US Cellular 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See Note 3—Income Taxes in the Notes to Consolidated Financial Statements for details regarding

U.S. Cellular’s income tax provision, deferred income taxes and liabilities, valuation allowances and

unrecognized tax benefits, including information regarding estimates that impact income taxes.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is the best estimate of the amount of probable credit losses related

to existing accounts receivable. The allowance is estimated based on historical experience and other

factors that could affect collectability. Accounts receivable balances are reviewed on either an aggregate

or individual basis for collectability depending on the type of receivable. When it is probable that an

account balance will not be collected, the account balance is charged against the allowance for doubtful

accounts. U.S. Cellular does not have any off-balance sheet credit exposure related to its customers.

Recent economic events have caused the consumer credit market to tighten for certain consumers. This

may cause U.S. Cellular’s bad debt expense to increase in future periods. U.S. Cellular will continue to

monitor its accounts receivable balances and related allowance for doubtful accounts on an ongoing

basis to assess whether it has adequately provided for potentially uncollectible amounts.

See Note 1—Summary of Significant Accounting Policies in the Notes to Consolidated Financial

Statements for additional information regarding U.S. Cellular’s allowance for doubtful accounts.

Stock-based Compensation

As described in more detail in Note 18—Stock-based Compensation in the Notes to Consolidated

Financial Statements, U.S. Cellular has established a long-term incentive plan, an employee stock

purchase plan and a non-employee director compensation plan; in addition, U.S. Cellular employees are

eligible to participate in the TDS employee stock purchase plan. All of these plans are stock-based

compensation plans. Prior to January 1, 2006, U.S. Cellular accounted for its stock-based compensation

plans in accordance with Accounting Principles Board (‘‘APB’’) Opinion No. 25, Accounting for Stock

Issued to Employees (‘‘APB 25’’) and related interpretations as allowed by SFAS No. 123, Accounting for

Stock Based Compensation, (‘‘SFAS 123’’). Accordingly, prior to 2006, compensation cost for share-

based payments was measured using the intrinsic value method as prescribed by APB 25. Under the

intrinsic value method, compensation cost is measured as the amount by which the market value of the

underlying equity instrument on the grant date exceeds the exercise price. Effective January 1, 2006,

U.S. Cellular adopted the fair value recognition provisions of SFAS 123(R), using the modified

prospective transition method. Under the modified prospective transition method, compensation cost

recognized during 2008, 2007 and 2006 includes: (a) compensation cost for all share-based payments

granted prior to but not yet vested as of January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of SFAS No. 123, Accounting for Stock Based Compensation,

and (b) compensation cost for all share-based payments granted subsequent to January 1, 2006, based

on the grant-date fair value estimated in accordance with the provisions of SFAS 123(R).

Upon adoption of SFAS 123(R), U.S. Cellular elected to value share-based payment transactions using a

Black-Scholes valuation model. This model requires assumptions regarding a number of complex and

subjective variables. The variables include U.S. Cellular’s expected stock price volatility over the term of

the awards, expected forfeitures, time of exercise, risk-free interest rate and expected dividends. Different

assumptions could create different results.

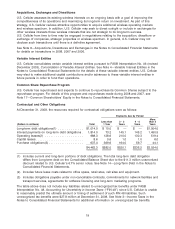

U.S. Cellular used the assumptions shown in the table below in valuing stock options granted in 2008,

2007 and 2006:

2008 2007 2006

Expected life ...................... 3.7 Years 3.1 Years 3.0 Years

Expected volatility .................. 28.1% - 40.3% 22.5% - 25.7% 23.5% - 25.2%

Dividend yield ..................... 0% 0% 0%

Risk-free interest rate ................ 1.2% - 3.5% 3.3% - 4.8% 4.5% - 4.7%

Estimated annual forfeiture rate ........ 11.29% 9.60% 4.40%

25