Vodafone 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business drivers

The following are some of our principal business

drivers which may influence our performance(1)

How we measure our progress

Organic European operating expenses

(£bn)

Return to shareholders (£bn)

Dividends paid

Share buybacks

A number of factors may impact the prices

we charge and therefore the revenue we

receive including:

■competition;

■regulatory decisions and legislation on

mobile termination rates, international

roaming charges and the availability

and cost of spectrum; and

■changes in macroeconomic conditions.

Our business in India has

grown from 28 million

customers at the time of

acquisition in May 2007

to become our largest

market with over

134 million customers

at 31 March 2011.

The net savings from our cost efciency

programmes may be impacted by inationary

pressures and the volume of trafc on our

networks which can affect our operating costs.

Net savings will be used either to invest in

commercial activities or respond to competitor

activity or retained for margin enhancement.

In those businesses in which we have a

non-controlling interest, matters such as the

timing and amount of cash distribution may

require the consent of our partners which can

inuence the level of free cash ow we receive

from that business .

The returns we make on investments may be

impacted by competitor activity, regulatory

decisions and macroeconomic conditions

that affect our commercial position, nancial

performance and the market environment in

which we operate.

The cost of nancing investment and hence

the return on investment may be inuenced by

changes in credit markets or our credit ratings.

Notes:

(4) Excludes India, Ghana and Qatar as these were not owned for the full financial year.

(5) Information not available.

(6) Excludes tax related dividend receipts from Verizon Wireless.

£15.7bn

Total returns to shareholders

over the last three years.

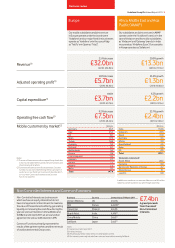

Key revenue performance indicators(2)

2009 2010 2011

Service revenue growth (0.3)% (1.6)% 2.1%

Data revenue growth 25.9% 19.3% 26.4%

Emerging markets service revenue growth(3) 6.4%(4) 7.9% 11.8%

Europe enterprise service revenue growth –(5) (4.8)% 0.5%

Fixed line revenue growth 2.1% 7.9% 5.2%

2009 2010 2011

2009 2010 2011

2009 2010 2011

Dividends and sale proceeds from

non-controlled interests (£bn)

Dividend income from non-controlled interests(6)

Cash received from the sale of non-controlled

interests(7)

4.1 3.9

0.5

3.7

4.5

(7) A further £1.5 billion is expected be received in April 2012 from the sale of the Group’s

interests in SoftBank.

1.0

2.1

4.0 4.1

5.9

0.5

0.4

Vodafone Group Plc Annual Report 2011 13

Business review