US Cellular 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

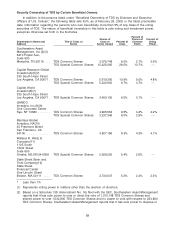

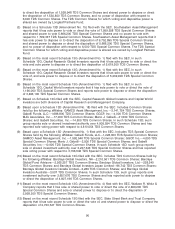

8,500 Common Shares. In such Schedule 13D, such group reports sole or shared investment authority over 3.670,579

Common Shares and has reported sole voting power with respect to 3,539,279 Common Shares.

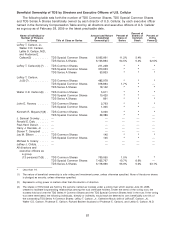

Security Ownership of U.S. Cellular by Management

Several of our officers and directors indirectly hold substantial ownership interests in U.S. Cellular by

virtue of their ownership of the capital stock of TDS. See ‘‘Beneficial Ownership of TDS by Directors and

Executive Officers of U.S. Cellular’’ below. In addition, the following executive officers and directors and

all officers and directors as a group beneficially owned the following number of our Common Shares as

of February 28, 2009 or the latest practicable date:

Amount and Percent of

Name of Individual Nature of Percent of Shares of Percent of

or Number of U.S. Cellular Beneficial Class or Common Voting

Persons in Group Title of Class or Series Ownership(1) Series Stock Power(2)

LeRoy T. Carlson ............... Common Shares 1,243 * * *

LeRoy T. Carlson, Jr. ............. Common Shares — — — —

John E. Rooney(3)(9) ............ Common Shares 228,729 * * *

Walter C.D. Carlson .............. Common Shares 5,904 * * *

Kenneth R. Meyers(4)(9) .......... Common Shares 80,220 * * *

J. Samuel Crowley .............. Common Shares 1,308 — — —

Ronald E. Daly ................. Common Shares 1,650 * * *

Paul-Henri Denuit ............... Common Shares — — — —

Harry J. Harczak, Jr. ............. Common Shares 2,363 * * *

Steven T. Campbell (5) ........... Common Shares 22,326 * * *

Jay M. Ellison(6) ................ Common Shares 82,219 * * *

Michael S. Irizarry(7) ............. Common Shares 48,859 * * *

Jeffrey J. Childs(8) .............. Common Shares 51,350 * * *

All directors and executive officers as a

group (13 persons)(9) .......... Common Shares 526,171 1.0% * *

* Less than 1%.

(1) The nature of beneficial ownership is sole voting and investment power unless otherwise specified. Except with respect to

customary brokerage agreement terms pursuant to which shares in a brokerage account are pledged as collateral security for

the repayment of debit balances, none of the above shares is pledged as security, unless otherwise specified.

(2) Represents voting power in matters other than the election of directors.

(3) Includes 136,000 Common Shares subject to stock options which are currently exercisable or exercisable within 60 days and

phantom stock with respect to 28,890 U.S. Cellular Common Shares.

(4) Includes 41,219 Common Shares subject to stock options which are currently exercisable or exercisable within 60 days, 3,163

restricted stock units with respect to U.S. Cellular Common Shares which are subject to vesting within 60 days and phantom

stock with respect to 1,144 shares. Also includes 1,000 Common Shares which are held by a trust for which Mr. Meyers is a

trustee and 2,500 Common Shares held for the benefit of his children. Mr. Meyers disclaims beneficial ownership of such

shares.

(5) Includes 21,446 Common Shares subject to stock options which are currently exercisable or exercisable within 60 days and

restricted stock units with respect to 590 U.S. Cellular Common Shares which are subject to vesting within 60 days.

(6) Includes 72,318 Common Shares subject to stock options which are currently exercisable or exercisable within 60 days,

restricted stock units with respect to 3,873 U.S. Cellular Common Shares which are subject to vesting within 60 days and

phantom stock with respect to 3,010 U.S. Cellular Common Shares.

(7) Includes 46,399 Common shares subject to stock options which are currently exercisable or exercisable within 60 days and

restricted stock units with respect to 2,458 U.S. Cellular Common Shares which are subject to vesting within 60 days.

(8) Includes 47,192 Common Shares subject to stock options which are currently exercisable or exercisable within 60 days and

restricted stock units with respect to 2,172 U.S. Cellular Common Shares which are subject to vesting within 60 days.

(9) Includes shares as to which voting and/or investment power is shared.

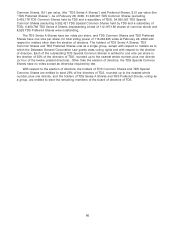

Description of TDS Securities

The authorized capital stock of TDS includes Common Shares, $.01 par value (the ‘‘TDS Common

Shares’’), Special Common Shares $.01 par value (the ‘‘TDS Special Common Shares’’) Series A

85