US Cellular 2008 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

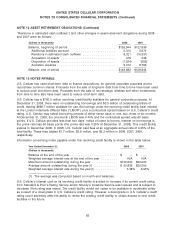

NOTE 14 LONG-TERM DEBT (Continued)

U.S. Cellular’s long-term debt indentures do not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a

downgrade in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt

financing in the future.

The annual requirements for principal payments on long-term debt over the next five years are

$10.3 million in 2009. No principal payments, excluding capital lease obligations, are required in the

years 2010 through 2013.

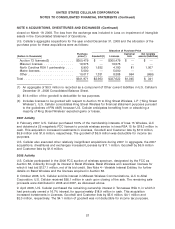

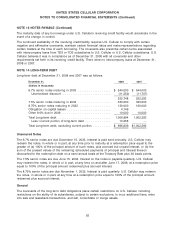

NOTE 15 FINANCIAL INSTRUMENTS

Financial instruments at December 31, 2008 and 2007 were as follows:

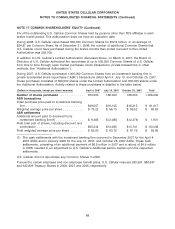

2008 2007

December 31, Book Value Fair Value Book Value Fair Value

(Dollars in thousands)

Cash and cash equivalents ............... $170,996 $170,996 $ 204,533 $204,533

Current portion of long-term debt(1) ........ 10,000 9,887 — —

Long-term debt(1) ..................... 992,748 663,432 1,002,293 888,807

(1) Excludes capital lease obligations

The book value of cash and cash equivalents approximates the fair value due to the short-term nature of

these financial instruments. The fair value of U.S. Cellular’s current portion of long-term debt, excluding

capital lease obligations, was estimated using a discounted cash flow analysis. The fair value of U.S.

Cellular’s long-term debt, excluding capital lease obligations, was estimated using market prices for the

7.5% senior notes, the 8.75% senior notes and discounted cash flow analysis for the remaining debt. The

computation of these fair values at December 31, 2008 is consistent with the guidance and framework

set forth in SFAS 157.

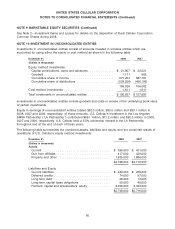

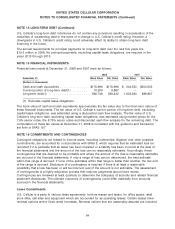

NOTE 16 COMMITMENTS AND CONTINGENCIES

Contingent obligations not related to income taxes, including indemnities, litigation and other possible

commitments, are accounted for in accordance with SFAS 5, which requires that an estimated loss be

recorded if it is probable that an asset has been impaired or a liability has been incurred at the date of

the financial statements and the amount of the loss can be reasonably estimated. Accordingly, those

contingencies that are deemed to be probable and where the amount of the loss is reasonably estimable

are accrued in the financial statements. If only a range of loss can be determined, the best estimate

within that range is accrued; if none of the estimates within that range is better than another, the low end

of the range is accrued. Disclosure of a contingency is required if there is at least a reasonable

possibility that a loss has been or will be incurred, even if the amount is not estimable. The assessment

of contingencies is a highly subjective process that requires judgments about future events.

Contingencies are reviewed at least quarterly to determine the adequacy of accruals and related financial

statement disclosures. The ultimate outcomes of contingencies could differ materially from amounts

accrued in the financial statements.

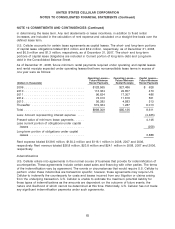

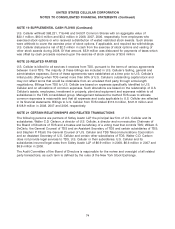

Lease Commitments

U.S. Cellular is a party to various lease agreements, both as lessee and lessor, for office space, retail

store sites, cell sites and equipment which are accounted for as operating leases. Certain leases have

renewal options and/or fixed rental increases. Renewal options that are reasonably assured are included

64