US Cellular 2008 Annual Report Download - page 56

Download and view the complete annual report

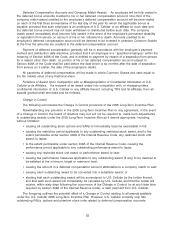

Please find page 56 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As noted above, U.S. Cellular’s overall compensation objectives for executive officers are to

(i) support U.S. Cellular’s overall business strategy and objectives; (ii) attract and retain high quality

management; (iii) link individual compensation with attainment of individual performance goals and with

attainment of U.S. Cellular objectives; and (iv) provide competitive compensation opportunities consistent

with the financial performance of U.S. Cellular.

To achieve these objectives, the Chairman and the Stock Option Compensation Committee believe

that the named executive officers must be offered a competitive compensation package, including

benefits and plans. U.S. Cellular’s compensation packages are designed to compete with other

companies for talented employees. U.S. Cellular’s benefits and plans are part of this package and enable

U.S. Cellular to attract and retain eligible employees, including the named executive officers. Thus, the

benefits and plans fit into U.S. Cellular’s overall compensation objectives primarily by helping U.S.

Cellular achieve the second objective of U.S. Cellular’s overall compensation objectives, which is to

attract and retain high quality management. Benefits and plans are an important part of the mix of

compensation used to attract and retain management, but do not otherwise significantly affect decisions

relating to other elements of annual or long-term compensation, which are provided consistent with the

above compensation objectives.

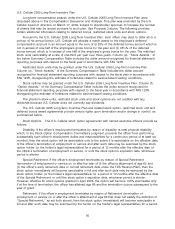

General Provisions under Plans and Certain Agreements

Deferred Salary and Bonus

Deferred Salary. The named executive officers are permitted to defer salary pursuant to deferred

salary compensation agreements. The entire amount of the salary earned is reported in the Summary

Compensation Table in column (c) under ‘‘Salary,’’ whether or not deferred. Pursuant to the agreement,

the officer’s deferred compensation account is credited with interest compounded monthly, computed at

a rate equal to one-twelfth of the sum of the average twenty-year Treasury Bond rate plus

1.25 percentage points until the deferred compensation amount is paid to such person. As required by

SEC rules, column (h) includes the portion of any interest that exceeds 120% of the applicable federal

long-term rate, with compounding (as prescribed under section 1274(d) of the Internal Revenue Code),

at the time each monthly interest rate is set. The deferred compensation account of an officer is paid at

the time and in the form elected by the officer, subject to any payment delay required by section 409A of

the Internal Revenue Code.

Messrs. Rooney and Ellison are parties to deferred compensation agreements, pursuant to which

they have deferred a specified portion of their salaries. The executive is always 100% vested in all salary

amounts that have been deferred and any interest credited with respect thereto. Accordingly, the

executive is entitled to 100% of the amount deferred and all earnings thereon upon any termination.

Such amounts are reported in the Nonqualified Deferred Compensation table below and, because there

would not be any increased benefit or accelerated vesting in the event of any termination or change in

control, are not included in the below table of Potential Payments upon Termination or Change in

Control.

Deferred Bonus. The named executive officers are also permitted to defer their bonuses pursuant

to deferred bonus compensation agreements under the 2005 Long-Term Incentive Plan, as discussed

below. The entire amount of the bonus earned is reported in the Summary Compensation Table in

column (d) under ‘‘Bonus,’’ whether or not deferred. Deferred bonus will be deemed invested in phantom

U.S. Cellular Common Shares. The named executive officers receive a distribution of the deferred

compensation account at the date elected by the officer, subject to any payment delay required by

section 409A of the Internal Revenue Code.

Mr. Rooney and Mr. Ellison is each a party to an executive deferred compensation agreement,

pursuant to which he has deferred a specified portion of his bonus in the current or prior years. The

executive is always 100% vested in all bonus amounts that have been deferred. Such amounts are

reported in the Nonqualified Deferred Compensation table and, because there would not be any

increased benefit or accelerated vesting in the event of any termination or change in control, are not

included in the below table of Potential Payments upon Termination or Change in Control.

49