Vodafone 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Vodafone Group Plc Annual Report 2011

Guidance

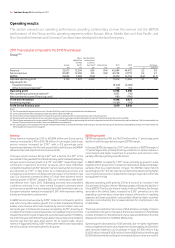

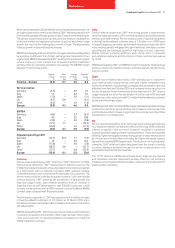

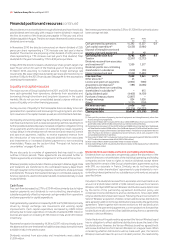

2012 nancial year and medium-term guidance

2011

actual 2012

performance guidance

£bn £bn

Adjusted operating profit 11.8 11.0 – 11.8

Free cash flow 7.0 6.0 – 6.5

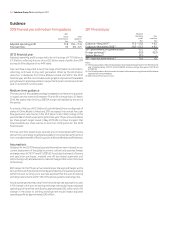

2012 nancial year

Adjusted operating profit is expected to be in the range of £11.0 billion to

£11.8 billion, reflecting the loss of our £0.5 billion share of profits from SFR

as a result of the disposal of our 44% stake.

Free cash flow is expected to be in the range of £6.0 billion to £6.5 billion,

reflecting continued strong cash generation offset by the £0.3 billion

reduction in dividends from China Mobile Limited and SFR in the 2012

financial year, and the more limited working capital improvements available

going forward. Capital expenditure is expected to be at a similar level to last

year on a constant currency basis.

Medium-term guidance

The execution of the updated strategy is targeted to achieve annual growth

in organic service revenue of between 1% and 4% in the period to 31 March

2014. We expect that the Group EBITDA margin will stabilise by the end of

this period.

As a result of the loss of £0.5 billion of cash dividends from our disposals of

stakes in China Mobile Limited and SFR, we expect that annual free cash

flow generation will now be in the £5.5 billion to £6.5 billion range in the

period to March 2014, underpinning the three year 7% per annum dividend

per share growth target issued in May 2010. We continue to expect that

total dividends per share will be no less than 10.18 pence for the 2013

financial year.

The free cash flow target range excludes any incremental benefit that we

derive from our strategy to generate liquidity or incremental cash flow from

non-controlled interests of the Group such as Verizon Wireless and Polkomtel.

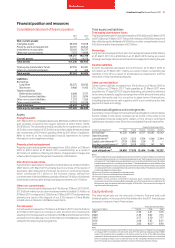

Assumptions

Guidance for the 2012 financial year and the medium-term is based on our

current assessment of the global economic outlook and assumes foreign

exchange rates of £1:€1.15 and £1:US$1.60. It excludes the impact of licence

and spectrum purchases, material one-off tax related payments and

restructuring costs and assumes no material change to the current structure

of the Group.

With respect to the 7% per annum dividend per share growth target, as the

Group’s free cash flow is predominantly generated by companies operating

within the euro currency zone, we have assumed that the euro to sterling

exchange rate remains within 10% of the above guidance exchange rate.

Actual exchange rates may vary from the exchange rate assumptions used.

A 1% change in the euro to sterling exchange rate would impact adjusted

operating profit and free cash flow by approximately £50 million and a 1%

change in the dollar to sterling exchange rate would impact adjusted

operating profit by approximately £50 million.

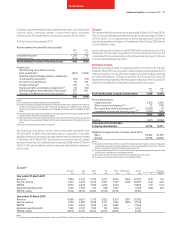

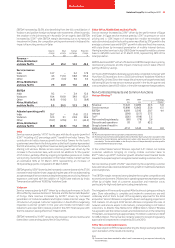

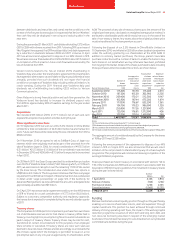

2011 nancial year

Adjusted

operating Free

profit cash flow

£bn £bn

Guidance – May 2010(1) 11.2 – 12.0 > 6.5

Guidance – November 2010(1) 11.8 – 12.2 > 6.5

2011 performance on guidance basis(3) 12.2 7.2

Foreign exchange(1) (0.3) (0.2)

Verizon Wireless(2) (0.1) –

2011 reported performance(3) 11.8 7.0

Notes:

(1) The Group’s guidance reflected assumptions for average exchange rates for the 2011 financial

year of approximately £1:€1.15 and £1:US$1.50. Actual exchange rates were £1:€1.18 and

£1:US$1.56.

(2) The Group’s guidance did not include the impact of the revenue recognition and Alltel related

adjustments in Verizon Wireless.

(3) After Verizon iPhone launch costs.