US Cellular 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acquisitions, Exchanges and Divestitures

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on investment. As part of this

strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets

and wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for

other wireless interests those wireless interests that are not strategic to its long-term success.

U.S. Cellular from time to time may be engaged in negotiations relating to the acquisition, divestiture or

exchange of companies, strategic properties or wireless spectrum. In general, U.S. Cellular may not

disclose such transactions until there is a definitive agreement.

See Note 6—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements

for details on transactions in 2008, 2007 and 2006.

Variable Interest Entities

U.S. Cellular consolidates certain variable interest entities pursuant to FASB Interpretation No. 46 (revised

December 2003), Consolidation of Variable Interest Entities. See Note 4—Variable Interest Entities in the

Notes to Consolidated Financial Statements for the details of these variable interest entities. U.S. Cellular

may elect to make additional capital contributions and/or advances to these variable interest entities in

future periods in order to fund their operations.

Common Share Repurchase Program

U.S. Cellular has repurchased and expects to continue to repurchase its Common Shares subject to the

repurchase program. For details of this program and repurchases made during 2008 and 2007, see

Note 17—Common Shareholders’ Equity in the Notes to Consolidated Financial Statements.

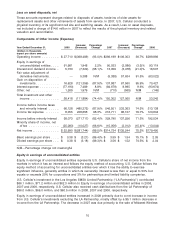

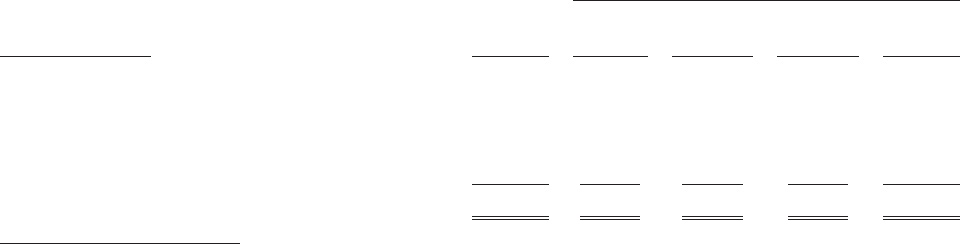

Contractual and Other Obligations

At December 31, 2008, the resources required for contractual obligations were as follows:

Payments due by Period

More

Less than 2 - 3 4 - 5 than 5

(Dollars in millions) Total 1 Year Years Years Years

Long-term debt obligations(1) .............. $1,014.0 $ 10.0 $ — $ — $1,004.0

Interest payments on long-term debt obligations . 1,814.0 73.2 145.1 145.2 1,450.5

Operating leases(2) ..................... 988.3 128.6 210.0 130.3 519.4

Capital leases .......................... 8.6 0.6 1.0 1.0 6.0

Purchase obligations(3) ................... 637.4 369.6 164.0 59.7 44.1

$4,462.3 $582.0 $520.1 $336.2 $3,024.0

(1) Includes current and long-term portions of debt obligations. The total long-term debt obligation

differs from Long-term debt on the Consolidated Balance Sheet due to the $11.3 million unamortized

discount related to U.S. Cellular’s 6.7% senior notes. See Note 14—Long-Term Debt in the Notes to

Consolidated Financial Statements.

(2) Includes future lease costs related to office space, retail sites, cell sites and equipment.

(3) Includes obligations payable under non-cancellable contracts, commitments for network facilities and

transport services, agreements for software licensing and long-term marketing programs.

The table above does not include any liabilities related to unrecognized tax benefits under FASB

Interpretation No. 48, Accounting for Uncertainty in Income Taxes (‘‘FIN 48’’) since U.S. Cellular is unable

to reasonably predict the ultimate amount or timing of settlement of such FIN 48 liabilities. Such

unrecognized tax benefits were $27.8 million at December 31, 2008. See Note 3—Income Taxes in the

Notes to Consolidated Financial Statements for additional information on unrecognized tax benefits.

19