US Cellular 2008 Annual Report Download - page 97

Download and view the complete annual report

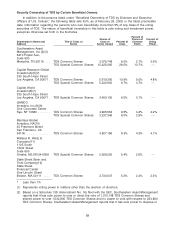

Please find page 97 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to direct the disposition of 1,538,948 TDS Common Shares and shared power to dispose or direct

the disposition of 1,530,800 TDS Common Shares, and no power of disposition with respect to

6,000 TDS Common Shares. The TDS Common Shares for which voting and dispositive power is

shared are owned by Longleaf Partners Fund.

(3) Based on a Schedule 13D (Amendment No. 15) filed with the SEC, Southeastern Asset Management

reports that it has sole power to vote or direct the vote of 7,959,558 TDS Special Common Shares

and shared power to vote 5,666,200 TDS Special Common Shares and no power to vote with

respect to 1,799,337 TDS Special Common Shares. Southeastern Asset Management reports that it

has sole power to dispose or to direct the disposition of 9,752,895 TDS Special Common Shares

and shared power to dispose or direct the disposition of 5,666,200 TDS Special Common Shares,

and no power of disposition with respect to 6,000 TDS Special Common Shares. The TDS Special

Common Shares for which voting and dispositive power is shared are owned by Longleaf Partners

Fund.

(4) Based on the most recent Schedule 13G (Amendment No. 1) filed with the SEC. In such

Schedule 13G, Capital Research Global Investors reports that it has sole power to vote or direct the

vote and sole power to dispose or to direct the disposition of 5,619,300 TDS Common Shares.

(5) Based on the most recent Schedule 13G (Amendment No. 1) filed with the SEC. In such

Schedule 13G, Capital Research Global Investors reports that it has sole power to vote or direct the

vote of, and sole power to dispose or to direct the disposition of 5,232,900 TDS Special Common

Shares.

(6) Based on the most recent Schedule 13G (Amendment No. 1) filed with the SEC. In such

Schedule 13G, Capital World Investors reports that it has sole power to vote or direct the vote of

1,190,000 TDS Special Common Shares and reports sole power to dispose or direct the disposition

of 3,493,100 TDS Special Common Shares.

(7) Based on Schedule 13G filed with the SEC, Capital Research Global Investors and Capital World

Investors are both divisions of Capital Research and Management Company.

(8) Based upon a Schedule 13D (Amendment No. 18) filed with the SEC. Includes Common Shares

held by the following affiliates: GAMCO Asset Management, Inc.—3,141,754 TDS Common Shares;

Gabelli Funds, LLC—1,686,800 TDS Common Shares; GGCP, Inc.—4,000 TDS Common Shares;

MJG Associates, Inc.—17,000 TDS Common Shares; Mario J. Gabelli—41,500 TDS Common

Shares; and Gabelli Securities, Inc.—14,500 TDS Common Shares. In such Schedule 13D, such

group reports sole or shared investment authority over 4,905,554 TDS Common Shares and has

reported sole voting power with respect to 4,810,054 TDS Common Shares.

(9) Based upon a Schedule 13D (Amendment No. 1) filed with the SEC. Includes TDS Special Common

Shares held by the following affiliates: Gabelli Funds, LLC—1,228,300 TDS Special Common Shares;

GAMCO Asset Management, Inc.—1,992,546 TDS Special Common Shares; GGCP, Inc.—4,000 TDS

Special Common Shares; Mario J. Gabelli—2,500 TDS Special Common Shares; and Gabelli

Securities, Inc.—10,000 TDS Special Common Shares. In such Schedule 13D, such group reports

sole or shared investment authority over 3,237,346 TDS Special Common Shares and has reported

sole voting power with respect to 3,156,546 TDS Special Common Shares.

(10) Based on the most recent Schedule 13G filed with the SEC. Includes TDS Common Shares held by

the following affiliates: Barclays Global Investors, NA—2,210,561 TDS Common Shares; Barclays

Global Fund Advisors—2,265,257 TDS Common Shares; Barclays Global Investors, Ltd.—228,340

TDS Common Shares; and Barclays Global Investors Japan Limited—96,742 TDS Common Shares;

Barclays Global Investors Canada Limited—3,289 TDS Common Shares; and Barclays Global

Investors Australia—3,007 TDS Common Shares. In such Schedule 13G, such group reports sole

investment authority over 3,657,676 TDS Common Shares and has reported sole power to dispose

or direct the disposition of 4,807,196 TDS Common Shares.

(11) Based on the most recent Schedule 13G (Amendment No. 4) filed with the SEC, Wallace R. Weitz &

Company reports that it has sole or shared power to vote or direct the vote of 2,890,200 TDS

Special Common Shares and sole or shared power to dispose or to direct the disposition of

2,928,200 TDS Special Common Shares.

(12) Based on the most recent Schedule 13G filed with the SEC, State Street Bank and Trust Company

reports that it has sole power to vote or direct the vote of, and shared power to dispose or direct the

disposition of 2,730,547 TDS Common Shares.

90