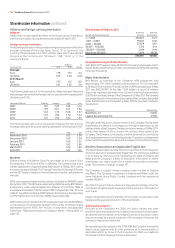

Vodafone 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

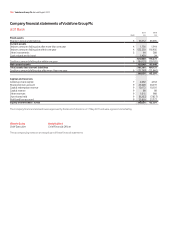

Vodafone Group Plc Annual Report 2011 131

Financials

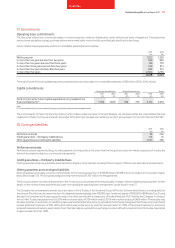

10. Equity dividends

2011 2010

£m £m

Declared during the financial year:

Final dividend for the year ended 31 March 2010: 5.65 pence per share (2009: 5.20 pence per share) 2,976 2,731

Interim dividend for the year ended 31 March 2011: 2.85 pence per share (2010: 2.66 pence per share) 1,492 1,400

4,468 4,131

Proposed after the balance sheet date and not recognised as a liability:

Final dividend for the year ended 31 March 2011: 6.05 pence per share (2010: 5.65 pence per share) 3,106 2,976

11. Contingent liabilities

2011 2010

£m £m

Performance bonds 3 5

Credit guarantees – third party indebtedness 3,113 5,112

Other guarantees and contingent liabilities –224

Performance bonds

Performance bonds require the Company to make payments to third parties in the event that the Company or its subsidiaries do not perform what is

expected of them under the terms of any related contracts.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities.

On 30 March 2011 the Essar Group exercised its underwritten put option over 22.0% of Vodafone Essar Limited (‘VEL’) following which, on 31 March 2011,

the Group exercised its call option over the remaining 11.0% of VEL owned by the Essar Group. The total consideration due under these two options is

US$5 billion (£3.1 billion). The company has guaranteed payment of up to US$5 billion related to these options.

Prior year credit guarantees included £1,821 million relating to debt issued by Vodafone Finance K.K. This facility was repaid in March 2011.

Other guarantees and contingent liabilities

There are no other guarantees in the current year. Prior year other guarantees included a £221 million guarantee relating to a commitment to the Spanish

tax authorities.

As discussed in note 28 to the consolidated financial statements the Company has covenanted to provide security in favour of the trustee of the Vodafone

Group UK Pension Scheme in respect of the funding deficit in the scheme.

The Company has pledged money market funds (£1,387 million), as collateral for the guarantee issued by Vodafone International Holdings B.V. to the Indian

Supreme Court in relation to the contested demand for payment from the Indian tax authority. See page 122 for details.

Legal proceedings

Details regarding certain legal actions which involve the Company are set out in note 28 to the consolidated financial statements.