US Cellular 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

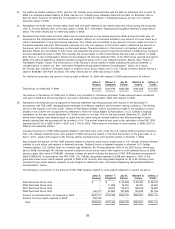

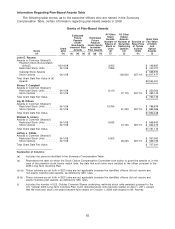

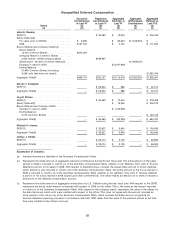

For reference purposes, the following is a summary of the grant date value of stock awards in 2008 reflected in column (l) of

the Grants of Plan-Based Awards Table below:

John E. Steven T. Jay M. Michael S. Jeffrey J.

Rooney Campbell Ellison Irizarry Childs

2008 Restricted Stock Units ..................... $440,077 $350,003 $788,879 $568,640 $337,592

2008 Bonus Match Awards ...................... 196,897 — — — —

Total ................................... $636,974 $350,003 $788,879 $568,640 $337,592

If an award ultimately vests in full, the amount cumulatively recognized in the Summary Compensation Table over a period of

years should equal 100% of the grant date fair value of the equity award or the total fair value at the date of settlement for a

liability award.

(f) Represents the dollar amount recognized for financial statement reporting purposes with respect to the fiscal year in

accordance with FAS 123R, disregarding the estimate of forfeitures related to service-based vesting conditions. The dates on

which the stock options become exercisable and expire is set forth below under ‘‘Grants of Plan-Based Awards.’’

Assumptions made in the valuation of the stock option awards in this column are incorporated by reference from Note 18—

Stock Based Compensation, in U.S. Cellular’s financial statements for the year ended December 31, 2008 included in its

Form 10-K for the year ended December 31, 2008. All above stock options were valued based on grant date fair value using

a forfeiture rate (the percentage of stock options granted in 2008 that are assumed will be forfeited) of 0%. The annual

forfeiture rate used in the calculation of the FAS 123R expense was 11.29% in 2008, 9.6% in 2007 and 4.4% in 2006. There

were no forfeitures of stock options in 2008, 2007 or 2006 for the identified officers. The awards represent stock options with

respect to U.S. Cellular Common Shares awarded during the fiscal year.

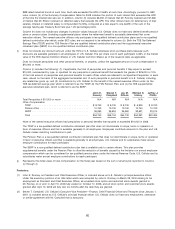

The following is a summary of the amount of FAS 123R expense relating to stock options reflected in column (f) above:

John E. Steven T. Jay M. Michael S. Jeffrey J.

Rooney Campbell Ellison Irizarry Childs

2004 Options ............................. $ — $ — $ 9,147 $ 5,901 $ 1,262

2005 Options ............................. — 6,989 38,308 24,250 21,438

2006 Options ............................. — 18,962 93,296 59,192 52,309

2007 Options ............................. — 95,678 223,064 160,343 95,678

2008 Options ............................. 1,917,477 176,055 396,804 286,024 169,898

Amount of stock option expense in 2008 ............ $1,917,477 $297,684 $760,619 $535,710 $340,585

For reference purposes, the following is a summary of the grant date value of stock options in 2008 reflected in column (l) of

the Grants of Plan-Based Awards Table below:

John E. Steven T. Jay M. Michael S. Jeffrey J.

Rooney Campbell Ellison Irizarry Childs

Grant date value of stock options awarded in 2008 ..... $1,917,477 $383,143 $863,569 $622,475 $369,749

If a stock option ultimately vests in full, the amount cumulatively recognized in the Summary Compensation Table over a

period of years should equal 100% of the grant date fair value of the equity award or the total fair value at the date of

settlement for a liability award.

For 2006 and 2007, the stock options granted became exercisable with respect to 25% of the shares underlying the stock

option each year over a four year period. However, beginning with awards made in April 2008, stock options become

exercisable with respect to 331⁄3% of the shares underlying the stock option each year over a three year period. As a result,

the FAS 123R expense for options granted in 2006 and 2007 is being reflected over four years whereas the FAS 123R

expense for options granted in 2008 will be reflected over three years.

(g) None of the above executive officers has any earnings for services performed during the fiscal year pursuant to awards under

‘‘non-equity incentive plans’’ or earnings on any outstanding awards, pursuant to SEC rules. All amounts paid or awarded are

disclosed in other columns under SEC rules. Although the annual Executive Officer Annual Incentive Plan provides incentives

to executive officers other than the Chairman and the President, this plan does not function in a way which permits the

determination of the bonus based on achievement of performance measures, and bonus payments under the plan are based

on the judgment and discretion of the President and Chairman, as discussed above. Amounts under this plan are not earned

until they are awarded and paid in the following year. There is no way under such plan to determine the amount to be paid

prior to such time. Accordingly, amounts paid under such plan are set forth above under Bonus in column (d) in the year

earned and paid. See the discussion under ‘‘Bonus’’ in the above Compensation Discussion and Analysis.

(h) As required by SEC rules, column (h) includes the portion of interest that exceeded 120% of the applicable federal long-term

rate (‘‘AFR’’), with compounding (as prescribed under section 1274(d) of the Internal Revenue Code), at the time each

monthly interest rate is set. Each of the identified officers participates in a supplemental executive retirement plan or SERP.

The interest rate for 2008 was set as of the last trading date of 2007 at 6.109% per annum, based on the yield on ten year

59