US Cellular 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

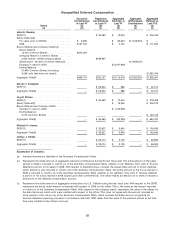

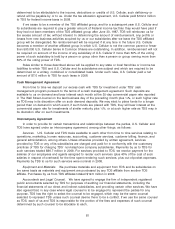

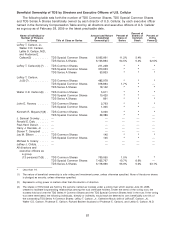

Compensation of Directors

The following table shows, as to directors who are not executive officers of U.S. Cellular or TDS,

certain information regarding director compensation.

Director Compensation

Change in

Pension

Value and

Fees Nonqualified

Earned Non-Equity Deferred

or Paid Stock Option Incentive Plan Compensation All Other

in Cash Awards Awards Compensation Earnings Compensation Total

Name ($) ($) ($) ($) ($) ($) ($)

(a) (b) (c) (d) (e) (f) (g) (h)

Walter C.D. Carlson ............. $103,000 $37,500 — — — — $140,500

J. Samuel Crowley ............. $153,000 $37,500 — — — — $190,500

Ronald E. Daly ................ $113,500 $37,500 — — — — $151,000

Paul-Henri Denuit .............. $149,000 $ 0 — — — — $149,000

Harry J. Harczak, Jr. ............ $131,500 $37,500 — — — — $169,000

Explanation of Columns:

(a) Includes each director unless such director is an executive officer whose compensation, including any compensation for

service as a director, is fully reflected in the Summary Compensation Table, except for directors that do not receive any

compensation directly from U.S. Cellular as discussed in the next paragraph. Accordingly, the above includes only

non-employee directors. Directors who are employees of TDS or its subsidiaries do not receive directors fees or any

compensation directly from U.S. Cellular.

LeRoy T. Carlson, Jr., LeRoy T. Carlson and Kenneth R. Meyers received no compensation directly from U.S. Cellular. Such

persons are or were compensated by TDS in connection with their services as officers of TDS and TDS subsidiaries, including

U.S. Cellular. A portion of such persons’ compensation expense incurred by TDS is allocated to U.S. Cellular by TDS, along

with other expenses of TDS. This allocation by TDS to U.S. Cellular is done in the form of a single management fee pursuant

to the Intercompany Agreement discussed below under ‘‘Intercompany Agreement.’’ There is no identification or quantification

of the compensation of such persons to U.S. Cellular, or of any other allocated expense in this management fee. The

management fee is recorded as a single expense by U.S. Cellular. U.S. Cellular does not obtain details of the components

that make up this fee and does not segregate this fee or allocate any part of the management fee to other accounts such as

compensation expense. Accordingly, the compensation expenses incurred by TDS with respect to such persons are not

reported in the above table. However, for purposes of disclosure, approximately 78% of LeRoy T. Carlson, Jr.’s compensation

expense in 2008, approximately 79% of Kenneth R. Meyers’ compensation expense in 2008 and approximately 78% of LeRoy

T. Carlson’s compensation expense in 2008 incurred by TDS is included by TDS in the total management fee to U.S. Cellular.

Information with respect to compensation from TDS to LeRoy T. Carlson, Jr., Kenneth R. Meyers and LeRoy T. Carlson is

included in TDS’ proxy statement related to its 2009 annual meeting of shareholders.

(b) Includes the aggregate dollar amount of all fees earned or paid in cash for services as a director, including annual retainer

fees, committee and/or chairmanship fees, and meeting fees.

(c) Pursuant to the terms of the plan as amended on August 29, 2007, the annual stock award of $45,000 which otherwise would

have been distributed in the form of shares in March 2008 was distributed in the form of cash due to the need to obtain

shareholder approval of the amended plan prior to the issuance of the shares. Accordingly, no shares were issued in 2008

but will be issued going forward in 2009 and subsequent years. The above amounts are the amounts of expense pursuant to

FAS 123R, which represents an accrual for the period from March 1, 2008 through December 31, 2008, relating to 10⁄12 of the

stock award that will be made in March 2009.

(d) This column is not applicable because non-employee directors do not receive stock options.

(e) This column is not applicable because non-employee directors do not participate in any non-equity incentive plans, as

defined by SEC rules.

(f) This column is not applicable because non-employee directors do not participate in any defined benefit pension plans or

pension plans (including supplemental plans) where the retirement benefit is actuarially determined or receive any earnings

on deferred compensation.

(g) This column is not applicable because there is no other compensation.

(h) Represents the sum of all amounts reported in columns (b) through (g).

77