US Cellular 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES CELLULAR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 18 STOCK-BASED COMPENSATION (Continued)

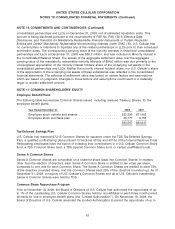

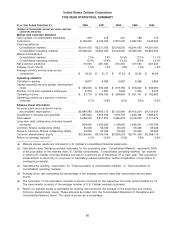

At December 31, 2008, U.S. Cellular had reserved 3,766,000 Common Shares for equity awards granted

and to be granted under the long-term incentive plan, and also had reserved 125,000 Common Shares

for issuance to employees under an employee stock purchase plan. The maximum number of U.S.

Cellular Common Shares that may be issued to employees under all stock-based compensation plans in

effect at December 31, 2008, was 3,891,000. U.S. Cellular currently utilizes treasury stock to satisfy

requirements for Common Shares issued pursuant to its various stock-based compensation plans.

U.S. Cellular also has established a Non-Employee Director Compensation Plan under which it has

reserved 53,000 Common Shares for issuance as compensation to members of the Board of Directors

who are not employees of U.S. Cellular or TDS.

On March 7, 2006, the U.S. Cellular Compensation Committee approved amendments to stock option

award agreements. The amendments modify current and future options to extend the exercise period

until 30 days following (i) the lifting of a ‘‘suspension’’ if options otherwise would expire or be forfeited

during the suspension period and (ii) the lifting of a blackout if options otherwise would expire or be

forfeited during a blackout period. U.S. Cellular temporarily suspended issuances of shares under the

2005 Long Term Incentive Plan between March 17, 2006 and October 10, 2006, as a consequence of

late SEC filings. As required under the provisions of SFAS 123(R), U.S. Cellular evaluated the impact of

this plan modification and recognized $1.5 million in stock-based compensation expense in 2006.

Long-Term Incentive Plan—Stock Options—Stock options granted to key employees are exercisable over

a specified period not in excess of ten years. Stock options generally vest over periods of between three

and five years from the date of grant. Stock options outstanding at December 31, 2008 expire between

2009 and 2018. However, vested stock options typically expire 30 days after the effective date of an

employee’s termination of employment for reasons other than retirement. Employees who leave at the

age of retirement have 90 days (or one year if they satisfy certain requirements) within which to exercise

their vested stock options. The exercise price of the option generally equals the market value of U.S.

Cellular Common Shares on the date of grant.

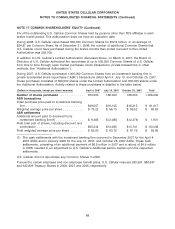

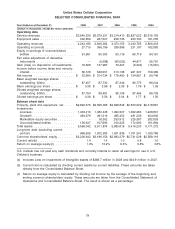

U.S. Cellular granted 685,000, 477,000 and 559,000 stock options during 2008, 2007 and 2006,

respectively. U.S. Cellular estimated the fair value of such stock options using the Black-Scholes

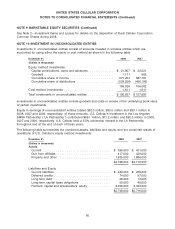

valuation model and the assumptions shown in the table below.

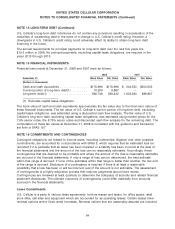

2008 2007 2006

Expected life ........................ 3.7 Years 3.1 Years 3.0 Years

Expected volatility .................... 28.1% - 40.3% 22.5% - 25.7% 23.5% - 25.2%

Dividend yield ....................... 0% 0% 0%

Risk-free interest rate .................. 1.2% - 3.5% 3.3% - 4.8% 4.5% - 4.7%

Estimated annual forfeiture rate .......... 11.29% 9.60% 4.40%

70