Vodafone 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5745

5163 5397

151

5643

165

5593

159

5958

177

6010

179

139

152

120

160

140

200

180

4000

5500

4750

7000

6250

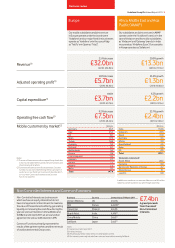

1 Apr 10 1 Jun 10 1 Aug 10 1 Oct 10 1 Dec 10 1 Apr 111 Feb 11

Vodafone (share price in pence) FTSE 100 index

Vodafone share price vs FTSE 100

+23%

Vodafone total

shareholder return

(2011 financial year)

+8%

FTSE 100 total

shareholder return

(2011 financial year)

Across the Group we continue to promote text giving, enabling

our customers to give money simply and free of charge

to support charitable appeals following disasters. Using this

platform we raised over NZ$1.3 million for the Red Cross to

support the people of Christchurch.

The Board

During the year the Board appointed Renee James as a

non-executive director. Renee is Senior Vice President and

General Manager of the Software and Services Group for

Intel Corporation. She joined the Board in January 2011 and it

is clear that her industry knowledge and expertise will make

a strong contribution to the Group through another period

of rapid technological change.

The Board welcomed the publication in February of the

Davies Review on Women on Boards and, in line with its

recommendations, it is our aspiration to have a minimum

of 25% female representation on the Board by 2015. The

Financial Reporting Council is currently consulting on

changes to the UK Corporate Governance Code including

a recommendation that companies adopt a boardroom

diversity policy; we expect to comply with any such

recommendation. The Board recognises the importance of

gender balance throughout the Group and continues to

support our CEO, Vittorio Colao, in his efforts to build a

diverse organisation. Further information can be found in the

Corporate Governance section of this report.

After ve years as Chairman I am retiring from the Board at

the AGM in July. It has been a privilege to chair a Board of such

diverse and rich experience, and to help steer the Group

through the challenges of a dynamic industry and an uncertain

economic environment.

As a Board, our goal has always been to make the right

decisions based on the long-term opportunities for the

business. As a result, we now have an established presence in

a number of emerging markets that offer attractive potential

for sustained growth; and our commitment to maintaining

investment throughout the economic cycle means we have

mobile networks that lead the industry for speed and reliability.

This will be crucial as customers’ expectations grow in line with

their data usage.

Furthermore, we have continually assessed the risks and

opportunities of having capital deployed in some of our

non-controlled interests. This is particularly true of Verizon

Wireless, from which we have not received a dividend (other

than tax related dividend receipts) for six years. It would

arguably have been easier to sell our stake along the way, but

our decision to remain invested has been strongly vindicated

by its exceptional operating performance and strong cash

generation, which have led to a signicant increase in the value

of the asset.

Our approach has led to strong returns to shareholders over

the last ve years. Total shareholder return since July 2006

has been 85%, compared to 22% for the FTSE 100.

I am delighted to welcome Gerard Kleisterlee as Vodafone’s

new Chairman. As CEO of Philips, Gerard spent ten successful

years at the helm of an international consumer technology

business, and the Group is certain to make continued good

progress under his stewardship. I wish him, and the Group, all

the best for the future.

Sir John Bond

Chairman

Vodafone Group Plc Annual Report 2011 7

Business reviewBusiness review