US Cellular 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discussed above, a portion of Mr. Carlson’s compensation paid by TDS is allocated to U.S. Cellular as

part of the management fee under the intercompany agreement described below. John E. Rooney, a

director and President and Chief Executive Officer of U.S. Cellular, participated in executive

compensation decisions for U.S. Cellular, other than for himself.

Long-term compensation for executive officers is approved by our Stock Option Compensation

Committee, which currently consists of Paul-Henri Denuit, J. Samuel Crowley and Ronald E. Daly. Our

Stock Option Compensation Committee is comprised of members of our board of directors who are

independent, as discussed above. None of such persons was, during 2008, an officer or employee of

U.S. Cellular or its affiliates, was formerly an officer of U.S. Cellular or had any relationship requiring

disclosure by U.S. Cellular under any paragraph of Item 404 of SEC Regulation S-K.

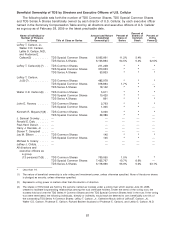

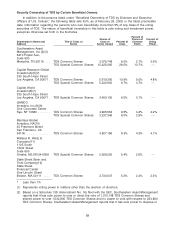

LeRoy T. Carlson, Jr. and Walter C.D. Carlson, directors of U.S. Cellular, are trustees and

beneficiaries of the voting trust which controls TDS, which controls U.S. Cellular, and LeRoy T. Carlson, a

director of U.S. Cellular, is a beneficiary of such voting trust. See ‘‘Security Ownership of Certain

Beneficial Owners and Management.’’ LeRoy T. Carlson, LeRoy T. Carlson, Jr., Walter C.D. Carlson and

Kenneth R. Meyers, directors of U.S. Cellular, are also directors of TDS. See ‘‘Election of Directors.’’

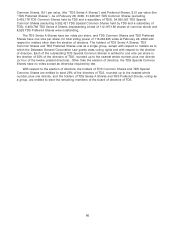

U.S. Cellular has entered into a number of arrangements and transactions with TDS. Some of these

arrangements were established at a time prior to our initial public offering when TDS owned more than

90% of our outstanding capital stock and were not the result of arm’s length negotiations. There can be

no assurance that such arrangements will continue or that the terms of such arrangements will not be

modified in the future. If additional transactions occur in the future, there can be no assurance that the

terms of such future transactions will be favorable to us or will continue to provide us with the same level

of support for our financing and other needs as TDS has provided in the past. The principal

arrangements that exist between U.S. Cellular and TDS are summarized below.

Other Relationships and Related Transactions

Exchange Agreement

U.S. Cellular and TDS are parties to an exchange agreement dated July 1, 1987, as amended as of

April 7, 1988.

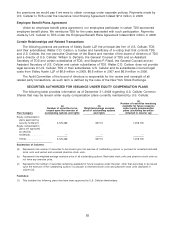

Common Share Purchase Rights; Potential Dilution. The exchange agreement granted TDS the right

to purchase additional Common Shares of U.S. Cellular sold after our initial public offering, to the extent

necessary for TDS to maintain its proportionate interest in our Common Shares. For purposes of

calculating TDS’ proportionate interest in our Common Shares, the Series A Common Shares are treated

as if converted into Common Shares. Upon notice to U.S. Cellular, TDS is entitled to subscribe to each

issuance in full or in part at its discretion. If TDS decides to waive, in whole or in part, one or more of its

purchase opportunities, the number of Common Shares subject to purchase as a result of subsequent

issuances will be further reduced.

If TDS elects to exercise its purchase rights, it is required to pay cash for all Common Shares issued

to it by us, unless otherwise agreed. In the case of sales by us of Common Shares for cash, TDS is

required to pay the same price per Common Share as the other buyers. In the case of sales for

consideration other than cash, TDS is required to pay cash equal to the fair market value of such other

consideration as determined by our board of directors. Depending on the price per Common Share paid

by TDS upon exercise of these rights, the issuance of Common Shares by us pursuant thereto could

have a dilutive effect on our other shareholders. The purchase rights described above are in addition to

the preemptive rights granted to TDS as a holder of Series A Common Shares under our restated

certificate of incorporation.

Funding of License Costs. Through the date of our initial public offering, TDS had funded or made

provisions to fund all the legal, engineering and consulting expenses incurred in connection with the

wireline application and settlement process and that portion of the price of cellular interests acquired by

purchase that represented the cost of cellular licenses. Pursuant to the exchange agreement, as

amended, TDS has agreed to fund as an additional capital contribution, without the issuance of

additional stock or the payment of any other consideration to TDS, additional costs associated with the

79