Vodafone 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Customer growth will be driven by rising mobile

penetration and GDP growth

The number of customers using mobile services in emerging

markets such as India and Africa has grown rapidly over the

last ten years, increasing by over 17 times compared to nearly

130% in more mature markets such as Europe. In the 2010

calendar year the Indian mobile market increased by more

than 225 million customers, nearly four times the size of

the UK population. The key driver of growth has been a

fundamental need for communication services against a

background of low quality xed infrastructure and strong

economic growth.

Most of the future growth in mobile phone users is expected to

continue to be in emerging markets where mobile penetration

is still only approximately 70% compared with around

130% in Europe, supported by the expectation of continued

strong economic growth. We expect to see between 20 to 40

percentage points of additional penetration by 2014 in

emerging markets(1).

Data is the next major opportunity

Data represents a substantial growth opportunity as only 19%

of our active customers in emerging markets use data services

which is about half the rate in Europe. There are two signicant

opportunities. One is mobile broadband, helped by the lack of

a comprehensive xed broadband infrastructure in emerging

markets. Already in South Africa mobile broadband accounts

for around 90% of all broadband. The other is mobile internet

which we are driving by:

■enhancing the mobile internet experience through

our Opera Mini browser software which provides faster

page downloads;

■driving down the cost of internet enabled handsets

powered by Opera Mini, with prices starting at US$45;

■low day-to-day micro pricing which allows the purchase

of individual data services, for example the download

of a single ring tone; and

■locally relevant content and services in local languages.

Focus on key areas of growth potential:

Emerging markets

Vodafone 252

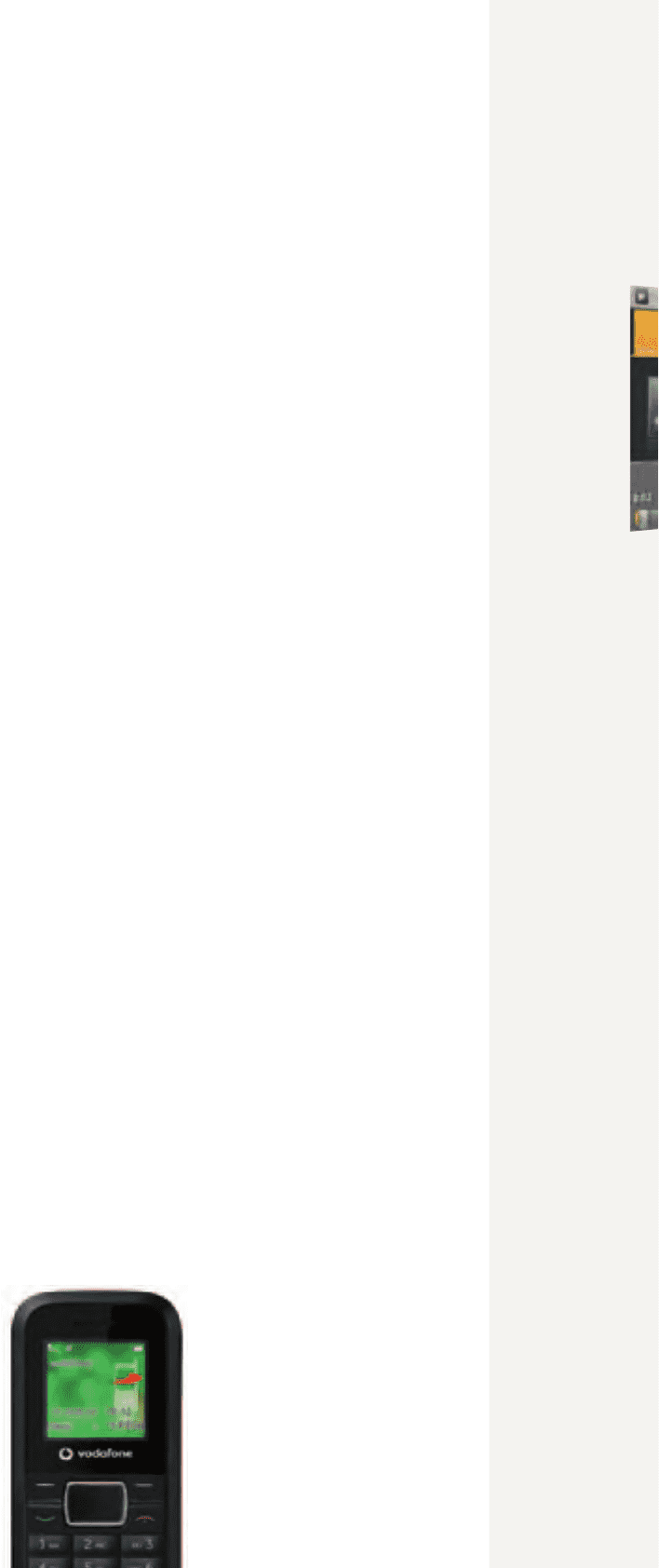

In April 2011 we launched

one of our most affordable

devices which now comes

pre-loaded with Vodafone

M-Pesa for mobile payment

services and a prepaid

balance indicator that helps

customers to keep track

of their phone credit to

avoid overspending.

Development impact of products and services

Mobile services are a key driver of economic development in

emerging markets by increasing access to communications

and mobile-enabled services. We continued to market

Vodafone-branded competitively priced handsets, selling

1.7 million devices during the year in our emerging markets(2).

The uptake of Vodafone M-Pesa, which brings nancial

services to people without bank accounts, continued to grow,

making an increasing contribution to economic development

in communities that lack conventional banking services. It

now has over 20 million customers globally (11 million in

2010), who transferred around US$500 million a month during

the year (up from US$300 million a month in the previous

nancial year). We launched Vodafone M-Pesa in South Africa,

Qatar and Fiji during the year, bringing the total to six markets,

and began pilots in India with ICICI Bank and HDFC Bank.

The Vodafone WebBox (see opposite) was launched in

South Africa in February 2011 and other markets will follow

in the 2012 nancial year.

Strong performance

We are either number one or two in six of our seven

emerging markets based on revenue. This year’s performance

highlights include:

■increased revenue market share in India and Turkey;

■data revenue growth of 43.8%(*) in Vodacom and 37.7%(*)

in Egypt; and

■surpassing the 134 million customer mark in India, an

increase of 34 million over the year.

We launched 3G services in India in February 2011 and

anticipate that this will provide further revenue growth

opportunities going forward.

Notes:

(1) Source: Informa WCIS.

(2) India, Vodacom, Egypt, Turkey, Ghana, Qatar and Fiji.

20 Vodafone Group Plc Annual Report 2011