US Cellular 2008 Annual Report Download - page 59

Download and view the complete annual report

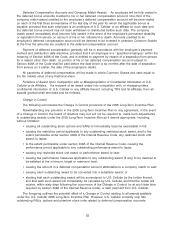

Please find page 59 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Deferred Compensation Accounts and Company Match Awards. An employee will be fully vested in

the deferred bonus amounts credited to his or her deferred compensation account. One-third of the

company match award credited to the employee’s deferred compensation account will become vested

on each of the first three anniversaries of the last day of the year for which the applicable bonus is

payable, provided that such employee is an employee of U.S. Cellular or an affiliate on such date and

the deferred bonus amount has not been withdrawn or distributed before such date. The company

match award immediately shall become fully vested in the event of the employee’s permanent disability

or separation from service on account of his or her retirement or death. Amounts credited to an

employee’s deferred compensation account will be deemed to be invested in phantom Common Shares

at the time the amounts are credited to the deferred compensation account.

Payment of deferred compensation generally will be in accordance with the employee’s payment

method and distribution date elections, provided that if an employee is a ‘‘specified employee’’ within the

meaning of Section 409A of the Code, and is entitled to payment by reason of a separation from service

for a reason other than death, no portion of his or her deferred compensation account subject to

Section 409A of the Code shall be paid before the date which is six months after the date of separation

from service (or if earlier, the date of the employee’s death).

All payments of deferred compensation will be made in whole Common Shares and cash equal to

the fair market value of any fractional share.

Forfeiture of Award Upon Competition with or Misappropriation of Confidential Information of U.S.

Cellular or its Affiliates. If a recipient of an award enters into competition with, or misappropriates

confidential information of, U.S. Cellular or any affiliate thereof, including TDS and its affiliates, then all

awards granted shall terminate and be forfeited.

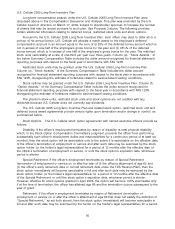

Change in Control

The following summarizes the Change in Control provisions of the 2005 Long-Term Incentive Plan:

Notwithstanding any provision in the 2005 Long-Term Incentive Plan or any agreement, in the event

of a Change in Control, the board of directors may, but will not be required to, make such adjustments

to outstanding awards under the 2005 Long-Term Incentive Plan as it deems appropriate, including,

without limitation:

• causing all outstanding stock options and SARs to immediately become exercisable in full;

• causing the restriction period applicable to any outstanding restricted stock award, and to the

extent permissible under section 409A of the Internal Revenue Code, any restricted stock unit

award, to lapse;

• to the extent permissible under section 409A of the Internal Revenue Code, causing the

performance period applicable to any outstanding performance award to lapse;

• causing any restricted stock unit award or performance award to vest;

• causing the performance measures applicable to any outstanding award (if any) to be deemed to

be satisfied at the minimum, target or maximum level;

• causing the amount in a deferred compensation account attributable to a company match to vest;

• causing each outstanding award to be converted into a substitute award; or

• electing that each outstanding award will be surrendered to U.S. Cellular by the holder thereof,

and that each such award will immediately be canceled by U.S. Cellular, and that the holder will

receive, within sixty days following the occurrence of the Change in Control (or at such later time

required by section 409A of the Internal Revenue Code), a cash payment from U.S. Cellular.

The foregoing outlines the potential effect of a Change in Control relating to all awards available

under the U.S. Cellular 2005 Long-Term Incentive Plan. However, U.S. Cellular currently only has

outstanding RSUs, options and phantom stock units related to deferred compensation accounts.

52