US Cellular 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Retirement Obligations

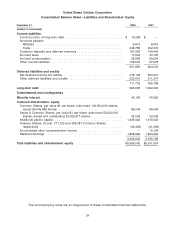

U.S. Cellular is subject to asset retirement obligations associated with its leased cell sites, retail store

sites and office locations. Asset retirement obligations generally include obligations to restore leased

land, retail store and office premises to their pre-existing condition. The asset retirement obligation is

included in Other deferred liabilities and credits in the Consolidated Balance Sheet.

U.S. Cellular accounts for its asset retirement obligations in accordance with SFAS No. 143, Accounting

for Asset Retirement Obligations (‘‘SFAS 143’’) and FASB Interpretation No. 47, Accounting for

Conditional Asset Retirement Obligations (‘‘FIN 47’’), which require entities to record the fair value of a

liability for legal obligations associated with an asset retirement in the period in which the obligations are

incurred. At the time the liability is incurred, U.S. Cellular records a liability equal to the net present value

of the estimated cost of the asset retirement obligation and increases the carrying amount of the related

long-lived asset by an equal amount. Over time, the liability is accreted to its present value, and the

capitalized cost is depreciated over the useful life of the related asset. Upon settlement of the obligation,

any difference between the cost to retire the asset and the recorded liability (including accretion of

discount) is recognized in the Consolidated Statement of Operations as a gain or loss.

The calculation of the asset retirement obligation includes the following estimates; the probability of the

need for remediation, the date of and cost estimates for such remediation, the likelihood of lease

renewals, and the salvage value of assets. Actual results may differ from these estimates and different

assumptions would lead to larger or smaller obligations and related accretion and depreciation until such

actual results are known.

See Note 12—Asset Retirement Obligations in the Notes to Consolidated Financial Statements for details

regarding U.S. Cellular’s asset retirement obligations.

Income Taxes

U.S. Cellular is included in a consolidated federal income tax return with other members of the TDS

consolidated group. TDS and U.S. Cellular are parties to a Tax Allocation Agreement which provides that

U.S. Cellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal

income tax return and in state income or franchise tax returns in certain situations. For financial

statement purposes, U.S. Cellular and its subsidiaries calculate their income, income tax and credits as if

they comprised a separate affiliated group. Under the Tax Allocation Agreement, U.S. Cellular remits its

applicable income tax payments to TDS.

The amounts of income tax assets and liabilities, the related income tax provision and the amount of

unrecognized tax benefits are critical accounting estimates because such amounts are significant to

U.S. Cellular’s financial condition and results of operations.

The preparation of the consolidated financial statements requires U.S. Cellular to calculate its provision

for income taxes. This process involves estimating the actual current income tax liability together with

assessing temporary differences resulting from the different treatment of items for tax purposes, as well

as estimating the impact of potential adjustments to filed tax returns. These temporary differences result

in deferred tax assets and liabilities, which are included in U.S. Cellular’s Consolidated Balance Sheet.

U.S. Cellular must then assess the likelihood that deferred tax assets will be realized based on future

taxable income and, to the extent management believes that realization is not likely, establish a valuation

allowance. Management’s judgment is required in determining the provision for income taxes, deferred

tax assets and liabilities and any valuation allowance that is established for deferred tax assets.

Effective January 1, 2007, U.S. Cellular adopted FIN 48. FIN 48 addressed the determination of how tax

benefits claimed or expected to be claimed on a tax return should be recorded in the financial

statements. Under FIN 48, U.S. Cellular must recognize the tax benefit from an uncertain tax position

only if it is more likely than not that the tax position will be sustained on examination by the taxing

authorities, based on the technical merits of the position. The tax benefits recognized in the financial

statements from such a position are measured based on the largest benefit that has a greater than 50%

likelihood of being realized upon ultimate resolution.

24