US Cellular 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

United States Cellular Corporation (‘‘U.S. Cellular’’), a Delaware Corporation, is an 81%-owned

subsidiary of Telephone and Data Systems, Inc. (‘‘TDS’’).

Nature of Operations

U.S. Cellular owns, operates and invests in wireless systems throughout the United States. As of

December 31, 2008, U.S. Cellular owned, or had the right to acquire pursuant to certain agreements,

interests in 278 wireless markets and served 6.2 million customers in 26 states, representing a total

population in its operating markets of approximately 46 million. U.S. Cellular operates as one reportable

segment.

Principles of Consolidation

The accounting policies of U.S. Cellular conform to accounting principles generally accepted in the

United States of America (‘‘GAAP’’). The consolidated financial statements include the accounts of U.S.

Cellular, its majority-owned subsidiaries, general partnerships in which U.S. Cellular has a majority

partnership interest and any entity in which U.S. Cellular has a variable interest that requires U.S. Cellular

to recognize a majority of the entity’s expected gains or losses. All material intercompany accounts and

transactions have been eliminated.

Reclassifications

Certain prior year amounts have been reclassified to conform to the 2008 financial statement

presentation. These reclassifications did not affect consolidated net income, assets, liabilities, cash flows

or shareholders’ equity for the years presented.

Business Combinations

U.S. Cellular uses the purchase method of accounting for business combinations and, therefore, costs of

acquisitions include the value of the consideration given and all related direct and incremental costs

relating to acquisitions. All costs relating to unsuccessful negotiations for acquisitions are charged to

expense when the acquisition is no longer considered probable.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to

make estimates and assumptions that affect (a) the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and (b) the reported

amounts of revenues and expenses during the reported period. Actual results could differ from those

estimates. Significant estimates are involved in accounting for revenue, contingencies and commitments,

goodwill and indefinite-lived intangible assets, asset retirement obligations, derivatives, depreciation,

amortization and accretion, allowance for doubtful accounts, stock-based compensation and income

taxes.

Cash and Cash Equivalents

Cash and cash equivalents include cash and short-term, highly liquid investments with original maturities

of three months or less.

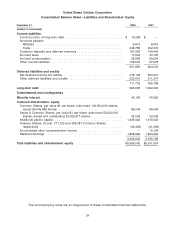

Outstanding checks totaled $20.3 million and $10.0 million at December 31, 2008 and 2007, respectively,

and are classified as Accounts payable-Trade in the Consolidated Balance Sheet.

38