US Cellular 2008 Annual Report Download - page 77

Download and view the complete annual report

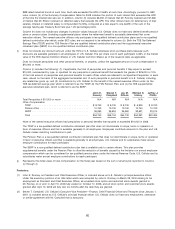

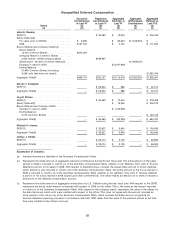

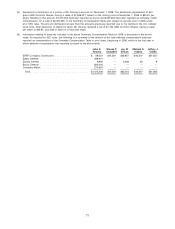

Please find page 77 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(d) Represents the dollar amount of aggregate interest or other earnings accrued during the last fiscal year. With respect to the

SERP, represents the actual dollar amount earned in 2008 by the officer, of which any amount that is deemed to be above-

market or preferential earnings as defined by SEC rules is included in column (h) of the Summary Compensation Table. With

respect to any deferred salary, includes the amount of interest credited to the deferred account for 2008, of which any amount

that is deemed to be above-market or preferential earnings as defined by SEC rules is included in column (h) of the Summary

Compensation Table.

(e) Represents the aggregate dollar amount of any withdrawals by or distributions to the executive during the last fiscal year. Any

such amounts represent withdrawals or distributions of company and/or employee contributions and/or earnings from prior

years and are not included in 2008 compensation in the Summary Compensation Table.

(f) Represents the dollar amount of total balance of the executive’s account as of the end of the last fiscal year. With respect to

the SERP, represents the actual dollar amount in the executive’s account as of December 31, 2008. With respect to any

deferred salary, represents the actual dollar amount in the executive’s account as of December 31, 2008. With respect to

bonus deferral and company match, represents the dollar value of the number of phantom stock units held in the executive’s

account based on the closing price of the underlying shares of $43.24 on December 31, 2008, the last trading day of the

year.

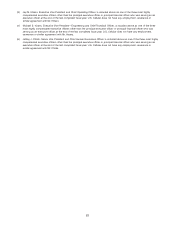

Footnotes:

(1) Each of the identified officers participates in a supplemental executive retirement plan (‘‘SERP’’). This plan provides

supplemental benefits to the TDS pension plan (‘‘Pension Plan’’) to offset the reduction of benefits caused by the limitation on

annual employee compensation which can be considered for tax qualified pension plans under the Internal Revenue Code.

The SERP is a non-qualified deferred compensation plan and is intended to be unfunded. Such officers are credited with

interest on their balances in the SERP. The interest rate for 2008 was set as of the last trading date of 2007 at 6.109% per

annum, based on the yield on ten year BBB rated industrial bonds at such time. Such rate exceeded 120% of the applicable

federal long-term rate, with compounding (as prescribed under section 1274(d) of the Internal Revenue Code), of 5.68% at

such time. Accordingly, pursuant to SEC rules, column (h) of the Summary Compensation Table includes the portion of such

interest that exceeded interest calculated using 120% of the applicable federal long-term rate, with compounding (as

prescribed under section 1274(d) of the Internal Revenue Code), at the time such interest rate was set.

See ‘‘Compensation Discussion and Analysis’’ for information relating to vesting and distribution of amounts under the SERP.

(2) Represents deferred salary accounts pursuant to deferred salary compensation agreements for Messrs. Rooney and Ellison

for 2008 and/or prior years. The other officers have not deferred any of their salaries. All of the annual salary earned is

reported in column (c) of the Summary Compensation Table, whether or not deferred. Pursuant to the agreements, the

deferred salary account is credited with interest compounded monthly, computed at a rate equal to one-twelfth of the sum of

the average twenty-year Treasury Bond rate plus 1.25 percentage points until the deferred compensation amount is paid to

such person. As required by SEC rules, column (h) of the Summary Compensation Table includes the portion of such interest

that exceeded interest calculated using 120% of the applicable federal long-term rate, with compounding (as prescribed under

section 1274(d) of the Internal Revenue Code), at the time each monthly interest rate was set.

(3) Column (e) includes a distribution of Mr. Rooney’s account of salary deferred relating to years prior to 2008, including

interest, on December 1, 2008.

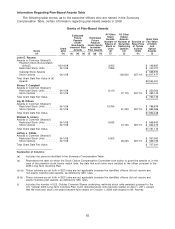

(4) The amounts in column (b) represent deferrals of bonus earned in 2008. All of the annual bonus is reported in column (d),

‘‘Bonus,’’ of the Summary Compensation Table, whether or not deferred. The amounts in column (c) represent the value of

company match awards credited with respect to the officer in the fiscal year. One-third of the phantom stock bonus match

units vest with respect to a particular year’s deferred bonus on each of the first three anniversaries of the last day of the year

for which the applicable bonus is payable, provided that such officer is an employee of U.S. Cellular or an affiliate on such

date. If the officer continues as an employee during the entire vesting period, he or she will receive a total bonus match equal

to the sum of (i) 25% of amounts deferred up to 50% of such year’s bonus and (ii) 331⁄3% of amounts deferred that exceed

50% of such year’s bonus. The vesting of unvested phantom stock units may accelerate under certain circumstances and the

effects of such acceleration are disclosed in the ‘‘Potential Payments Upon Termination or Change in Control’’ table below.

The FAS 123R expense of the company match stock units is reported in the Summary Compensation Table in column

(e) under ‘‘Stock Awards.’’

An officer will receive in shares an amount equal to his or her vested deferred compensation account balance at the date

elected by the officer (either the officer’s separation from service, subject to any delay required by Section 409A of the

Internal Revenue Code, or a date specified by the officer). See the Compensation Disclosure and Analysis for information

relating to vesting and distribution of deferred bonus and company match balances.

70