US Cellular 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Inbound roaming revenues

In both years, the increase in Inbound roaming revenues was related primarily to higher usage for both

voice and data products and services, partially offset by a decline in rates per minute or kilobyte of use

with key roaming partners. The increase in inbound usage was driven primarily by the overall growth in

the number of customers and higher usage per customer throughout the wireless industry, including

usage related to both voice and data products and services, which led to an increase in inbound traffic

from other wireless carriers.

A significant portion of Inbound roaming revenues is derived from Verizon Wireless (‘‘Verizon’’) and Alltel

Corporation (‘‘Alltel’’). In January 2009, Verizon acquired Alltel. As a result of this transaction, the network

footprints of Verizon and Alltel were combined. This is expected to result in a significant decrease in

inbound roaming revenues for U.S. Cellular, because the combined Verizon and Alltel entity is expected

to significantly reduce its use of U.S. Cellular’s network in certain coverage areas that are currently used

by Verizon and Alltel as separate entities. U.S. Cellular anticipates that such a decline would more than

offset the positive impact of the trends of increasing minutes of use and increasing data usage described

in the preceding paragraph. Additional changes in the network footprints of other carriers also could

have an adverse effect on U.S. Cellular’s inbound roaming revenues. For example, consolidation among

other carriers which have network footprints that currently overlap U.S. Cellular’s network could further

decrease the amount of inbound roaming revenues for U.S. Cellular. U.S. Cellular also anticipates that its

roaming revenue per minute or kilobyte of use could decline over time due to the renegotiation of

existing contracts as a result of the aforementioned further industry consolidation. The foregoing could

have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

Other revenues

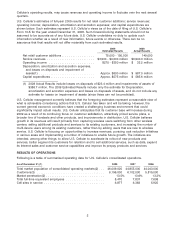

The increases in Other revenues in 2008 and 2007 were due primarily to increases in amounts that were

received from the USF for states in which U.S. Cellular has been designated as an ETC. In 2008, 2007

and 2006, U.S. Cellular was eligible to receive ETC funds in sixteen, nine and seven states, respectively.

ETC revenues recorded in 2008, 2007 and 2006 were $127.5 million, $98.0 million and $67.9 million,

respectively. As described in U.S. Cellular’s Form 10-K, Item 1. Business Description, under the heading

of ‘‘Regulation, Pending Proceedings—Universal Service,’’ ETC revenues may decline significantly in

future periods.

Equipment sales revenues

Equipment sales revenues include revenues from sales of handsets and related accessories to both new

and existing customers, as well as revenues from sales of handsets and accessories to agents. All

equipment sales revenues are recorded net of anticipated rebates.

U.S. Cellular strives to offer a competitive line of quality handsets to both new and existing customers.

U.S. Cellular’s customer retention efforts include offering new handsets at discounted prices to existing

customers as the expiration date of the customer’s service contract approaches. U.S. Cellular also

continues to sell handsets to agents; this practice enables U.S. Cellular to provide better control over the

quality of handsets sold to its customers, establish roaming preferences and earn quantity discounts

from handset manufacturers which are passed along to agents. U.S. Cellular anticipates that it will

continue to sell handsets to agents in the future.

The increase in 2008 Equipment sales revenues was driven by an increase of 10% in average revenue

per handset sold, primarily reflecting the sale of more expensive handsets with expanded capabilities.

Average revenue per handset sold was flat in 2007 compared to 2006. The increase in 2007 Equipment

sales revenues was due primarily to an increase of 3% in the number of handsets sold.

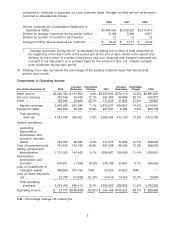

Operating Expenses

System operations expenses (excluding Depreciation, amortization, and accretion)

System operations expenses (excluding Depreciation, amortization, and accretion) include charges from

wireline telecommunications service providers for U.S. Cellular’s customers’ use of their facilities, costs

7