Vodafone 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Vodafone Group Plc Annual Report 2011

Letter from the Remuneration Committee

Dear Shareholder

Although business conditions were somewhat more stable this year

compared to the prior year, the global economy still remained

challenging. As a consequence, the Remuneration Committee has

maintained its focus on ensuring that the Company’s remuneration

policies in general, and the packages of the executive directors in

particular, were designed to allow the Company to recruit, retain and

motivate its talented people and to ensure those people were fully

incentivised to maximise shareholder value.

The key principles of our reward philosophy are set out on page 63. Each

year the Remuneration Committee reviews these principles as well as the

operation and design of the compensation packages provided to

executives. If changes are required, the Committee is both willing and

able to effect those changes. The key changes made during the year are

detailed below:

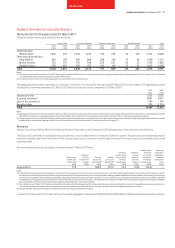

■ In order to reflect the equal importance of growing revenue and profit

we rebalanced the relative weightings of these two measures in the

short-term incentive plan. At the same time we also changed the

definition of profit from adjusted operating profit to EBITDA. Details of

this are on page 65.

■ In order to simplify the long-term incentive awards both the

co-investment requirement and the matching awards are now

defined in terms of a percentage of gross salary. Details of this plan are

on page 64.

■ In order to ensure greater alignment with shareholders we have

re-emphasised the importance of share ownership for executives and

have introduced share ownership goals to all our operating company

chief executives and to the rest of the senior leadership team. Details

of the current ownership levels are on page 63 where it is noted that

at the year end the value of shares held by the Executive Committee

exceeded £15 million.

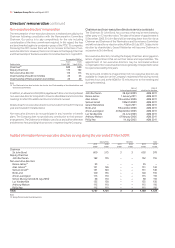

■ Finally after reviewing base salaries for the Executive Committee it was

decided appropriate to make some modest salary increases. Details of

the increases for the executive directors are found on page 67 but it

should be noted that the average increase for the Executive Committee

is 3% which is in line with general increases for employees of the Group

based in the UK.

As in previous years the Remuneration Committee has had dialogue with

its shareholders about the changes and appreciates the feedback from

them. The Remuneration Committee will continue to take an active

interest in investors’ views and the voting on the remuneration report.

As such, it hopes to receive your support at the AGM on 26 July 2011.

Luc Vandevelde

Chairman of the Remuneration Committee

17 May 2011

Directors’ remuneration

Remuneration Committee

The Remuneration Committee is comprised to exercise independent

judgement and consists only of independent non-executive directors. In

anticipation of the retirement of Simon Murray on 27 July 2010, the Board

appointed Samuel Jonah to the Remuneration Committee. Further details

can be found on page 58.

Remuneration Committee

Chairman Luc Vandevelde

Committee members Samuel Jonah (from 1 June 2010)

Simon Murray (until 27 July 2010)

Anthony Watson

Philip Yea

The Remuneration Committee regularly consults with the Chief Executive

and the Group HR Director on various matters relating to the appropriateness

of awards for executive directors and senior executives, though they are not

present when their own compensation is discussed. In addition, the Group

Reward and Policy Director provides a perspective on information provided

to the Committee, and requests information and analyses from external

advisors as required. The Deputy Group Company Secretary advises the

Committee on corporate governance guidelines and acts as secretary to

the Committee.

Management attendees at Remuneration

Committee meetings

Chief Executive Vittorio Colao

Group HR Director Ronald Schellekens

Group Reward and Policy Director Adrian Jackson

Deputy Group Company Secretary Philip Howie

External advisors

The Remuneration Committee appointed Towers Watson (‘TW’) and

PricewaterhouseCoopers LLP (‘pwc’) as independent advisors in 2007.

During the year TW supplied market data and advice on market practice and

governance and pwc provided performance analyses and advice on plan

design and performance measures. The advisors also provided advice to the

Company on general human resource and compensation related matters.

In addition, pwc provided a broad range of tax, share scheme and advisory

services to the Group during the year.

As noted in his biographical details on page 53 of this annual report,

Philip Yea sits on an advisory board for pwc. In light of their role as advisor to

the Remuneration Committee on remuneration matters, the Committee

continue to consider this position and have determined that there is no

conflict or potential conflict arising.

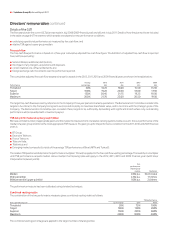

Meetings

The Remuneration Committee had five meetings during the year. The

Committee’s work during these meetings and throughout the year included,

but was not limited to:

■ a review of the total compensation packages of the executive directors

and the most senior management of the company;

■ approval of the global short-term incentive bonus framework and targets;

■ approval of the 2011 global short-term incentive bonus payout;

■ approval of the long-term incentive framework, targets and 2011

grant levels;

■ approval of the July 2008 global long-term incentive vesting level;

■ approval of the introduction of share ownership goals to all operating

company chief executive officers and selected senior leadership

individuals below the Board and Executive Committee;

■ a review of the current UK corporate governance environment and the

implications for our company;

■ a review of the director’s remuneration report; and

■ a review of Chairman’s fees.

On an annual basis, the Committee’s effectiveness is reviewed as part of the

evaluation of the Board.