Vodafone 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 49

Performance

between debt levels and maturities, and overall market conditions in the

context of the five year business plan. It is expected that Verizon Wireless’

free cash flow will be deployed in servicing and reducing debt in the

near term.

During the year ended 31 March 2011 cash dividends totalling £373 million

(2010: £389 million) were received from SFR. Following SFR’s purchase of

Neuf Cegetel it was agreed that SFR would partially fund debt repayments

by a reduction in dividends between 2009 and 2011 inclusive. In April

2011 we announced an agreement to dispose of our 44% interest in SFR.

We will also receive a final dividend from SFR of €200 million (£176 million)

on completion of the transaction. Future cash flows will be reduced by the

loss of dividends from SFR.

Verizon Communications Inc. has an indirect 23.1% shareholding in

Vodafone Italy and under the shareholders’ agreement the shareholders

have agreed to take steps to cause Vodafone Italy to pay dividends at least

annually, provided that such dividends will not impair the financial

condition or prospects of Vodafone Italy including, without limitation, its

credit standing. During the 2011 financial year Vodafone Italy paid

dividends net of withholding tax totalling €325 million to Verizon

Communications Inc.

Given Vodacom’s strong financial position and cash flow generation, the

Vodacom board has decided to increase its dividend payout ratio

from 40% to approximately 60% of headline earnings for the year ended

March 2011.

Acquisitions

We invested £183 million (2010: £1,777 million), net of cash and cash

equivalents acquired, in acquisition activities during the year.

Other significant transactions

On 10 September 2010 we sold our entire 3.2% interest in China Mobile

Limited for a total consideration of £4.3 billion before tax and transaction

costs. Future cash flows will be reduced by the loss of dividends from China

Mobile Limited.

On 9 November 2010 we agreed to sell to SoftBank Corp. of Japan our

interests which were originally received as part of the proceeds from the

sale of Vodafone Japan in 2006, for a total consideration of ¥412.5 billion

(£3.1 billion). ¥212.5 billion (£1.6 billion) of the consideration was received

in December 2010 and ¥200 billion (£1.5 billion) is expected to be received

in April 2012.

On 30 March 2011 the Essar Group exercised its underwritten put option

over 22.0% of Vodafone Essar Limited (‘VEL’) following which, on 31 March

2011, we exercised our call option over the remaining 11.0% of VEL owned

by the Essar Group. The consideration due under these two options is

US$5 billion (£3.1 billion). The Group does not believe that there is any legal

requirement to withhold tax in respect of these transactions but as discussed

in detail under ‘Legal proceedings’ on page 122, if the Authority for

Advanced Rulings directs tax to be withheld, this amount is anticipated to be

approximately an additional US$1 billion.

On 3 April 2011 we announced an agreement to sell our entire 44% interest

in SFR to Vivendi for a cash consideration of €7.75 billion (£6.8 billion).

Subject to customary competition authority and regulatory approvals,

the transaction is expected to complete during the second calendar quarter

of 2011.

Treasury shares

The Companies Act 2006 permits companies to purchase their own shares

out of distributable reserves and to hold shares in treasury. While held in

treasury, no voting rights or pre-emption rights accrue and no dividends are

paid in respect of treasury shares. Treasury shares may be sold for cash,

transferred (in certain circumstances) for the purposes of an employee

share scheme or cancelled. If treasury shares are sold, such sales are

deemed to be a new issue of shares and will accordingly count towards the

5% of share capital which the Company is permitted to issue on a non

pre-emptive basis in any one year as approved by its shareholders at the

AGM. The proceeds of any sale of treasury shares up to the amount of the

original purchase price, calculated on a weighted average price method, is

attributed to distributable profits which would not occur in the case of the

sale of non-treasury shares. Any excess above the original purchase price

must be transferred to the share premium account.

Following the disposal of our 3.2% interest in China Mobile Limited on

10 September 2010, we initiated a £2.8 billion share buyback programme

under the authority granted by our shareholders at the 2010 AGM. In

addition to ordinary market purchases, the Group placed irrevocable

purchase instructions with a number of banks to enable the banks to buy

back shares on our behalf when we may otherwise have been prohibited

from buying in the market. Details of the shares purchased to date, including

those purchased under irrevocable instructions, are shown below:

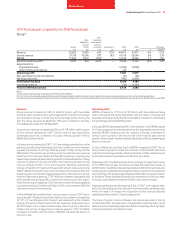

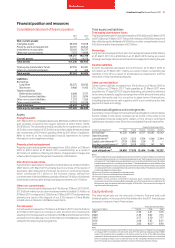

Date of share purchase

Number of

shares

purchased(1)

’000

Average price

paid per share

inclusive of

transaction

costs

Pence

Total number

of shares

purchased

under share

repurchase

programme(2)

’000

Maximum

value of shares

that may yet

be purchased

under the

programme(3)

£m

September 2010 115,400 161.78 115,400 2,613

October 2010 187,500 165.50 302,900 2,303

November 2010 209,400 170.21 512,300 1,947

December 2010 162,900 167.44 675,200 1,674

January 2011 177,090 176.67 852,290 1,361

February 2011 134,700 179.23 986,990 1,120

March 2011 250,900 177.26 1,237,890 675

April 2011 135,100 176.81 1,372,990 436

May 2011 127,000 170.14 1,499,990 268

Total 1,499,990(4) 172.01 1,499,990 220

Notes:

(1) The nominal value of shares purchased is 11 3/7 US cents each.

(2) No shares were purchased outside the publicly announced share buyback programme.

(3) In accordance with shareholder authority granted at the 2010 AGM.

(4) The total number of shares purchased represents 2.9% of our issued share capital at 16 May 2011.

The aggregate amount of consideration paid by the Company for the shares

at 16 May 2011 was £2,580 million.

Following the announcement of the agreement to dispose of our 44%

interest in SFR on 3 April 2011, we also announced that we will return

£4 billion of the net proceeds to shareholders by way of a share buyback

programme. This programme will commence following completion of the

existing £2.8 billion programme.

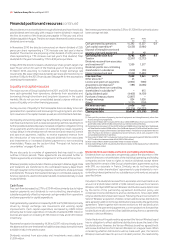

Shares purchased are held in treasury in accordance with sections 724 to

732 of the Companies Act 2006 and are cancelled in accordance with the

Association of British Insurers guidelines. The movement in treasury shares

during the year is shown below:

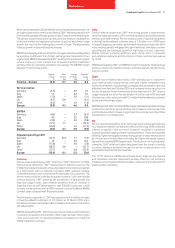

Number

Million £m

1 April 2010 5,146 7,810

Reissue of shares (150) (232)

Purchase of shares 1,238 2,125

Cancelled shares (1,000) (1,532)

31 March 2011 5,234 8,171

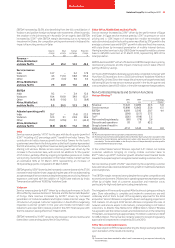

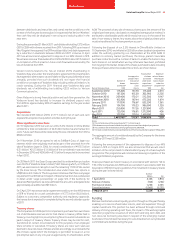

Funding

We have maintained a robust liquidity position throughout the year thereby

enabling us to service shareholder returns, debt and expansion through

capital investment. This position has been achieved through continued

delivery of strong operating cash flows, the impact of the working capital

reduction programme, issuances of short-term and long-term debt, and

non-recourse borrowing assumed in respect of the emerging market

businesses. It has not been necessary for us to draw down on our syndicated

committed bank facilities during the year.