US Cellular 2008 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 3 INCOME TAXES (Continued)

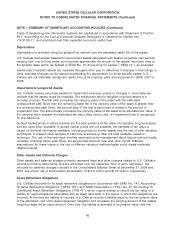

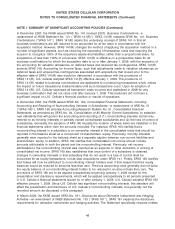

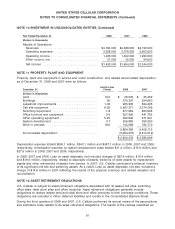

U.S. Cellular’s noncurrent deferred income tax assets and liabilities at December 31, 2008 and 2007 and

the temporary differences that gave rise to them were as follows:

December 31, 2008 2007

(Dollars in thousands)

Noncurrent deferred tax assets

Net operating loss carryforward (‘‘NOL’’) ................ $ 31,236 $ 30,126

Other ......................................... 29,665 32,647

60,901 62,773

Less valuation allowance ........................... (23,565) (22,874)

Total noncurrent deferred tax assets ................... 37,336 39,899

Noncurrent deferred tax liabilities

Licenses/intangibles ............................... 202,606 286,965

Property, plant and equipment ....................... 258,453 216,583

Partnership investments ............................ 51,059 85,498

Other ......................................... 3,324 5,265

Total noncurrent deferred tax liabilities .................. 515,442 594,311

Net noncurrent deferred income tax liability ............... $478,106 $554,412

At December 31, 2008, U.S. Cellular and certain subsidiaries had $567.3 million of state NOL

carryforwards (generating a $27.2 million deferred tax asset) available to offset future taxable income

primarily of the individual subsidiaries which generated the losses. The state NOL carryforwards expire

between 2009 and 2028. Certain subsidiaries which are not included in the federal consolidated income

tax return, but file separate federal tax returns, had federal NOL carryforwards (generating a $4.0 million

deferred tax asset) available to offset future taxable income. The federal NOL carryforwards expire

between 2009 and 2028. A valuation allowance totaling $23.6 million was established for certain state

NOL carryforwards and federal NOL carryforwards since it is more likely than not that a portion of such

carryforwards will expire before they can be utilized.

Effective January 1, 2007, U.S. Cellular adopted FIN 48. In accordance with FIN 48, U.S. Cellular

recognized a cumulative effect adjustment of $1.3 million, increasing its liability for unrecognized tax

benefits, interest and penalties and reducing the January 1, 2007 balance of Retained earnings.

At December 31, 2008, U.S. Cellular had $27.8 million in unrecognized tax benefits which, if recognized,

would reduce income tax expense by $15.3 million, net of the federal benefit from state income taxes. At

December 31, 2007, U.S. Cellular had $33.9 million in unrecognized tax benefits, which, if recognized,

would reduce income tax expense by $16.1 million, net of the federal benefit from state income taxes.

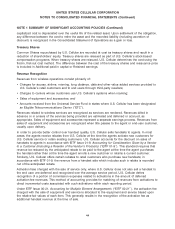

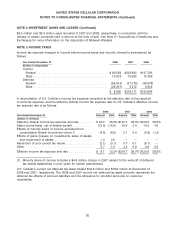

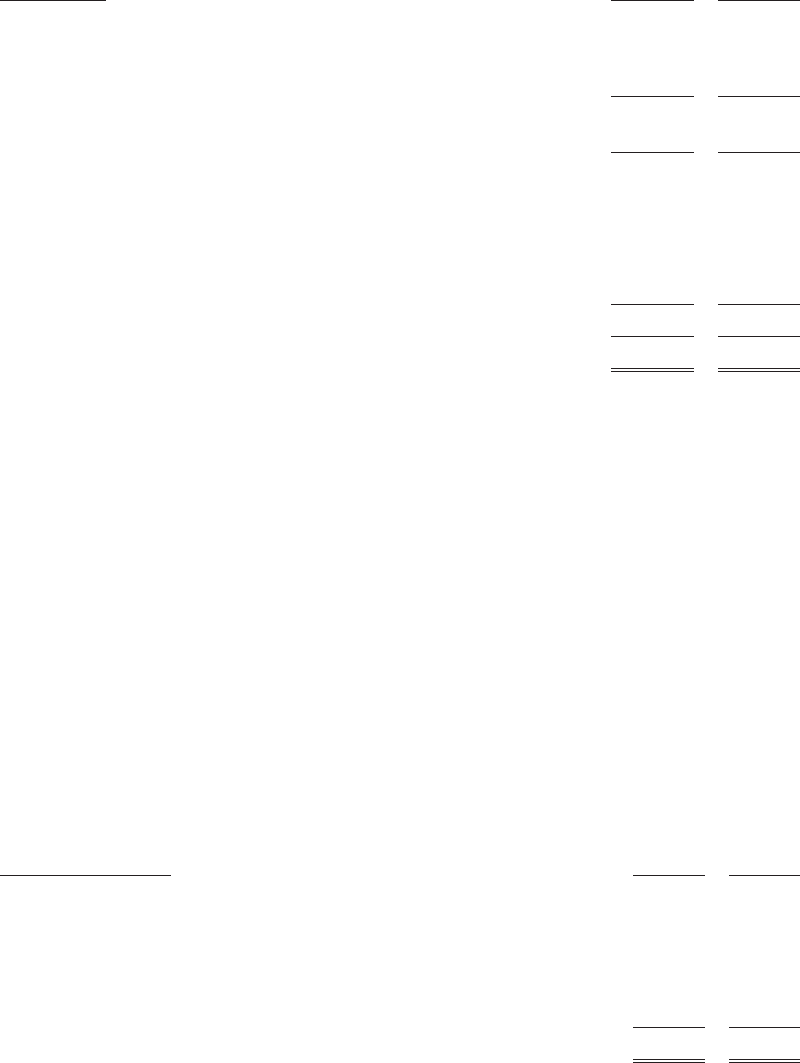

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

(Dollars in thousands) 2008 2007

Balance at January 1, ................................. $33,890 $25,751

Additions for tax positions of current year ................. 4,858 6,213

Additions for tax positions of prior years .................. 692 2,793

Reductions for tax positions of prior years ................. (5,320) (491)

Reductions for settlements of tax positions ................ (3,177) (117)

Reductions for lapses in statutes of limitations .............. (3,157) (259)

Balance at December 31, .............................. $27,786 $33,890

51