US Cellular 2008 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 7 LICENSES AND GOODWILL (Continued)

During 2007, U.S. Cellular recognized a $2.1 million impairment loss as a result of its annual impairment

assessment in the second quarter of 2007. In addition, U.S. Cellular recognized an impairment of

licenses of $20.8 million in the fourth quarter of 2007 in conjunction with an exchange of licenses with

Sprint Nextel. See Note 6—Acquisitions, Divestitures and Exchanges for more information related to the

Sprint Nextel exchange.

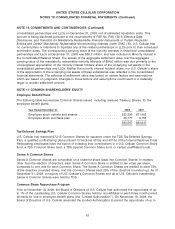

NOTE 8 CUSTOMER LISTS

Customer lists, which are intangible assets resulting from acquisitions of wireless markets, are amortized

based on estimated customer retention periods reflecting historical experience. Amortization expense is

determined using the double-declining balance method in the first year, switching to the straight-line

method over the remainder of the estimated retention period. U.S. Cellular reviews its customer lists

periodically to ensure that they are being amortized over periods which represent the actual retention

periods for the acquired customers.

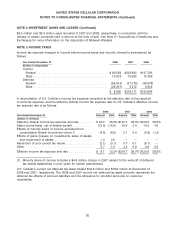

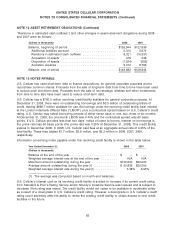

The changes in the customer lists during 2008 and 2007 were as follows:

Year Ended December 31, 2008 2007

(Dollars in thousands)

Balance, beginning of period ........................... $15,375 $ 26,196

Acquisitions ...................................... 1,045 1,560

Impairment ...................................... — (1,947)

Amortization ...................................... (7,484) (10,434)

Balance, end of period ............................... $ 8,936 $ 15,375

In 2007, it was determined that the carrying value of certain customer list balances exceeded their

estimated fair values and an impairment loss of $1.9 million was recorded. The loss was included in Loss

on impairment of intangible assets in the Consolidated Statement of Operations. Fair values were

determined based upon a present value analysis of expected future cash flows and customer churn

rates.

Based on the Customer lists balance as of December 31, 2008, amortization expense for the years

2009-2013 is expected to be $4.9 million, $3.3 million, $0.4 million, $0.2 million and $0.1 million,

respectively.

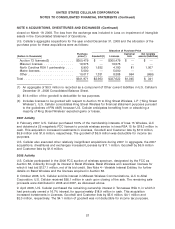

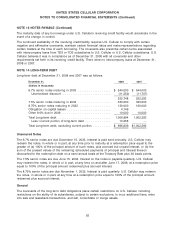

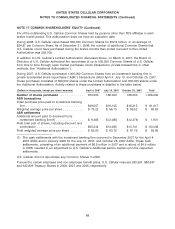

NOTE 9 MARKETABLE EQUITY SECURITIES

Information regarding U.S. Cellular’s marketable equity securities and unrealized gains on marketable

equity securities is summarized below:

Year Ended December 31, 2008 2007

(Dollars in thousands)

Rural Cellular Corporation—0 and 370,882 Common Shares,

respectively ......................................... $— $16,352

Accounting cost basis ................................... — (334)

Gross unrealized holding gains ............................. — 16,018

Deferred income tax liability ............................... — (5,884)

Net unrealized holding gains ............................... $— $10,134

59