Vodafone 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

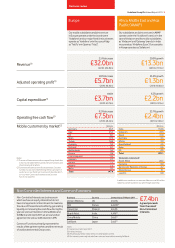

Dividend per share (pence)

7.77 8.31 8.90

Improving operational performance

After the macroeconomic shocks of the previous nancial

year and the business challenges that accompanied them,

our overall operating environment did not deteriorate further

during the year. Most markets saw economic growth recover,

although southern Europe remained weaker.

Within this context, the Group has performed well. We achieved

organic service revenue growth of 2.1%(*), a signicant change

in momentum from last year’s 1.6%(*) decline.

Our adjusted operating prot was up 3.1% at £11.8 billion,

reecting a stable performance in our controlled operations

and strong growth in the contribution from Verizon Wireless,

our US associate.

Data has been the key driver of growth over the last year. Our

customers around the world are increasingly drawn to the

experience of the mobile internet and related services.

Organic data revenue growth was 26.4%(*) achieved through

combining increasingly disciplined pricing structures with a

broad range of devices and a network with a deserved

reputation for market-leading speed and reliability.

We have continued to make substantial investments in our

infrastructure to maintain our advantage over our peers, with a

total capital expenditure outlay of £6.2 billion during the year.

The Group, however, remains highly cash generative, with free

cash ow for the year totalling £7.0 billion.

Delivering value from non-controlled interests

The Board remains committed to achieving full value from

the non-controlled interests within the Group. This has been

an ongoing process, starting with the disposals of our

interests in Belgacom and Swisscom ve years ago, but

inevitably pausing during the nancial crisis when asset

prices were depressed. During the year, we successfully

disposed of our holdings in China Mobile Limited and

SoftBank, generating proceeds of £7.4 billion. Just after the

year end, we were pleased to announce the sale of our 44%

interest in SFR, the number two mobile operator in France.

Increasing shareholder returns

This time last year the Board put in place a target to grow total

dividends per share by at least 7% per annum over the

following three years, and I am pleased to announce a 7.1%

increase in the nal dividend for the March 2011 year, giving a

total payout for the year of 8.90 pence.

In addition, from the proceeds from our portfolio

rationalisation, we have committed £6.8 billion to share

buyback programmes. Combined with the dividend, this

takes total committed shareholder returns during the year

to £15.7 billion, or 17% of our market capitalisation at

31 March 2011. Including share price appreciation, our total

shareholder return for the year was 23%, compared to 8% for

the FTSE 100.

Tax policy

During the year, the Group has been involved in two high

prole tax cases in the UK and India. Our tax policy is

straightforward: we pay taxes that are due in the countries

where we make prots or record capital gains in line with the

prevailing legislation of those jurisdictions.

Our people

I am proud to say every year that our people all around the

world are absolutely committed to serving our customers

and are often the difference between Vodafone and our

competitors. However, this year I must highlight the

extraordinary commitment and dedication shown to

maintaining services to customers in two of our markets

in extremis.

In Egypt, our employees risked their personal safety in a very

volatile environment to keep the network up and running at

a time when mobile communication was more important

than ever, keeping the voice network outage to less than

24 hours.

In New Zealand, our people responded magnicently to the

earthquake that devastated Christchurch in February 2011.

They ensured network coverage was maintained 24 hours a

day despite major power outages and structural damage, and

managed unprecedented levels of demand as the mobile

phone became the primary means of communication for the

people of Christchurch and the rescue services. The team

worked around the clock to ensure the safety of our own staff

and to provide temporary stores and subsidised packages to

support customers’ communications needs.

The Vodafone Foundation

We have continued to fund the good work of the Vodafone

Foundation. Through the Vodafone Foundation and our

network of national afliate foundations we support

communities and societies in the countries in which we

operate. In this nancial year we invested a total of £50 million

in foundation programmes and social causes.

Our World of Difference programme is now in 20 countries

and has so far enabled 1,500 people to take paid time to work

for a charitable purpose of their choice in their own

community or in a developing country.

Our Mobiles for Good programme, combining our

technology with our giving, saw the launch of Instant

Network, a partnership with Telecoms Sans Frontieres which

enables a network to be deployed from three suitcases,

covering 10 sq km for usage of up to 12,000 people. Field trials

are currently underway.

“I leave Vodafone

with huge optimism

for its future”

2009 2010 2011

Chairman’s statement

6 Vodafone Group Plc Annual Report 2011