Vodafone 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 51

Performance

Under the terms and conditions of the €4.2 billion and US$4.2 billion

syndicated committed bank facilities lenders have the right, but not the

obligation, to cancel their commitments and have outstanding advances

repaid no sooner than 30 days after notification of a change of control. This

is in addition to the rights of lenders to cancel their commitment if we

commit an event of default; however, it should be noted that a material

adverse change clause does not apply.

The facility agreements provide for certain structural changes that do not

affect the obligations to be specifically excluded from the definition of a

change of control.

The terms and conditions of the €0.4 billion loan facility maturing on

14 February 2014 are similar to those of the €4.2 billion and US$4.2 billion

syndicated committed bank facilities with the addition that, should our

Turkish operating company spend less than the equivalent of €0.8 billion on

capital expenditure, we will be required to repay the drawn amount of the

facility that exceeds 50% of the capital expenditure.

The terms and conditions of the €0.4 billion loan facility maturing 12 August

2015 are similar to those of the €4.2 billion and US$4.2 billion syndicated

committed bank facilities with the addition that, should our Italian operating

company spend less than the equivalent of €1.5 billion on capital

expenditure, we will be required to repay the drawn amount of the facility

that exceeds 18% of the capital expenditure.

The loan facility agreed on 15 September 2009 provides €0.4 billion of seven

year term finance for the Group’s virtual digital subscriber line (‘VDSL’)

project in Germany. The terms and conditions are similar to those of the

€4.2 billion and US$4.2 billion syndicated committed bank facilities with the

addition that should the Group’s German operating company spend less

than the equivalent of €0.8 billion on VDSL related capital expenditure, the

Group will be required to repay the drawn amount of the facility that exceeds

50% of the VDSL capital expenditure.

The Group entered into an export credit agency loan agreement on

29 September 2009 for US$0.7 billion. The terms and conditions of the

facility are similar to those of the €4.2 billion and US$4.2 billion syndicated

committed bank facilities with the addition that the Company is permitted

to draw down under the facility based on the eligible spend with Ericsson up

until the final drawdown date of 30 June 2011. Quarterly repayments of any

drawn balance commenced on 30 June 2010 with a final maturity date of

19 September 2018.

Furthermore, certain of our subsidiaries are funded by external facilities

which are non-recourse to any member of the Group other than the

borrower due to the level of country risk involved. These facilities may only

be used to fund their operations. At 31 March 2011 Vodafone Essar had

facilities of INR 281 billion (£3.9 billion) of which INR 262 billion (£3.7 billion)

is drawn. Vodafone Egypt has a partly drawn EGP 1.2 billion (£121 million)

syndicated bank facility of EGP 4.0 billion (£418 million) that matures in

March 2014. Vodacom had fully drawn facilities of ZAR 8.1 billion

(£741 million), US$120 million (£73 million) and TZS 87 billion (£36 million),

Vodafone Americas has a US$1.4 billion (£871 million) US private placement

with a maturity of 17 August 2015 and Ghana had a fully drawn facility of

US$75 million (£47 million) with a final maturity of 15 March 2018.

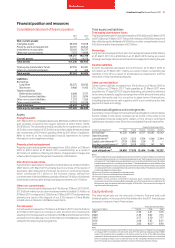

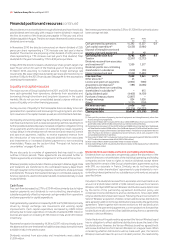

In aggregate we have committed facilities of approximately £15,703 million,

of which £7,247 million was undrawn and £8,456 million was drawn at

31 March 2011.

We believe that we have sufficient funding for our expected working

capital requirements for at least the next 12 months. Further details

regarding the maturity, currency and interest rates of the Group’s gross

borrowings at 31 March 2011 are included in note 22 to the consolidated

financial statements.

Financial assets and liabilities

Analyses of financial assets and liabilities including the maturity profile

of debt, currency and interest rate structure are included in notes 18 and 22

to the consolidated financial statements. Details of our treasury

management and policies are included within note 21 to the consolidated

financial statements.

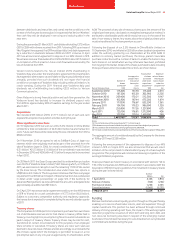

Option agreements and similar arrangements

Potential cash outflows

In respect of our interest in the Verizon Wireless partnership, an option

granted to Price Communications, Inc. by Verizon Communications Inc. was

exercised on 15 August 2006. Under the option agreement Price

Communications, Inc. exchanged its preferred limited partnership interest

in Verizon Wireless of the East LP for 29.5 million shares of common stock in

Verizon Communications Inc. Verizon Communications Inc. has the right,

but not the obligation, to contribute the preferred interest to the Verizon

Wireless partnership diluting our interest. However, we also have the right to

contribute further capital to the Verizon Wireless partnership in order to

maintain our percentage partnership interest. Such amount, if contributed,

would be US$0.8 billion.

Our aggregate direct and indirect interest in Vodafone Essar Limited (‘VEL’),

our Indian operating company, is 59.9% at 31 March 2011. We have call

options to acquire shareholdings in companies which indirectly own a

further 7.1% interest in VEL. The shareholders of these companies also have

put options which, if exercised, would require us to purchase the remaining

shares in the respective company. If these options were exercised, which can

only be done in accordance with Indian law prevailing at the time of exercise,

we would have a direct and indirect interest of 67.0% in VEL. On 30 March

2011 the Essar Group exercised its underwritten put option over 22.0% of

VEL following which, on 31 March 2011, we exercised our call option over the

remaining 11.0% of VEL owned by the Essar Group. The consideration due

under these two options is US$5 billion (£3.1 billion). The Group does not

believe that there is any legal requirement to withhold tax in respect of these

transactions but as discussed on page 122, if the Authority for Advanced

Rulings directs tax to be withheld, this amount is anticipated to be

approximately an additional US$1 billion.

Off-balance sheet arrangements

On 7 January 2011 State Bank of India provided a guarantee on our behalf

of INR 85 billion (£1.2 billion) to the Supreme Court of India in relation to the

ongoing litigation in respect of the purchase of Vodafone Essar Limited as

disclosed on page 122. We have counter indemnified State Bank of India for

any amounts payable under this guarantee.

Other than this guarantee we do not have any material off-balance sheet

arrangements as defined in item 5.E.2. of the SEC’s Form 20-F. Please refer

to notes 27 and 28 to the consolidated financial statements for a discussion

of our commitments and contingent liabilities.

Quantitative and qualitative disclosures about market risk

A discussion of our financial risk management objectives and policies and

the exposure of the Group to liquidity, market and credit risk is included

within note 21 to the consolidated financial statements.