Vodafone 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Vodafone Group Plc Annual Report 2011

Verizon Wireless

In the US, our associate Verizon Wireless has

continued to perform strongly. Organic service

revenue increased by 5.8%(*) led by a 3.1% increase

in the customer base to 88.4 million and strong data

revenue growth driven by increased smartphone

penetration. Verizon Wireless launched 4G LTE

services in December 2010 and began distribution

of the iPhone on its network in February 2011.

Generate liquidity or free cash flow

from non-controlled interests

Non-controlled interests constitute around 40% (based on third

party estimates) of the value of the Group’s assets. We aim to

maximise the value of these interests either by generating

liquidity or increasing free cash ow in order to fund protable

investment and enhance shareholder returns.

Verizon Wireless

Verizon Wireless is our largest non-controlled interest, in which

we have an equity interest of 45%. It is the revenue market leader

in the US and performed strongly this year with service revenue

growth of 5.8%(*). To create additional value we are working

closely with Verizon Wireless on several initiatives that leverage

our combined scale and scope including purchasing of network

equipment, IT and services, technology enhancements and

propositions for multinational companies. We received around

£1.0 billion in dividends this year, in relation to tax related

dividend receipts (see “Dividends from associates and to non-

controlling shareholders” on page 48 for further information),

which was substantially less than our proportionate share of

Verizon Wireless’ free cash ow which shows the material

opportunity for incremental returns.

Polkomtel

Polkomtel trades as Plus in Poland and is a leading operator in

Poland. Along with the four other owners we are exploring

options for a sale of the business.

Bharti Airtel

Bharti is the market leader in India. Following the purchase of

our controlling interest in Vodafone Essar in India in 2007, we

sold 5.6% of our stake in Bharti in 2008 and retained a 4.4%

indirect interest.

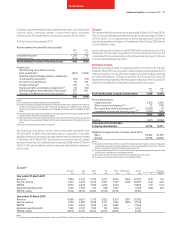

Sale of interests

In September 2010 we sold our 3.2% interest in China Mobile

Limited for £4.3 billion. In November 2010 we sold our interests

in SoftBank of Japan for £3.1 billion and approximately half of

the proceeds have been received to date and used to reduce

the Group’s net debt. The remaining proceeds are expected to

be received in April 2012. In April 2011 we announced the sale

of our 44% interest in SFR, the second largest mobile operator

in France, for £6.8 billion. The transaction, which is subject to

competition authority and regulatory approvals, is expected to

complete during the second calendar quarter of 2011.

Proceeds from the sale of all of these interests are being used

to reduce net debt and committed to a £6.8 billion buyback of

our shares of which £2.6 billion has been completed to date.

39%

Group adjusted

operating prot from

Verizon Wireless

(2010: 36%)