Vodafone 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Chief Executive’s review

Financial review of the year

We have performed well this year, combining a better

operational performance with good strategic progress.

Organic service revenue growth improved during the year,

with a strong result from emerging markets and signs of

renewed growth in some parts of Europe.

Customers have adopted data services in increasing numbers,

as smartphones proliferate and the tablet market begins

to take off. Our network investment is becoming a key

differentiator, as we are leading the migration to smartphones

in most of our European operations. Through this and our

continued stronger commercial focus, we are growing our

market share again in most of our markets.

However, markets remain competitive and the economic

environment, particularly across southern Europe, is

challenging. We continue to keep a tight rein on costs

and working capital, allowing us to maintain our levels

of investment while again delivering a strong free cash

ow performance.

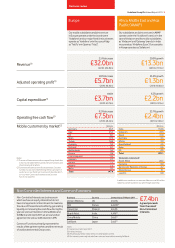

Group revenue for the year was up 3.2% to £45.9 billion, with

Group service revenue up 2.1%(*) on an organic basis and up

2.5%(*) in Q4. Group EBITDA margin fell 1.1 percentage points,

reecting continuing weakness across southern Europe,

higher growth in lower margin markets, and the increased

investment in migrating customers to higher value

smartphones. As a result, EBITDA fell 0.4% year-on-year.

Group adjusted operating prot rose 3.1% to £11.8 billion, at

the top end of our guidance range after allowing for currency

exchange rate movements and despite the additional costs

incurred by Verizon Wireless’s iPhone launch. The main

drivers were good growth in the Africa, Middle East and Asia

Pacic region (‘AMAP’) and a strong performance from

Verizon Wireless.

We recorded impairment charges of £6.1 billion relating to

our businesses in Spain, Greece, Portugal, Italy and Ireland

which were primarily driven by higher discount rates given

sharply increased interest rates. The impairment in Spain

represented approximately half of the total.

Free cash ow was £7.0 billion, at the top end of our medium-

term guidance as a result of our continued nancial discipline

and a strong working capital performance. Capital expenditure

was £6.2 billion, broadly at on last year and in line with our

target, as we focused on widening our data coverage and

improving network performance.

Adjusted earnings per share was 16.75 pence, up 4.0% on last

year, reecting higher protability and lower shares in issue

as a result of the ongoing £2.8 billion buyback programme.

The Board is recommending a nal dividend per share of

6.05 pence, to give total dividends per share for the year of

8.90 pence, up 7.1% year-on-year.

Europe

Organic service revenue in Europe was down 0.4%(*) during the

year and down 0.8%(*) in Q4. This represents a good recovery

on last year (-3.8%)(*) and is the result of two different trends:

the more stable economies of northern Europe (Germany, UK,

Netherlands) were up 2.7%(*), while the rest of Europe was

down 2.9%(*) as a result of the ongoing macroeconomic

challenges. Data revenue growth continued to be strong, but

was offset by continued voice price declines and cuts to mobile

termination rates (‘MTRs’).

Organic EBITDA for Europe was down 3.7%(*) and the EBITDA

margin fell 1.7 percentage points as a result of the decline in

revenue, ongoing competitive activity and higher commercial

costs as we accelerated smartphone adoption.

AMAP

Organic service revenue growth in AMAP was 9.5%(*),

accelerating through the year to a level of 11.8%(*) in Q4. Our

two major businesses, India and Vodacom, reported growth of

16.2%(*) and 5.8%(*) respectively. Our performance in India has

been driven by increasing voice penetration and a more stable

pricing environment. In South Africa, Vodacom continues to be

highly successful in promoting data services.

Organic EBITDA was up 7.5%(*) with EBITDA margin falling 0.6

percentage points(*). The two main factors behind the margin

decline were the adverse impact from higher recurring licence

fee costs in India and the change in regional mix from the

strong growth in India.

Verizon Wireless

Our US associate, Verizon Wireless, has continued to perform

strongly. Organic service revenue was up 5.8%(*) and EBITDA

was up 6.7%(*), with good growth in customers and strong data

take-up. In Q4, Verizon Wireless launched a CDMA version of

the iPhone, ending the exclusivity of its main competitor. Our

share of prots from Verizon Wireless amounted to £4.6 billion,

up 8.5%(*).

Delivering a more valuable Vodafone

In November 2010 we announced an updated strategy,

designed to build on the progress made during my rst two

years as CEO. There are four main elements to the strategy to

build a more valuable Vodafone:

■Focus on key areas of growth potential;

■Deliver value and efficiency from scale;

■Generate liquidity or free cash flow from non-controlled

interests; and

■Apply rigorous capital discipline to investment decisions.

I am pleased to say that we are making good progress in

each area.

“We are gaining or holding market share in

most of our major markets and are leading our

competitors in the drive to migrate customers

to smartphones and data packages.”

10 Vodafone Group Plc Annual Report 2011