US Cellular 2008 Annual Report Download - page 137

Download and view the complete annual report

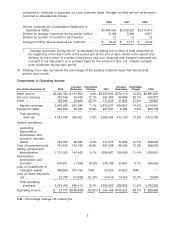

Please find page 137 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Divestitures provided $6.8 million, $4.3 million and $101.6 million in 2008, 2007 and 2006, respectively.

U.S. Cellular received $95.1 million of cash related to the sale of its interest in Midwest Wireless during

2006. See Note 6—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial

Statements for details of these transactions.

In 2008, U.S. Cellular realized cash proceeds of $16.7 million from the disposition of Rural Cellular

Corporation (‘‘RCC’’) Common Shares in conjunction with Verizon Wireless’ acquisition of RCC. In 2007,

U.S. Cellular realized cash proceeds of $4.3 million related to the disposition of Vodafone ADRs. See

Note 2—Investment Gains and Losses in the Notes to Consolidated Financial Statements for details of

these transactions.

At an extraordinary general meeting held on July 25, 2006, shareholders of Vodafone approved a special

distribution of £0.15 per share (£1.50 per ADR) and a share consolidation under which every eight ADRs

of Vodafone were consolidated into seven ADRs. As a result of the special distribution, which was paid

on August 18, 2006, U.S. Cellular received approximately $28.6 million in cash. These proceeds,

representing a return of capital for financial statement purposes, were recorded as a reduction in the

accounting cost basis of marketable equity securities in 2006.

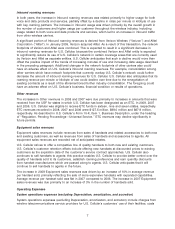

Cash Flows from Financing Activities

Cash flows from financing activities primarily reflect changes in short-term debt balances, cash used to

repurchase Common Shares and cash proceeds from re-issuance of Common Shares pursuant to stock-

based compensation plans. U.S. Cellular has used short-term debt to finance acquisitions, for general

corporate purposes and to repurchase Common Shares. Internally generated funds as well as proceeds

from forward contracts and the sale of non-strategic wireless and other investments, from time to time,

have been used to reduce short-term debt.

Cash received from short-term borrowings under U.S. Cellular’s revolving credit facility provided

$100.0 million in 2008, $25.0 million in 2007 and $415.0 million in 2006, while repayments required

$100.0 million in 2008, $60.0 million in 2007 and $515.0 million in 2006.

The re-issuance of treasury shares in connection with employee benefits plans, net of tax payments

made by U.S. Cellular on behalf of stock award holders, required $2.3 million in 2008, provided

$10.1 million in 2007 and $15.9 million in 2006. In certain situations, U.S. Cellular withholds shares that

are issuable upon the exercise of stock options or the vesting of restricted shares to cover, and with a

value equivalent to, the exercise price and/or the amount of taxes required to be withheld from the stock

award holder at the time of the exercise or vesting. U.S. Cellular then pays the amount of the required

tax withholdings to the taxing authorities in cash.

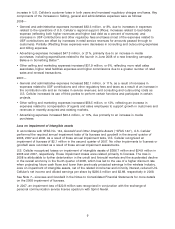

In 2008, U.S. Cellular repurchased 600,000 Common Shares at an aggregate cost of $32.9 million. U.S.

Cellular also received $4.6 million in 2008 from an investment banking firm for the final settlement of the

Accelerated Share Repurchases (‘‘ASR’’) made in the second half of 2007. In 2007, U.S. Cellular

purchased 1,006,000 Common Shares for $87.9 million from an investment banking firm in connection

with three ASR programs. As discussed above, in 2008, U.S. Cellular received $4.6 million from the

investment banking firm in final settlement of the ASR programs; thus, the net cost of Common Shares

purchased pursuant to such programs was $83.3 million. U.S. Cellular did not repurchase any shares in

2006. See Note 17—Common Shareholders’ Equity in the Notes to Consolidated Financial Statements

for details of these transactions.

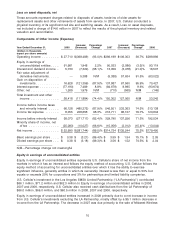

LIQUIDITY AND CAPITAL RESOURCES

Recent events in the financial services sector and correlating impacts to other sectors of the economy

have resulted in concerns regarding investment security values, the availability of and concentration of

credit, insurance coverage and a variety of other areas. Although U.S. Cellular’s cash balance,

conservative strategies for investing cash on hand and funds available under its revolving credit

agreement have limited its exposure to these events to date, U.S. Cellular continues to monitor economic

conditions and developments and will make adjustments to its cash investments, borrowing

arrangements and insurance coverage as necessary and feasible.

15