US Cellular 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 2 INVESTMENT GAINS AND LOSSES (Continued)

$6.3 million and $0.3 million were recorded in 2007 and 2008, respectively, in connection with the

release of certain proceeds held in escrow at the time of sale. See Note 6—Acquisitions, Divestitures and

Exchanges for more information on the disposition of Midwest Wireless.

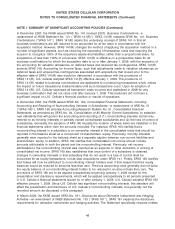

NOTE 3 INCOME TAXES

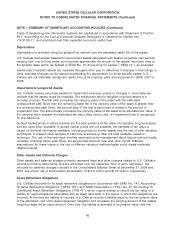

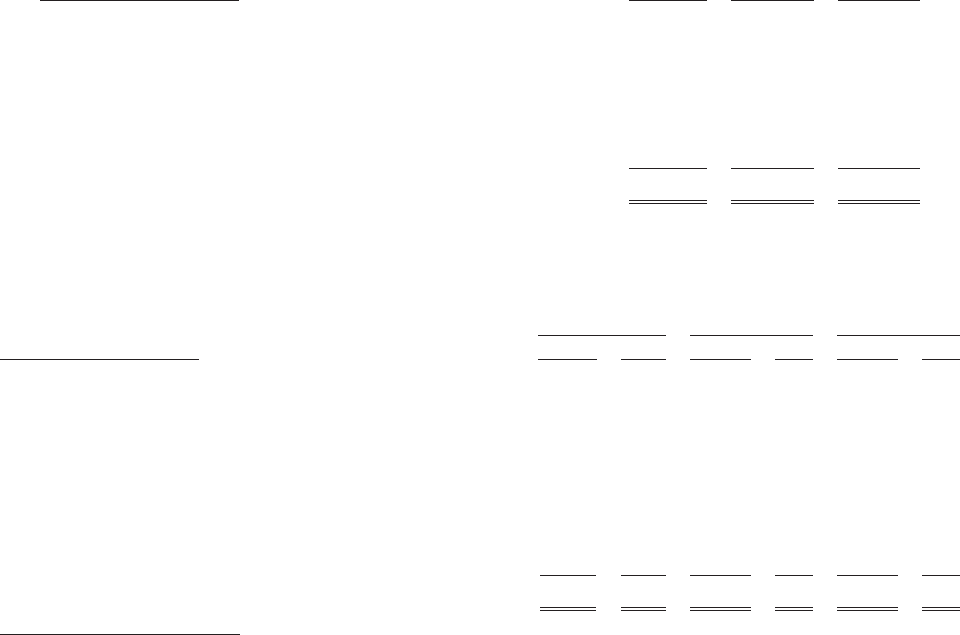

Income tax expense charged to Income before income taxes and minority interest is summarized as

follows:

Year Ended December 31, 2008 2007 2006

(Dollars in thousands)

Current

Federal ...................................... $80,558 $223,952 $137,793

State ........................................ 10,618 19,262 15,756

Deferred

Federal ...................................... (54,814) (31,775) (39,578)

State ........................................ (28,307) 5,272 6,633

$ 8,055 $216,711 $120,604

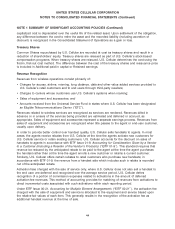

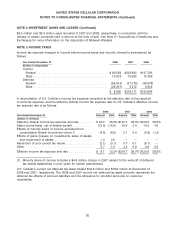

A reconciliation of U.S. Cellular’s income tax expense computed at the statutory rate to the reported

income tax expense, and the statutory federal income tax expense rate to U.S. Cellular’s effective income

tax expense rate is as follows:

2008 2007 2006

Year Ended December 31, Amount Rate Amount Rate Amount Rate

(Dollars in millions)

Statutory federal income tax expense and rate ....... $23.2 35.0% $191.3 35.0% $109.6 35.0%

State income taxes, net of federal benefit ........... (10.5) (15.9) 18.4 3.4 14.2 4.5

Effects of minority share of income excluded from

consolidated federal income tax return(1) ......... (4.5) (6.8) 2.1 0.4 (3.9) (1.2)

Effects of gains (losses) on investments, sales of assets

and impairment of assets ..................... 1.3 2.0 — — — —

Resolution of prior period tax issues ............... (2.1) (3.1) 0.7 0.1 (0.1) —

Other ..................................... 0.7 1.0 4.2 0.8 0.8 0.2

Effective income tax expense and rate ............. $ 8.1 12.2% $216.7 39.7% $120.6 38.5%

(1) Minority share of income includes a $4.6 million charge in 2007 related to the write-off of deferred

tax assets established in prior years for certain partnerships.

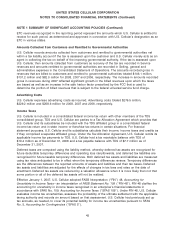

U.S. Cellular’s current net deferred tax asset totaled $19.5 million and $18.6 million at December 31,

2008 and 2007, respectively. The 2008 and 2007 current net deferred tax asset primarily represents the

deferred tax effects of accrued liabilities and the allowance for doubtful accounts on customer

receivables.

50