Vodafone 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 121

Financials

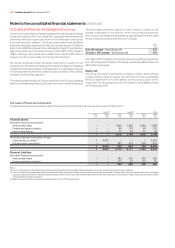

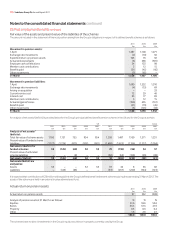

27. Commitments

Operating lease commitments

The Group has entered into commercial leases on certain properties, network infrastructure, motor vehicles and items of equipment. The leases have

various terms, escalation clauses, purchase options and renewal rights, none of which are individually significant to the Group.

Future minimum lease payments under non-cancellable operating leases comprise:

2011 2010

£m £m

Within one year 1,225 1,200

In more than one year but less than two years 958 906

In more than two years but less than three years 746 776

In more than three years but less than four years 638 614

In more than four years but less than five years 602 512

In more than five years 2,344 2,235

6,513 6,243

The total of future minimum sublease payments expected to be received under non-cancellable subleases is £240 million (2010: £246 million).

Capital commitments

Company and subsidiaries Share of joint ventures Group

2011 2010 2011 2010 2011 2010

£m £m £m £m £m £m

Contracts placed for future capital expenditure not provided in the

financial statements(1) 1,786 1,800 338 219 2,124 2,019

Note:

(1) Commitment includes contracts placed for property, plant and equipment and intangible assets.

The commitments of Cellco Partnership (‘Cellco’), which trades under the name of Verizon Wireless, are disclosed within the consolidated financial

statements of Cellco for the year ended 31 December 2010, which are included as an exhibit to our 2011 annual report on Form 20-F filed with the SEC.

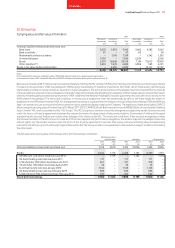

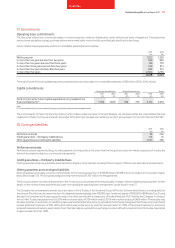

28. Contingent liabilities

2011 2010

£m £m

Performance bonds 94 246

Credit guarantees – third party indebtedness 114 76

Other guarantees and contingent liabilities 1,527 496

Performance bonds

Performance bonds require the Group to make payments to third parties in the event that the Group does not perform what is expected of it under the

terms of any related contracts or commercial arrangements.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities including those in respect of the Group’s associates and investments.

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to the India Supreme Court of INR 85 billion (£1,188 million) in relation to the taxation matter

discussed on page 122. The Group has pledged money market funds (£1,387 million) for this guarantee.

The Group also enters into lease arrangements in the normal course of business which are principally in respect of land, buildings and equipment. Further

details on the minimum lease payments due under non-cancellable operating lease arrangements can be found in note 27.

The Company has covenanted to provide security in favour of the Trustee of the Vodafone Group UK Pension Scheme whilst there is a funding deficit in

the scheme. The initial security was in the form of a Japanese law share pledge over 400,000 class 1 preferred shares of ¥200,000 in BB Mobile Corp. During

the year, the Company and trustee agreed to replace the initial security with a charge over UK index linked gilts (‘ILG’) held by the Company. A charge in

favour of the Trustee was agreed over ILG 2016 with a notional value of £100 million and ILG 2013 with a notional value of £48.9 million. The security may

be replaced either on a voluntary or mandatory basis. As and when alternative security is provided, the Company has agreed that the security cover should

include additional headroom of 33%, although if cash is used as the security asset the ratio will revert to 100% of the relevant liabilities or where the

proposed replacement security asset is listed on an internationally recognised stock exchange in certain defined core jurisdictions, the trustee may decide

to agree a lower ratio than 133%.