US Cellular 2008 Annual Report Download - page 128

Download and view the complete annual report

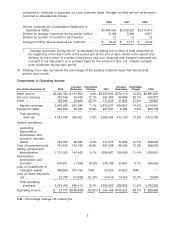

Please find page 128 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Revenues

Service revenues

Service revenues consist primarily of: (i) charges for access, airtime, roaming, recovery of regulatory

costs and value-added services, including data products and services and long distance, provided to

U.S. Cellular’s retail customers and to end users through third-party resellers (‘‘retail service’’);

(ii) charges to other wireless carriers whose customers use U.S. Cellular’s wireless systems when

roaming, including long-distance roaming (‘‘inbound roaming’’); and (iii) amounts received from the

Federal Universal Service Fund (‘‘USF’’).

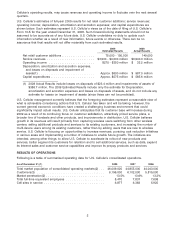

The increase in Service revenues was due to the growth in the average customer base, which increased

3% to 6.2 million in 2008 following an increase of 5% to 6.0 million in 2007 and higher monthly service

revenue per customer. Monthly service revenue per customer averaged $53.23 in 2008, $51.17 in 2007

and $47.23 in 2006.

Retail service revenues

The increases in Retail service revenues in 2008 and 2007 were due primarily to growth in U.S. Cellular’s

average customer base and an increase in average monthly retail service revenue per customer.

The increase in the average number of customers each year was driven primarily by the net retail

customer additions that U.S. Cellular generated from its marketing distribution channels. The average

number of customers also was affected by the timing of acquisitions, divestitures and exchanges.

U.S. Cellular anticipates that its customer base will increase during 2009 as a result of its continuing

focus on customer satisfaction, attractively priced service plans, a broader line of handsets and other

products, and improvements in distribution. U.S. Cellular believes growth in its revenues will be primarily

from capturing wireless users switching from other wireless carriers, selling additional products to its

existing customers and increasing the number of multi-device users among its existing customers, rather

than by adding users that are new to wireless service. However, the level of growth in the customer base

for 2009 will depend upon U.S. Cellular’s ability to attract new customers and retain existing customers in

a highly and increasingly competitive marketplace. The rate of growth in U.S. Cellular’s total customer

base has slowed over time, as U.S. Cellular’s total customers increased 5% from 2006 to 2007 and 2%

from 2007 to 2008. See ‘‘Overview—2009 Estimates’’ for U.S. Cellular’s estimate of net retail customer

additions for 2009.

Average monthly retail service revenue per customer increased 3% to $46.55 in 2008 from $45.25 in

2007, and increased 7% in 2007 from $42.35 in 2006. The increase in average monthly retail service

revenue was driven primarily by growth in revenues from data products and services.

Monthly retail voice minutes of use per customer averaged 695 in 2008, 676 in 2007 and 590 in 2006.

The increases in both years were driven primarily by U.S. Cellular’s focus on designing sales incentive

programs and customer billing rate plans to stimulate overall usage. The impact on retail service

revenues of the increase in average monthly minutes of use was offset by a decrease in average revenue

per minute of use. The decrease in average revenue per minute of use reflects the impact of increasing

competition, which has led to the inclusion of an increasing number of minutes in package pricing plans

and the inclusion of features such as unlimited inbound calling, which U.S. Cellular had made a

differentiating factor in its current calling plans, as well as unlimited night and weekend minutes and

unlimited mobile-to-mobile minutes in certain pricing plans. U.S. Cellular anticipates that its average

revenue per minute of use may continue to decline in the future, reflecting increased competition and

continued penetration of the consumer market.

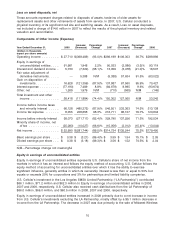

Revenues from data products and services grew significantly year-over-year totaling $511.7 million in

2008, $367.9 million in 2007 and $217.4 million in 2006 and represented 13% of total service revenues in

2008 compared to 10% and 7% of total service revenues in 2007 and 2006, respectively. Such growth,

which positively impacted average monthly retail service revenue per customer, reflected customers’

continued and increasing acceptance and usage of U.S. Cellular’s text messaging and picture

messaging services, easyedgeSM service and applications, and Smartphone handsets and services.

6