US Cellular 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207

|

|

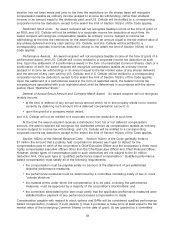

Federal Income Taxes

In general, a non-employee director who is issued Common Shares under the Directors Plan will

recognize taxable compensation in the year of issuance in an amount equal to the fair market value of

such Common Shares on the date of issuance, and U.S. Cellular will be allowed a deduction for federal

income tax purposes at the time the non-employee director recognizes taxable compensation equal to

the amount of compensation recognized by such non-employee director.

In general, a non-employee director’s basis for Common Shares received under the Directors Plan

will be the amount recognized as taxable compensation with respect to such Common Shares, and a

non-employee director’s holding period for such shares will begin on the date the non-employee director

recognizes taxable compensation with respect to the shares.

The foregoing tax effects may be different if Common Shares are subject to restrictions imposed by

Section 16(b) of the Exchange Act. In such case, a non-employee director who is issued Common

Shares under the Directors Plan will recognize taxable compensation on the issued shares when the

restrictions on such shares imposed by Section 16(b) of the Exchange Act lapse, unless the

non-employee director makes an appropriate election under Section 83(b) of the Internal Revenue Code

of 1986, as amended, to be taxed at the time of issuance of the shares.

In general, a non-employee director will recognize taxable compensation in the year of payment of

the cash annual retainer or meeting fees in an amount equal to such cash payment, and in the year of

payment U.S. Cellular will be allowed a deduction for federal income tax purposes equal to the

compensation recognized by such non-employee director.

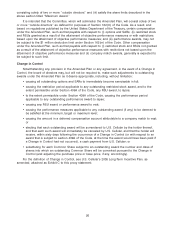

Plan Benefits

No disclosure is being made of the benefits or amounts that will be received by or allocated to any

participants because the benefit or amount is not determinable until earned and paid.

The board of directors recommends a vote ‘‘FOR’’ approval of the Compensation Plan for

Non-Employee Directors, as amended.

18