Vodafone 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 95

Financials

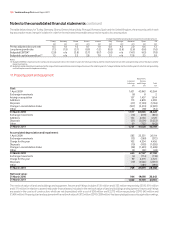

Deferred tax

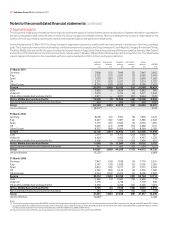

Analysis of movements in the net deferred tax balance during the year:

£m

1 April 2010 (6,344)

Exchange movements 305

Credited to the income statement 183

Credited directly to OCI 117

Credited directly to equity 19

Reclassification to current tax(1) 1,249

Arising on acquisition 3

31 March 2011 (4,468)

Note:

(1) See note below regarding CFC settlement.

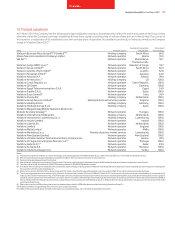

Deferred tax assets and liabilities, before offset of balances within countries, are as follows:

Amount Net

credited/ recognised

(charged) Gross Gross Less deferred tax

in income deferred deferred tax amounts asset/

statement tax asset liability unrecognised (liability)

£m £m £m £m £m

Accelerated tax depreciation (1,374) 253 (3,682) – (3,429)

Tax losses 1,198 27,882 – (25,784) 2,098

Deferred tax on overseas earnings 764 – (1,775) – (1,775)

Other short-term temporary differences (405) 4,890 (2,844) (3,408) (1,362)

31 March 2011 183 33,025 (8,301) (29,192) (4,468)

Analysed in the statement of financial position, after offset of balances within countries, as:

£m

Deferred tax asset 2,018

Deferred tax liability (6,486)

31 March 2011 (4,468)

Amount Net

credited/ recognised

(charged) Gross Gross Less deferred tax

in income deferred deferred tax amounts asset/

statement tax asset liability unrecognised (liability)

£m £m £m £m £m

Accelerated tax depreciation (577) 627 (2,881) (1) (2,255)

Tax losses 493 27,816 – (27,185) 631

Deferred tax on overseas earnings (22) – (4,086) – (4,086)

Other short-term temporary differences 745 4,796 (3,135) (2,295) (634)

31 March 2010 639 33,239 (10,102) (29,481) (6,344)

Analysed in the statement of financial position, after offset of balances within countries, as:

£m

Deferred tax asset 1,033

Deferred tax liability (7,377)

31 March 2010 (6,344)

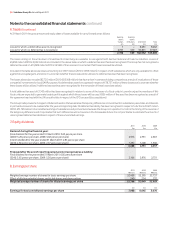

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include the impact of corporate restructurings, the resolution of open issues, future planning

opportunities, corporate acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates.

The Group is routinely subject to audit by tax authorities in the territories in which it operates, and the items discussed below have reached litigation. The

Group holds provisions in respect of the potential tax liability that may arise, however, the amount ultimately paid may differ materially from the amount

accrued and could therefore affect the Group’s overall profitability and cash flows in future periods.

On 22 July 2010 Vodafone reached agreement with the UK tax authorities with respect to the UK Controlled Foreign Company (‘CFC’) tax case. Vodafone

will pay £1.25 billion to settle all outstanding CFC issues from 2001 to date and has also reached agreement that no further UK CFC tax liabilities will arise

in the near future under current legislation. Longer term, no CFC liabilities are expected to arise as a consequence of the likely reforms of the UK CFC regime

due to the facts established in this agreement.

A Spanish subsidiary, Vodafone Holdings Europe SL (‘VHESL’), has resolved its dispute with the Spanish tax authorities regarding the tax treatment of interest

expenses claimed in the accounting periods ended 31 March 2003 and 31 March 2004.