US Cellular 2008 Annual Report Download - page 70

Download and view the complete annual report

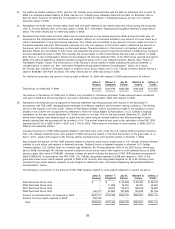

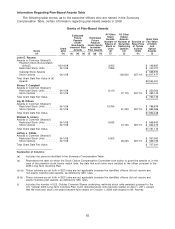

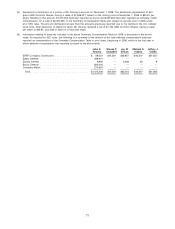

Please find page 70 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Also includes the number of phantom stock bonus match units in U.S. Cellular Common Shares credited to such

officer with respect to deferred bonus compensation. Mr. Rooney deferred all of his bonus earned in 2008 under

the U.S. Cellular 2005 Long-Term Incentive Plan, which permits the above officers to defer all or a portion of their

annual bonus to a deferred compensation account. Deferred compensation will be deemed invested in phantom

U.S. Cellular Common Shares. The phantom stock units are not credited with dividends because U.S. Cellular does

not currently pay dividends. The officer makes an election as to when to receive a distribution of the deferred

compensation account. If an officer elects to defer all or a portion of his annual bonus, U.S. Cellular will allocate a

match award to the employee’s deferred compensation account in an amount equal to the sum of (i) 25% of the

deferred bonus amount which is not in excess of one-half of the employee’s gross bonus for the year and

(ii) 331⁄3% of the deferred bonus amount which is in excess of one-half of the employee’s gross bonus for the year.

The entire amount of the bonus is included in the Summary Compensation Table in column (d) under ‘‘Bonus,’’

whether or not deferred. The FAS 123R expense of the matched stock units is reported in the Summary

Compensation Table in column (e) under ‘‘Stock Awards.’’ See ‘‘Information Regarding Nonqualified Deferred

Compensation’’ below.

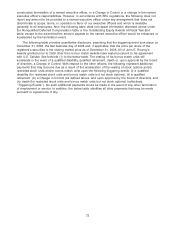

(j) Represents the number of U.S. Cellular Common Shares underlying stock options awarded during the fiscal year

pursuant to the U.S. Cellular 2005 Long-Term Incentive Plan. The U.S. Cellular stock options were granted at an

exercise price of $57.19 per share, which was the closing price of a U.S. Cellular Common Share on April 1, 2008.

Such stock options become exercisable with respect to one third of the shares underlying the stock option on

April 1, 2009, 2010 and 2011, except that the stock options vested in their entirety on October 1, 2008 with respect

to Mr. Rooney, and are exercisable until April 1, 2018.

(k) Represents the per-share exercise price of the stock options granted in column (j). Such exercise price is not less

than the closing market price of the underlying security on the date of the grant.

(l) Represents the grant date fair value of each equity award computed in accordance with FAS 123R or, in the case of

any adjustment or amendment of the exercise or base price of stock options, SARs or similar option-like

instruments previously awarded to a named executive officer, whether through amendment, cancellation or

replacement grants, or any other means (‘‘repriced’’), or other material modification of such awards, represents the

incremental fair value, computed as of the repricing or modification date in accordance with FAS 123R, with respect

to that repriced or modified award. No stock options were repriced or materially modified in the last fiscal year with

respect to the identified executive officers.

Footnotes:

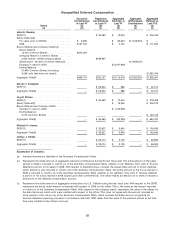

(1) Pursuant to the U.S. Cellular 2005 Long-Term Incentive Plan, on April 1, 2008, such executive officer was granted

restricted stock units and stock options to purchase U.S. Cellular Common Shares as indicated above. The

FAS 123R expense of the restricted stock unit awards is reported in the Summary Compensation Table in column

(e) and the FAS 123R expense of the stock option awards is reported in the Summary Compensation Table in

column (f).

(2) Includes the number of phantom stock units in U.S. Cellular Common Shares credited to such officer with respect

to company match units related to deferred bonus compensation. Only Mr. Rooney deferred his bonus earned in

2008 (based upon 2007 performance). John E. Rooney participates in the U.S. Cellular 2005 Long-Term Incentive

Plan. This plan permits officers to defer all or a portion of their annual bonus to a deferred compensation account.

The FAS 123R expense of the company match stock units is reported in the Summary Compensation Table in

column (e) under ‘‘Stock Awards.’’ U.S. Cellular does not currently pay dividends. Does not include the amount of

the bonus earned that was credited as phantom stock because this is reported in the Summary Compensation

Table in column (d) under ‘‘Bonus’’ whether or not deferred and credited as phantom stock, rather than in column

(e) as ‘‘Stock Awards’’. John E. Rooney deferred $675,000, representing 100% of the bonus earned by him in 2008,

and was credited with 12,004 shares of phantom stock on March 14, 2008.

63