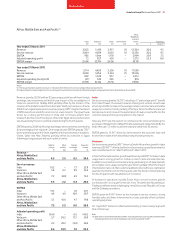

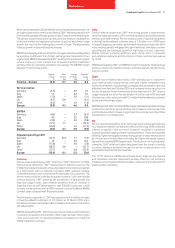

Revenue

Group revenue increased by 3.2% to £45,884 million and Group service

revenue increased by 2.4% to £42,738 million. On an organic basis Group

service revenue increased by 2.1%(*), with a 0.8 percentage point

improvement between the first and second half as both Europe and AMAP

delivered improved organic service revenue trends.

In Europe service revenue fell by 0.4%(*) with a decline of 0.3%(*) in the

second half of the year. Both the UK and Germany performed well delivering

full year service revenue growth of 4.7%(*) and 0.8%(*) respectively. Spain

continued to experience economic pressures which have intensified

competition leading to a 6.9%(*) decline in service revenue. Service revenue

also declined by 2.1%(*) in Italy driven by a challenging economic and

competitive environment combined with the impact of termination rate

cuts. Our improved commercial offers in Turkey have delivered service

revenue growth of 28.9%(*), despite a 52% cut in termination rates which

was effective from 1 April 2010. Challenging economic and competitive

conditions continued in our other central European businesses where

service revenue growth was also impacted by mobile termination rate cuts.

European enterprise revenue increased by 0.5%(*) with improved roaming

activity and important customer wins.

In AMAP service revenue grew by 9.5%(*). Vodacom continued to perform

well, with strong data revenue growth from mobile broadband offsetting

weaker voice revenue which was impacted by two termination rate cuts

during the year. In India service revenue increased by 16.2%(*), driven by an

increase in the mobile customer base and a more stable pricing environment

towards the end of the year. In Qatar the customer base reached 757,000 by

the end of the year, with 45% of the population now actively using Vodafone

services less than two years after launch. On an organic basis, service

revenue in Egypt declined by 0.8%(*) where performance was impacted by

the socio-political unrest during the fourth quarter.

EBITDA and profit

EBITDA decreased by 0.4% to £14,670 million with a 1.1 percentage point

decline in both the reported and organic EBITDA margin.

In Europe EBITDA decreased by 3.7%(*), with a decline in EBITDA margin of

1.7 percentage points, primarily driven by a reduction in service revenue in

most markets and higher investment in acquisition and retention costs,

partially offset by operating cost efficiencies.

In AMAP EBITDA increased by 7.5%(*), driven primarily by growth in India,

together with improvements in Vodacom, Ghana, New Zealand and Qatar,

partially offset by a slight decline in Egypt. The EBITDA margin fell 0.6

percentage points(*), the two main factors behind the decline being higher

recurring licence fee costs in India and the change in regional mix from the

strong growth in India.

Adjusted operating profit grew by 3.1% as a result of an increase in the

Group’s share of results of Verizon Wireless partially offset by the decline in

Group EBITDA. The Group’s share of results in Verizon Wireless, the Group’s

associate in the United States, increased by 8.5%(*) primarily due to the

expanding customer base, robust data revenue, efficiencies in operating

expenses and lower acquisition costs partially offset by higher customer

retention costs reflecting the increased demand for smartphones in the

United States.

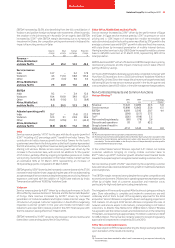

The Group recorded other net income of £5,342 million, primarily in relation

to a £2.8 billion net gain on the sale of the Group’s interests in China Mobile

Limited, £1.8 billion on the settlement of a tax case and £0.5 billion from the

disposal of investments in SoftBank Mobile Corp.

Operating profit decreased by 41.0% primarily due to higher impairment

losses compared to the prior year. Impairment losses totalling £6,150 million

were recorded relating to our businesses in Spain (£2,950 million), Italy

(£1,050 million), Ireland (£1,000 million), Greece (£800 million) and Portugal

(£350 million) primarily resulting from increased discount rates as a result of