US Cellular 2008 Annual Report Download - page 124

Download and view the complete annual report

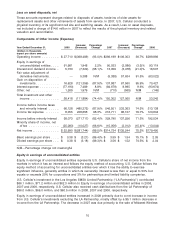

Please find page 124 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.industry. Loss on impairment of intangible assets, net of the related income tax and minority interest,

reduced U.S. Cellular’s net income and diluted earnings per share by $236.3 million and $2.69,

respectively.

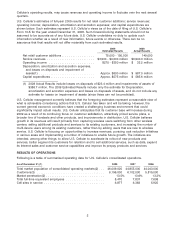

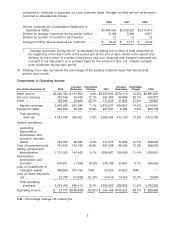

Service revenues increased $261.1 million, or 7%, to $3,940.3 million in 2008 from $3,679.2 million in

2007. U.S. Cellular experienced an increase in the number of customers, as well as an increase in

average monthly revenue per customer driven primarily by growth in revenues from data products and

services.

Operating income decreased $368.5 million, or 93%, to $27.7 million in 2008 from $396.2 million in 2007,

primarily as a result of the 2008 impairment loss related to licenses.

U.S. Cellular anticipates that future growth in its operating income will be affected by the following

factors:

• Uncertainty related to current economic conditions and their impact on demand for U.S. Cellular’s

products and services;

• Increasing penetration in the wireless industry;

• Costs of customer acquisition and retention, such as equipment subsidies and advertising;

• Industry consolidation and the resultant effects on roaming revenues, service and equipment pricing

and other effects of competition;

• Providing service in recently launched areas or potential new market areas;

• Potential increases in prepay and reseller customers as a percentage of U.S. Cellular’s customer base;

• Costs of developing and introducing new products and services;

• Costs of development and enhancement of office and customer support systems;

• Continued enhancements to its wireless networks, including potential deployments of new technology;

• Increasing costs of regulatory compliance; and

• Uncertainty in future eligible telecommunication carrier (‘‘ETC’’) funding.

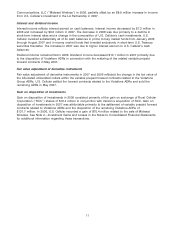

Investment and other income (expense) totaled $38.4 million in 2008 and $150.3 million in 2007. The

decrease is due primarily to the settlement of variable prepaid forward contracts related to Vodafone

American Depository Receipts (‘‘ADRs’’) and disposition of the remaining ADRs in 2007. In connection

with the delivery and sale of the ADRs, U.S. Cellular recognized a pre-tax gain of $131.7 million.

Net income decreased $281.7 million to $33.0 million in 2008 compared to $314.7 million in 2007,

primarily due to an increase in Loss on impairment of intangible assets and lower Investment and other

income (expense). Basic earnings per share was $0.42 in 2008, which was $3.17 lower than in 2007 and

Diluted earnings per share was $0.42, which was $3.14 lower than in 2007.

Cash Flows and Investments

U.S. Cellular believes that cash on hand, expected future cash flows from operating activities and

sources of external financing provide financial flexibility and are sufficient to permit U.S. Cellular to

finance its contractual obligations and anticipated capital expenditures for the foreseeable future. U.S.

Cellular continues to seek to maintain a strong balance sheet and an investment grade credit rating.

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ below for additional information

related to cash flows and investments.

2009 Estimates

U.S. Cellular expects the factors described above to impact revenues and operating income for the next

several quarters. Any changes in the above factors, as well as the effects of other drivers of U.S.

2