Vodafone 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 111

Financials

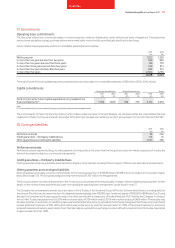

Market risk

Interest rate management

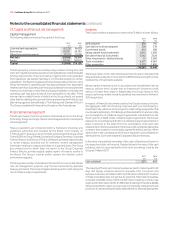

Under the Group’s interest rate management policy, interest rates on

monetary assets and liabilities denominated in euros, US dollars and sterling

are maintained on a floating rate basis except for periods up to six years where

interest rate fixing has to be undertaken in accordance with treasury policy.

Where assets and liabilities are denominated in other currencies interest rates

may also be fixed. In addition, fixing is undertaken for longer periods when

interest rates are statistically low.

At 31 March 2011 71% (2010: 36%) of the Group’s gross borrowings were fixed

for a period of at least one year. For each one hundred basis point fall or rise

in market interest rates for all currencies in which the Group had borrowings

at 31 March 2011 there would be a reduction or increase in profit before tax

by approximately £30 million (2010: increase or reduce by £165 million)

including mark-to-market revaluations of interest rate and other derivatives

and the potential interest on outstanding tax issues. There would be no

material impact on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange its share price

is quoted in sterling. Since the sterling share price represents the value of its

future multi-currency cash flows, principally in euro, US dollars and sterling,

the Group maintains the currency of debt and interest charges in proportion

to its expected future principal multi-currency cash flows and has a policy to

hedge external foreign exchange risks on transactions denominated in other

currencies above certain de minimis levels. As the Group’s future cash flows

are increasingly likely to be derived from emerging markets it is likely that

more debt in emerging market currencies will be drawn.

As such, at 31 March 2011 130% of net debt was denominated in currencies

other than sterling (55% euro, 47% US dollar and 28% other) while 30% of net

debt had been purchased forward in sterling in anticipation of sterling

denominated shareholder returns via dividends and share buybacks. This

allows euro, US dollar and other debt to be serviced in proportion to expected

future cash flows and therefore provides a partial hedge against income

statement translation exposure, as interest costs will be denominated in

foreign currencies. Yen debt is used as a hedge against the value of yen assets

as the Group has minimal yen cash flows.

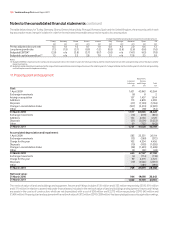

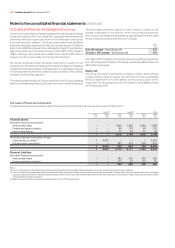

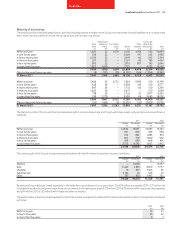

The following table presents ageing of receivables that are past due and

are presented net of provisions for doubtful receivables that have

been established.

2011 2010

£m £m

30 days or less 1,561 1,499

Between 31 – 60 days 100 119

Between 61 – 180 days 85 155

Greater than 180 days 298 183

2,044 1,956

Concentrations of credit risk with respect to trade receivables are limited

given that the Group’s customer base is large and unrelated. Due to this

management believes there is no further credit risk provision required in

excess of the normal provision for bad and doubtful receivables. Amounts

charged to administrative expenses during the year ended 31 March 2011

were £460 million (2010: £465 million, 2009: £423 million) (see note 17).

The Group’s investments in preferred equity and a subordinated loan

received as part of the disposal of Vodafone Japan to SoftBank in the 2007

financial year were disposed of during the year. The Group has a receivable

of £1,488 million (2010: £nil) in relation to the second tranche of

consideration receivable in relation to the disposal.

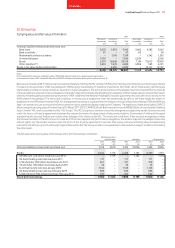

As discussed in note 28 the Group has covenanted to provide security in

favour of the Trustee of the Vodafone Group UK Pension Scheme in respect

of the funding deficit in the scheme. The security takes the form of an

English law pledge over UK index linked government bonds.

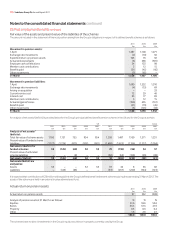

Liquidity risk

At 31 March 2011 the Group had €4.2 billion and US$4.2 billion syndicated

committed undrawn bank facilities and US$15 billion and £5 billion

commercial paper programmes, supported by the €4.2 billion and

US$4.2 billion syndicated committed bank facilities, available to manage

its liquidity. The Group uses commercial paper and bank facilities to

manage short-term liquidity and manages long-term liquidity by raising

funds in the capital markets.

€4.2 billion of the syndicated committed facility has a maturity date of 1 July

2015 and US$4.2 billion has a maturity of 9 March 2016 which may be

extended by a further year if agreed by those banks who have participated

in the facility. Both facilities have remained undrawn throughout the

financial year and since year end and provide liquidity support.

The Group manages liquidity risk on long-term borrowings by maintaining

a varied maturity profile with a cap on the level of debt maturing in any one

calendar year, therefore minimising refinancing risk. Long-term borrowings

mature between one and 26 years.

Liquidity is reviewed daily on at least a 12 month rolling basis and stress

tested on the assumption that all commercial paper outstanding matures

and is not reissued. The Group maintains substantial cash and cash

equivalents which at 31 March 2011 amounted to £6,252 million (2010:

£4,423 million).