Vodafone 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 105

Financials

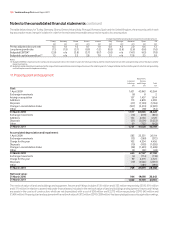

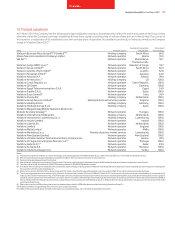

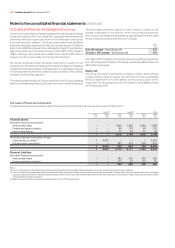

14. Investments in associates

At 31 March 2011 the Company had the following principal associates carrying on businesses which affect the profits and assets of the Group. The

Company’s principal associates all have share capital consisting solely of ordinary shares, unless otherwise stated, and are all indirectly held. The country

of incorporation or registration of all associates is also their principal place of operation.

Country of incorporation Percentage(1)

Name Principal activity or registration shareholdings

Cellco Partnership(2) Network operator US 45.0

Société Française du Radiotéléphone S.A. (‘SFR’)(3) Network operator France 44.0

Safaricom Limited(4)(5) Network operator Kenya 40.0

Notes:

(1) Rounded to nearest tenth of one percent.

(2) Cellco Partnership trades under the name Verizon Wireless.

(3) On 3 April 2011 the Group announced an agreement to sell its entire 44% interest in SFR. See note 32 for further information.

(4) The Group also holds two non-voting shares.

(5) At 31 March 2011 the fair value of Safaricom Limited was KES 61 billion (£456 million) based on the closing quoted share price on the Nairobi Stock Exchange.

The Group’s share of the aggregated financial information of equity accounted associates is set out below. The amounts for the year ended 31 March 2009

include the share of results in Safaricom from 28 May 2008, at which time its consolidation status changed from being a joint venture to an associate.

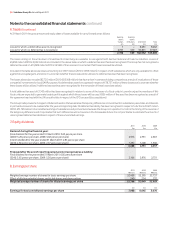

2011 2010 2009

£m £m £m

Share of revenue in associates 24,213 23,288 19,307

Share of result in associates 5,059 4,742 4,091

Share of discontinued operations in associates 18 93 57

2011 2010

£m £m

Non-current assets 45,446 47,048

Current assets 5,588 4,901

Share of total assets 51,034 51,949

Non-current liabilities 5,719 8,295

Current liabilities 6,656 6,685

Non-controlling interests 554 592

Share of total liabilities and non-controlling interests 12,929 15,572

Share of equity shareholders’ funds in associates 38,105 36,377

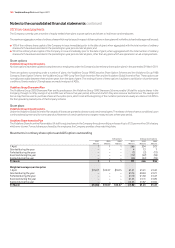

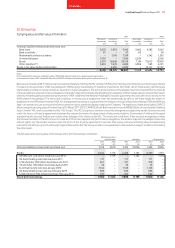

15. Other investments

Non-current other investments comprise the following, all of which are classified as available-for-sale, with the exception of other debt and bonds, which

are classified as loans and receivables, and cash held in restricted deposits:

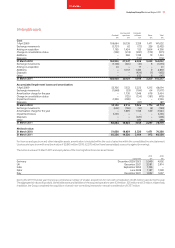

2011 2010

£m £m

Included within non-current assets:

Listed securities:

Equity securities 1 4,072

Unlisted securities:

Equity securities 967 879

Public debt and bonds 3 11

Other debt and bonds 72 2,355

Cash held in restricted deposits 338 274

1,381 7,591

Included within current assets:

Government bonds 610 388

Other 64 –

674 388

At 31 March 2010 listed equity securities included £4,071 million in relation to the Group’s 3.2% interest in China Mobile Limited which was sold in

September 2010 for £4,264 million generating a £3,019 million income statement gain, including income statement recognition of foreign exchange rate

gains previously recognised in equity.

Unlisted equity securities include a 26% interest in Bharti Infotel Private Limited through which the Group has a 4.37% economic interest in Bharti Airtel

Limited. Unlisted equity investments are recorded at fair value where appropriate, or at cost if their fair value cannot be reliably measured as there is no

active market upon which they are traded.

For public debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.

The short-term investments primarily consist of index linked gilts with less than six years to maturity, which can be readily converted into cash via the gilt

repurchase market and are held on an effective floating rate basis.