US Cellular 2008 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

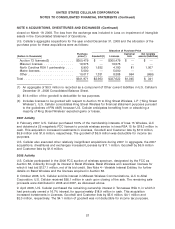

NOTE 16 COMMITMENTS AND CONTINGENCIES (Continued)

Legal Proceedings

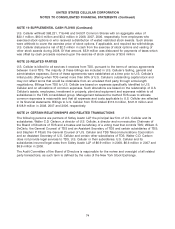

The United States Department of Justice (‘‘DOJ’’) has notified U.S. Cellular and its parent, TDS, that each

is a named defendant in a civil action brought by a private party in the U.S. District Court for the District

of Columbia under the ‘‘qui tam’’ provisions of the federal False Claims Act. TDS and U.S. Cellular were

advised that the complaint seeks return of approximately $165 million of bid credits from certain FCC auctions

and requests treble damages. The complaint remains under seal pending the DOJ’s consideration as to

whether to intervene in the proceeding. The DOJ has not yet made any decision as to whether it will intervene.

However, as a result of the complaint, the DOJ is investigating TDS’ and U.S. Cellular’s participation in certain

spectrum auctions conducted by the FCC between 2005 and 2008, through Carroll Wireless, L.P., Barat

Wireless, L.P., and King Street Wireless, L.P. These limited partnerships were winning bidders in Auction 58,

Auction 66, and Auction 73, respectively, and received a 25% bid credit in the applicable auction price under

FCC rules. The DOJ is investigating whether these limited partnerships qualified for the 25% bid credit in

auction price considering their arrangements with TDS and U.S. Cellular. TDS and U.S. Cellular are cooperating

with the DOJ’s review. TDS and U.S. Cellular believe that U.S. Cellular’s arrangements with these limited

partnerships and the limited partnerships’ participation in the FCC auctions complied with applicable law and

FCC rules and each of TDS and U.S. Cellular intends to vigorously defend itself against any claim that it

violated applicable law or FCC rules. At this time, U.S. Cellular cannot predict the outcome of this review or any

proceeding.

U.S. Cellular is involved or may be involved from time to time in legal proceedings before the FCC, other

regulatory authorities, and/or various state and federal courts. If U.S. Cellular believes that a loss arising

from such legal proceedings is probable and can be reasonably estimated, an amount is accrued in the

financial statements for the estimated loss. If only a range of loss can be determined, the best estimate

within that range is accrued; if none of the estimates within that range is better than another, the low end

of the range is accrued. The assessment of the expected outcomes of legal proceedings is a highly

subjective process that requires judgments about future events. The legal proceedings are reviewed at

least quarterly to determine the adequacy of accruals and related financial statement disclosures. The

ultimate outcomes of legal proceedings could differ materially from amounts accrued in the financial

statements.

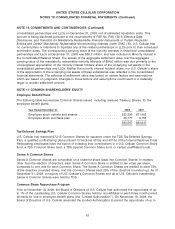

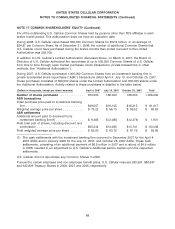

Mandatorily Redeemable Minority Interest in Subsidiaries

Under SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities

and Equity (‘‘SFAS 150’’), certain minority interests in consolidated entities with finite lives may meet the

standard’s definition of a mandatorily redeemable financial instrument and thus require reclassification as

liabilities and re-measurement at the estimated amount of cash that would be due and payable to settle

such minority interests under the applicable entity’s organization agreement assuming an orderly

liquidation of the finite-lived entity, net of estimated liquidation costs (the ‘‘settlement value’’). U.S.

Cellular’s consolidated financial statements include certain minority interests that meet the standard’s

definition of mandatorily redeemable financial instruments. These mandatorily redeemable minority

interests represent interests held by third parties in consolidated partnerships and limited liability

companies (‘‘LLCs’’), where the terms of the underlying partnership or LLC agreement provide for a

defined termination date at which time the assets of the subsidiary are to be sold, the liabilities are to be

extinguished and the remaining net proceeds are to be distributed to the minority interest holders and

U.S. Cellular in accordance with the respective partnership and LLC agreements. The termination dates

of U.S. Cellular’s mandatorily redeemable minority interests range from 2042 to 2107.

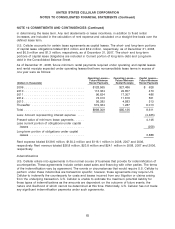

The settlement value of U.S. Cellular’s mandatorily redeemable minority interests was estimated to be

$149.9 million at December 31, 2008. This represented the estimated amount of cash that would be due

and payable to settle these minority interests assuming an orderly liquidation of the finite-lived

66