Vodafone 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 101

Financials

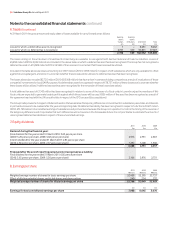

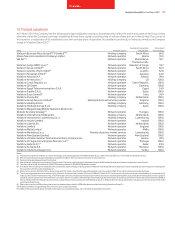

The table below shows the key assumptions used in the value in use calculations.

Assumptions used in value in use calculation

Italy Spain Greece Ireland Portugal Turkey India Ghana

% % % % % % % %

Pre-tax adjusted discount rate 11.9 11.5 14.0 14.5 14.0 14.1 14.2 20.8

Long-term growth rate 0.8 1.6 2.0 2.0 1.5 6.1 6.3 6.3

Budgeted EBITDA(1) (1.0) – 1.2 2.4 (1.2) 16.8 16.5 41.4

Budgeted capital expenditure(2) 9.6 – 11.3 7.8 – 10.6 10.7 – 12.3 9.4 – 11.6 12.4 – 14.1 10.0 – 16.6 12.9 – 22.7 7.3 – 41.3

Notes:

(1) Budgeted EBITDA is expressed as the compound annual growth rates in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating units of the plans used for

impairment testing.

(2) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating

units of the plans used for impairment testing.

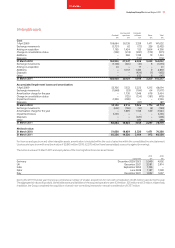

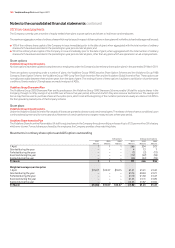

The table below shows, for Turkey, India and Ghana, the amount by which each key assumption must change in isolation in order for the estimated

recoverable amount to be equal to its carrying value.

Change required for the carrying value

to equal the recoverable amount(1)

Turkey India Ghana

pps pps pps

Pre-tax adjusted discount rate 5.6 1.1 6.9

Long-term growth rate (19.6) (1.0) n/a

Budgeted EBITDA(2) (4.7) (2.2) (8.7)

Budgeted capital expenditure(3) 7.0 2.5 8.9

Notes:

(1) The recoverable amount for Greece, which was impaired at 30 September 2010, equals the carrying value at 31 March 2011.

(2) Budgeted EBITDA is expressed as the compound annual growth rates in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating units of the plans used for

impairment testing.

(3) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating

units of the plans used for impairment testing.

The changes in the following table to assumptions used in the impairment review would, in isolation, lead to an (increase)/decrease to the aggregate

impairment loss recognised in the year ended 31 March 2011:

Italy Spain Greece Ireland Portugal All other

Increase Decrease Increase Decrease Increase Decrease Increase Decrease Increase Decrease Increase Decrease

by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps by 2 pps

£bn £bn £bn £bn £bn £bn £bn £bn £bn £bn £bn £bn

Pre-tax adjusted discount rate (2.4) 1.0 (1.5) 2.2 (0.2) – (0.2) 0.3 (0.3) 0.4 (0.7) –

Long-term growth rate 1.0 (2.4) 2.2 (1.3) – (0.1) 0.2 (0.1) 0.4 (0.3) – (0.7)

Budgeted EBITDA(1) 1.0 (2.0) 1.4 (1.3) – (0.2) 0.2 (0.2) 0.3 (0.3) – –

Budgeted capital expenditure(2) (1.1) 1.0 (1.0) 1.0 (0.1) – (0.1) 0.3 (0.2) 0.2 – –

Notes:

(1) Budgeted EBITDA is expressed as the compound annual growth rates in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating units of the plans used for

impairment testing.

(2) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating

units of the plans used for impairment testing.

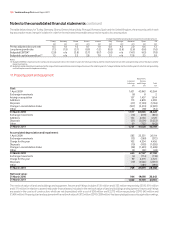

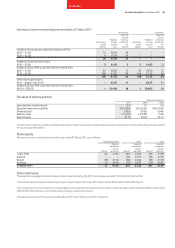

31 March 2010

The estimated recoverable amount of the Group’s operations in India equalled its respective carrying value at 31 March 2010 and, consequently, any

adverse change in key assumptions would, in isolation, cause a further impairment loss to be recognised. The estimated recoverable amount of the Group’s

operations in Turkey, Germany, Ghana, Greece, Ireland, Italy, Portugal, Romania, Spain and the UK exceeded their carrying value by approximately

£130 million, £4,752 million, £18 million, £118 million, £259 million, £1,253 million, £1,182 million, £372 million, £821 million and £1,207 million respectively.

The table below shows the key assumptions used in the value in use calculations.

Assumptions used in value in use calculation

India Turkey Germany Ghana Greece Ireland Italy Portugal Romania Spain UK

% % % % % % % % % % %

Pre-tax adjusted

discount rate 13.8 17.6 8.9 24.4 12.1 9.8 11.5 10.6 11.5 10.2 9.6

Long-term growth rate 6.3 7.7 1.0 5.2 1.0 1.0 – 0.5 2.1 1.5 1.5

Budgeted EBITDA(1) 17.5 34.4 n/a 20.2 3.9 0.8 (0.1) n/a (2.5) (0.7) 4.9

Budgeted capital

expenditure(2)

13.4 –

30.3

8.3 –

32.5 n/a

8.4 –

39.6

11.1 –

13.6

7.4 –

9.6

8.2 –

11.4 n/a

12.0 –

19.0

9.1 –

10.9

9.3 –

11.2

Notes:

(1) Budgeted EBITDA is expressed as the compound annual growth rates in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating units of the plans used for

impairment testing.

(2) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial ten years for Turkey and Ghana and the initial five years for all other cash generating

units of the plans used for impairment testing.