US Cellular 2008 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED STATES CELLULAR CORPORATION

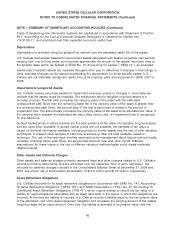

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

capitalized cost is depreciated over the useful life of the related asset. Upon settlement of the obligation,

any difference between the cost to retire the asset and the recorded liability (including accretion of

discount) is recognized in the Consolidated Statement of Operations as a gain or loss.

Treasury Shares

Common Shares repurchased by U.S. Cellular are recorded at cost as treasury shares and result in a

reduction of shareholders’ equity. Treasury shares are reissued as part of U.S. Cellular’s stock-based

compensation programs. When treasury shares are reissued, U.S. Cellular determines the cost using the

first-in, first-out cost method. The difference between the cost of the treasury shares and reissuance price

is included in Additional paid-in capital or Retained earnings.

Revenue Recognition

Revenues from wireless operations consist primarily of:

• Charges for access, airtime, roaming, long distance, data and other value added services provided to

U.S. Cellular’s retail customers and to end users through third-party resellers;

• Charges to carriers whose customers use U.S. Cellular’s systems when roaming;

• Sales of equipment and accessories; and

• Amounts received from the Universal Service Fund in states where U.S. Cellular has been designated

an Eligible Telecommunications Carrier (‘‘ETC’’).

Revenues related to wireless services are recognized as services are rendered. Revenues billed in

advance or in arrears of the services being provided are estimated and deferred or accrued, as

appropriate. Sales of equipment and accessories represent a separate earnings process. Revenues from

sales of equipment and accessories are recognized when title passes to the agent or end-user customer,

usually upon delivery.

In order to provide better control over handset quality, U.S. Cellular sells handsets to agents. In most

cases, the agents receive rebates from U.S. Cellular at the time the agents activate new customers for

U.S. Cellular service or retain existing customers. U.S. Cellular accounts for the discount on sales of

handsets to agents in accordance with EITF Issue 01-9, Accounting for Consideration Given by a Vendor

to a Customer (Including a Reseller of the Vendor’s Products) (‘‘EITF 01-9’’). This standard requires that

revenue be reduced by the anticipated rebate to be paid to the agent at the time the agent purchases

the handset rather than at the time the agent enrolls a new customer or retains a current customer.

Similarly, U.S. Cellular offers certain rebates to retail customers who purchase new handsets; in

accordance with EITF 01-9, the revenue from a handset sale which includes such a rebate is recorded

net of the anticipated rebate.

Activation fees charged with the sale of service only, where U.S. Cellular does not also sell a handset to

the end user, are deferred and recognized over the average service period. U.S. Cellular defers

recognition of a portion of commission expenses related to activations in the amount of deferred

activation fee revenues. This method of accounting provides for matching of revenues from activations to

direct incremental costs associated with such activations within each reporting period.

Under EITF Issue 00-21, Accounting for Multiple Element Arrangements (‘‘EITF 00-21’’), the activation fee

charged with the sale of equipment and service is allocated to the equipment and service based upon

the relative fair values of each item. This generally results in the recognition of the activation fee as

additional handset revenue at the time of sale.

44