US Cellular 2008 Annual Report Download - page 50

Download and view the complete annual report

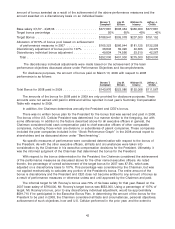

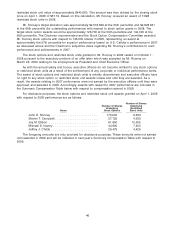

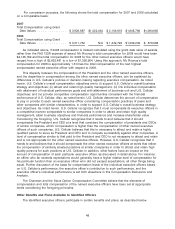

Please find page 50 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which the President contributed to U.S. Cellular’s performance, as discussed above. Based on these

factors, on February 21, 2008, the Chairman approved a bonus to John E. Rooney of $675,000 with

respect to 2007 performance. This was 122% of his target bonus amount reflecting U.S. Cellular’s

performance as discussed above and the Chairman’s subjective views regarding Mr. Rooney’s

contributions to such performance and achievements in 2007.

On June 30, 2008, U.S. Cellular’s Chairman approved an Executive Bonus Plan for 2008. A copy of

this plan was filed with the SEC on a Form 8-K dated June 30, 2008. Performance and bonuses under

this plan will be reflected in next year’s proxy statement.

Beginning with the 2008 performance year relating to bonuses that were paid and earned in 2009,

U.S. Cellular established performance guidelines and procedures for awarding bonuses to the President

and CEO. These guidelines and procedures were filed by U.S. Cellular as Exhibit 10.1 to U.S. Cellular’s

Form 8-K dated November 19, 2008. These guidelines and procedures provide that the Chairman in his

sole discretion determines whether an annual bonus will be payable to the President and CEO for a

performance year and, if so, the amount of such bonus, and describes factors that may be considered

by the Chairman in making such determination, including any factors that the Chairman in the exercise of

his judgment and discretion determines relevant. The guidelines and procedures provide that no single

factor will be determinative and no factor will be applied mechanically to calculate any portion of the

bonus to the President and CEO. The entire amount of the bonus is discretionary. The guidelines and

procedures provide that the President and CEO will have no right or expectation with respect to any

bonus until the Chairman has determined whether a bonus will be paid for a performance year, and any

such bonus is not earned or vested until the date the bonus is paid. The guidelines also provide that any

bonus awarded with respect to a performance year will be paid during the period commencing on the

January 1 immediately following the performance year and ending on the March 15 immediately

following the performance year.

For disclosure purposes, the amount of bonus paid on March 13, 2009 with respect to 2008

performance to the President and CEO was $410,000. The amount of the bonus for 2008 paid in 2009 is

only provided for disclosure purposes. This amount was not earned until paid in 2009 and will be

reported in next year’s Summary Compensation Table with respect to 2009.

Long-Term Equity Compensation

The Chairman recommends and the Stock Option Compensation Committee approves long-term

equity compensation awards to the named executive officers under the U.S. Cellular 2005 Long-Term

Incentive Plan, which awards generally have included stock options, restricted stock units and bonus

match units.

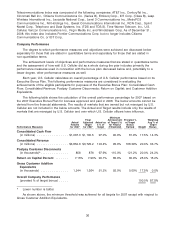

Long-term compensation decisions for the named executive officers are evaluated in a manner

similar to that described for annual base salary and bonus decisions above, except that the stock

options and restricted stock units are generally intended to vest over several years, in order to reflect the

goal of relating long-term compensation of the named executive officers to increases in shareholder

value over the same period.

The Stock Option Compensation Committee may establish performance measures and restriction

periods, and determine the form, amount and timing of each grant of an award, the number of shares of

stock subject to an award, the purchase price or base price per share of stock associated with the

award, the time and conditions of exercise or settlement of the award and all other terms and conditions

of the award.

Although the Stock Option Compensation Committee has the discretion to grant various awards, it

generally only grants service-based restricted stock units and service-based stock options. The restricted

stock units generally vest in full (cliff vesting) on the third anniversary of the date of grant, subject to

continued employment. Stock options are exercisable until the tenth anniversary of the date of grant,

subject to continued employment. For several years prior to 2008, the stock options granted became

exercisable with respect to 25% of the shares underlying the stock option each year over a four year

43