US Cellular 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

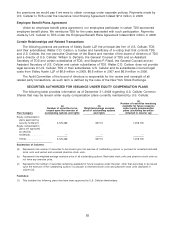

Number of securities remaining

Number of securities to be available for future issuance

issued upon the exercise of (excluding securities reflected

Plan outstanding options and rights in prior column) Total

2003 Employee Stock Purchase Plan . . — —

2009 Employee Stock Purchase Plan . . — 125,000 125,000

Non-Employee Director Compensation

Plan ..................... — 53,139 53,139

2005 Long-Term Incentive Plan ...... 2,125,466 1,640,637 3,766,103

TOTAL.................... 2,125,466 1,818,776 3,944,242

See Note 18—Stock-Based Compensation, in the notes to the consolidated financial statements included in our 2008 Annual

Report to Shareholders for certain information about these plans, which is incorporated by reference herein.

The 2003 Employee Stock Purchase Plan expired on December 31, 2008. This was replaced by the 2009 Employee Stock

Purchase Plan that became effective January 1, 2009.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

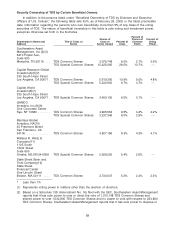

On February 28, 2009, there were outstanding 54,130,230 Common Shares, par value $1.00 per

share (excluding 937,989 shares held by U.S. Cellular and a subsidiary of U.S. Cellular), and 33,005,877

Series A Common Shares, par value $1.00 per share, representing a total of 87,136,107 shares of

common stock. As of February 28, 2009 no shares of our Preferred Stock, par value $1.00 per share,

were outstanding. Holders of outstanding Common Shares are entitled to elect 25% of the directors

(rounded up to the nearest whole number) and are entitled to one vote for each Common Share held in

such holder’s name with respect to all matters on which the holders of Common Shares are entitled to

vote at the annual meeting. The holder of Series A Common Shares is entitled to elect 75% of the

directors (rounded down to the nearest whole number) and is entitled to ten votes for each Series A

Common Share held in such holder’s name with respect to all matters on which the holder of Series A

Common Shares is entitled to vote. Accordingly, the voting power of the Series A Common Shares with

respect to matters other than the election of directors was 330,058,770 votes, and the total voting power

of all outstanding shares of capital stock was 384,189,000 as of February 28, 2009.

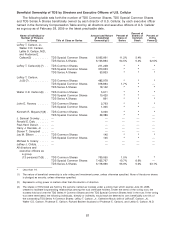

Security Ownership of U.S. Cellular by Certain Beneficial Owners

The following table sets forth, as of February 28, 2009, or the latest practicable date, information

regarding the person(s) who beneficially own more than 5% of any class of our voting securities.

Shares of Percent of

Class or Percent of Shares of Percent of

U.S. Cellular Series Class or Common Voting

Shareholder’s Name and Address Title of Class or Series Owned(1) Series Stock Power(2)

Telephone and Data Systems, Inc.

30 North LaSalle Street

Chicago, Illinois 60602 Common Shares 37,782,826 69.8% 43.3% 9.8%

Series A Common Shares(3) 33,005,877 100.0% 37.9% 85.9%

Total 70,788,703 N/A 81.2% 95.7%

GAMCO Investors, Inc.(4)

One Corporate Center

Rye, New York 10580 Common Shares 3,670,579 6.8% 4.2% *

* Less than 1%.

(1) The nature of beneficial ownership is sole voting and investment power unless otherwise specified.

(2) Represents voting power in matters other than the election of directors.

(3) The Series A Common Shares are convertible on a share-for-share basis into Common Shares.

(4) Based on the most recent Schedule 13D (Amendment No. 4) filed with the SEC. Includes shares held by the following

affiliates: Gabelli Funds, LLC—864,630 Common Shares; GAMCO Asset Management Inc.—2,792,949 Common Shares;

Gabelli Foundation, Inc.—2,500 Common Shares; Mario J. Gabelli—2,000 Common Shares; and Gabelli Securities, Inc.—

84