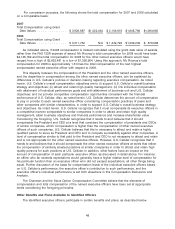

US Cellular 2008 Annual Report Download - page 61

Download and view the complete annual report

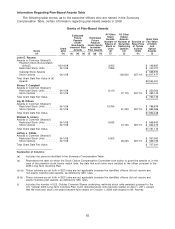

Please find page 61 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Generally Applicable Benefits and Plans

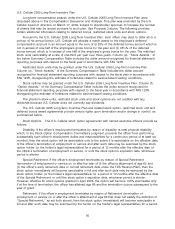

Employee Stock Purchase Plans

TDS sponsors an Employee Stock Purchase Plan that permits eligible employees of TDS and its

subsidiaries, including U.S. Cellular, to purchase a limited number of TDS Special Common Shares on a

quarterly basis. The per share cost to each participant is 85% of the market value of the Special

Common Shares as of the quarterly purchase date. Pursuant to SEC rules, the Summary Compensation

Table does not include the discount amount because such discount is available generally to all salaried

employees of TDS and U.S. Cellular.

U.S. Cellular also sponsors an Employee Stock Purchase Plan that permits eligible employees of

U.S. Cellular and its subsidiaries to purchase a limited number of U.S. Cellular Common Shares on a

quarterly basis. The per share cost to each participant is 85% of the market value of the Common

Shares as of the quarterly purchase date. Pursuant to SEC rules, the Summary Compensation Table

does not include the discount amount because such discount is available generally to all salaried

employees of U.S. Cellular.

Under the TDS and U.S. Cellular Employee Stock Purchase Plans, all shares purchased are

distributed quarterly and no shares are retained for distribution upon retirement or otherwise. These

plans do not discriminate in scope, terms, or operation in favor of executive officers and are available

generally to all employees of TDS or U.S. Cellular, as applicable, and benefits are not enhanced upon

any termination or change in control. Accordingly, no amounts are reported in the below table of

Potential Payments upon Termination or Change in Control.

Tax-Deferred Savings Plan

TDS sponsors the Tax-Deferred Savings Plan, a qualified defined contribution plan pursuant to

Sections 401(a) and 401(k) of the Internal Revenue Code. This plan is available to employees of TDS

and its subsidiaries, including U.S. Cellular. Employees contribute amounts and U.S. Cellular makes

matching contributions in part. U.S. Cellular and participating employers make matching contributions to

the plan in cash equal to 100% of an employee’s contributions up to the first 3% and 40% of an

employee’s contributions up to the next 2% of such employee’s compensation. Participating employees

have the option of investing their contributions and U.S. Cellular’s contributions in a TDS Common Share

fund, a TDS Special Common Share fund, a U.S. Cellular Common Share fund or certain unaffiliated

funds. The amount of the contribution with respect to the executives identified in the Summary

Compensation Table is included in column (i), ‘‘All Other Compensation,’’ of the Summary Compensation

Table. SEC rules do not require the Summary Compensation Table to include earnings or other amounts

with respect to tax-qualified defined contribution plans.

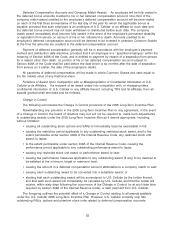

Under the TDS Tax-Deferred Savings Plan, vesting is not accelerated upon a change in control or

other termination event. The vested portion of an employee’s account becomes payable following the

employee’s termination of employment as (a) a lump sum or (b) in a series of annual or more frequent

installments. This plan does not discriminate in scope, terms, or operation in favor of executive officers

and is available generally to all employees, and benefits are not enhanced upon any termination or

change in control. Accordingly, no amounts are reported in the below table of Potential Payments upon

Termination or Change in Control.

Pension Plan

TDS sponsors a qualified noncontributory defined contribution Pension Plan for the employees of

TDS and its subsidiaries, including U.S. Cellular. Under this plan, pension costs are calculated separately

for each participant and are funded annually. The Pension Plan is designed to provide retirement benefits

for eligible employees of TDS and certain of its affiliates which adopted the Pension Plan. TDS and its

subsidiaries make annual employer contributions for each eligible participant based on the applicable

pension formula. The amount of the contribution with respect to the executives identified in the Summary

Compensation Table is included in column (i), ‘‘All Other Compensation,’’ of the Summary Compensation

54