Vodafone 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 63

Governance

Reward philosophy

The principles of reward, as well as the individual elements of the reward

package, are reviewed each year to ensure that they continue to support our

company strategy. These principles are set out below.

Competitive reward assessed on a total compensation basis

Vodafone wishes to provide a level of remuneration which attracts, retains

and motivates executive directors of the highest calibre. Within the package

there needs to be the opportunity for executive directors to achieve

significant upside for truly exceptional performance. The package provided

to the executive directors is reviewed annually on a total compensation

basis i.e. single elements of the package are not reviewed in isolation. When

the package is reviewed it is done so in the context of individual and

company performance, internal relativities, criticality of the individual to the

business, experience and the scarcity or otherwise of talent with the relevant

skill set.

The principal external comparator group (which is used for reference

purposes only) is made up of companies of similar size and complexity

to Vodafone, and is principally representative of the European top 25

companies and a few other select companies relevant to the sector. The

comparator group excludes any financial services companies. When

undertaking the benchmarking process the Remuneration Committee

makes assumptions that individuals will invest their own money into

the long-term incentive plan. This means that individuals will need to make

a significant investment in order to achieve the maximum payout.

Pay for performance

A high proportion of total reward will be awarded through short-term and

long-term performance related remuneration. The Remuneration

Committee believes that incorporating and setting appropriate performance

measures and targets in the package is paramount – this will be reflected in

an appropriate balance of operational and equity performance.

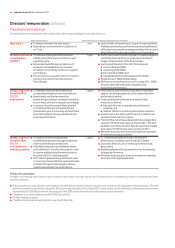

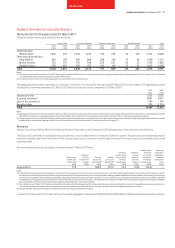

This is demonstrated in the charts below where we see that at target payout

over 70% of the package is delivered in the form of variable pay which rises

to almost 90% if maximum payout is achieved. Fixed pay comprises base

salary and pension contributions, while variable pay comprises the annual

bonus and the long-term incentive opportunity assuming maximum

co-investment and no movement in current share price.

Alignment to shareholder interests

Chief executive

Target

Maximum

Other executive directors(1)

Target

Maximum

Fixed Variable

Base Pension Bonus LTI

27.8% 72.2%

10.1% 89.9%

29.5% 70.5%

11.1% 88.9%

Note:

(1) Proportions for the directors other than the Chief Executive are the same.

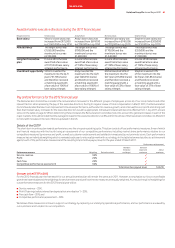

Share ownership is a key cornerstone of our reward policy and is designed

to help maintain commitment over the long-term, and to ensure that the

interests of our senior management team are aligned with those of

shareholders. Executive directors are expected to build and maintain a

significant shareholding in Vodafone shares as follows:

■ Chief Executive – four times base salary; and

■ Other executive directors – three times base salary.

In all cases executives have been given five years to achieve these goals.

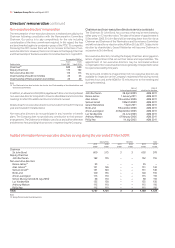

Current levels of ownership and the date by which the goal should be or was

required to be achieved are as shown below:

Goal as a

% of salary

Current %

of salary held(1)

Value of

shareholding

(£m)(1)

Date for goal

to be achieved

Vittorio Colao 400% 460% 4.9 July 2012

Andy Halford 300% 634% 4.4 July 2010

Michel Combes 300% 154% 1.2 June 2014

Stephen Pusey 300% 240% 1.3 June 2014

Note:

(1) Based on a share price at 31 March 2011 of 176.5 pence and includes net intrinsic value of any

option gains.

Collectively the Executive Committee including the executive directors own

8.7 million Vodafone shares, with a value of £15.2 million at 31 March 2011.

Alignment with shareholders is also achieved through the use of total

shareholder return (‘TSR’) measure in the Global Long-Term Incentive

(‘GLTI’) plan.

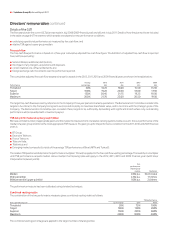

Incentive targets linked to business strategy

When designing our incentives, performance measures are chosen that

support our strategic objectives as shown below:

Strategic objectives Supported by

Focus on key areas of growth potential –

Aiming to deliver organic service revenue

growth of 1 – 4% a year until the year ended

31 March 2014 in five key areas: mobile data,

emerging markets, enterprise, total

communications and new services.

Revenue and relative

performance targets

in the Global Short-

Term Incentive Plan

(‘GSTIP’).

Delivering value and efficiency from scale –

Continuing to drive benefit from the Group’s

scale advantage and maintain our focus

on cost.

EBITDA, free cash

flow and relative

performance targets

in the GSTIP.

Generate liquidity or free cash flow from

non-controlled interests – Aim to seek to

maximise the value of non-controlled interests

through generating liquidity or increasing

free cash flow in order to fund profitable

investments and enhance shareholders returns.

The use of TSR as

a performance

measure in GLTI as

well as the value of

the underlying shares.

Apply rigorous capital discipline to investment

decisions – Continuing to apply capital

discipline to our investment decisions through

rigorous commercial analysis and demanding

investment criteria to ensure any investment

in existing businesses or acquisitions will

enhance value for shareholders.

Free cash flow targets

in both the GSTIP and

GLTI as well as the

TSR target in the GLTI.

Assessment of risk

In setting the balance between base salary, annual bonus and long-term

incentive levels, the Remuneration Committee has considered the risk

involved in the incentive schemes and is satisfied that the following design

elements mitigate the principal risks:

■ the heavy weighting on long-term incentives which reward sustained

performance;

■ the need for short-term incentive payouts to be used to purchase and

hold investment shares in order to fully participate in the long-term

arrangements; and

■ a considerable weighting on non-financial measures in the short-term

plan, which provides an external perspective on our performance

by focusing on customer satisfaction and performance relative to

our competitors.

The Remuneration Committee will continue to consider the risks involved

in the incentive plans on an ongoing basis.