US Cellular 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Loss on asset disposals, net

These amounts represent charges related to disposals of assets, trade-ins of older assets for

replacement assets and other retirements of assets from service. In 2007, U.S. Cellular conducted a

physical inventory of its significant cell site and switching assets. As a result, Loss on asset disposals,

net included a charge of $14.6 million in 2007 to reflect the results of the physical inventory and related

valuation and reconciliation.

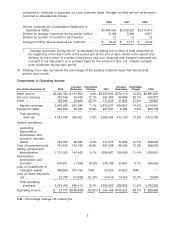

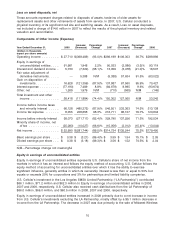

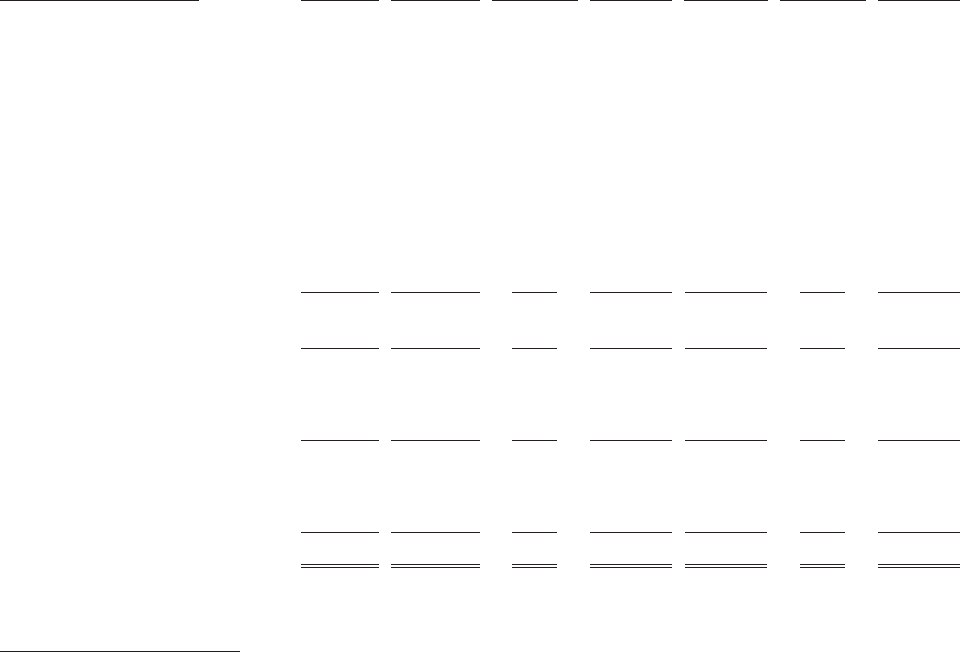

Components of Other Income (Expense)

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2008 (Decrease) Change 2007 (Decrease) Change 2006

(Dollars in thousands,

expect per share amounts)

Operating income .......... $27,710 $(368,489) (93.0)% $396,199 $106,303 36.7% $289,896

Equity in earnings of

unconsolidated entities ..... 91,981 1,948 2.2% 90,033 (3,086) (3.3)% 93,119

Interest and dividend income . . 5,730 (7,329) (56.1)% 13,059 (3,478) (21.0)% 16,537

Fair value adjustment of

derivative instruments ...... — 5,388 N/M (5,388) 57,634 91.5% (63,022)

Gain on disposition of

investments ............. 16,628 (121,359) (87.9)% 137,987 67,560 95.9% 70,427

Interest expense ........... (77,190) 7,489 8.8% (84,679) 8,995 9.6% (93,674)

Other, net ................ 1,269 1,979 N/M (710) (565) N/M (145)

Total investment and other

income ................ 38,418 (111,884) (74.4)% 150,302 127,060 N/M 23,242

Income before income taxes

and minority interest ...... 66,128 (480,373) (87.9)% 546,501 233,363 74.5% 313,138

Income tax expense ........ 8,055 208,656 96.3% 216,711 96,107 79.7% 120,604

Income before minority interest . 58,073 (271,717) (82.4)% 329,790 137,256 71.3% 192,534

Minority share of income, net

of tax ................. (25,083) (10,027) (66.6)% (15,056) (2,012) (15.4)% (13,044)

Net income ............... $32,990 $(281,744) (89.5)% $314,734 $135,244 75.3% $179,490

Basic earnings per share ..... $ 0.38 $ (3.21) (89.4)% $ 3.59 $ 1.54 75.1% $ 2.05

Diluted earnings per share .... $ 0.38 $ (3.18) (89.3)% $ 3.56 $ 1.52 74.5% $ 2.04

N/M—Percentage change not meaningful

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular’s share of net income from the

markets in which it has an interest and follows the equity method of accounting. U.S. Cellular follows the

equity method of accounting for unconsolidated entities over which it has the ability to exercise

significant influence, generally entities in which its ownership interest is less than or equal to 50% but

equals or exceeds 20% for corporations and 3% for partnerships and limited liability companies.

U.S. Cellular’s investment in the Los Angeles SMSA Limited Partnership (‘‘LA Partnership’’) contributed

$66.1 million, $71.2 million and $62.3 million to Equity in earnings of unconsolidated entities in 2008,

2007 and 2006, respectively. U.S. Cellular also received cash distributions from the LA Partnership of

$66.0 million, $66.0 million, and $60.5 million in 2008, 2007 and 2006, respectively.

Equity in earnings of unconsolidated entities increased in 2008 primarily due to a net increase in income

from U.S. Cellular’s investments excluding the LA Partnership, mostly offset by a $5.1 million decrease in

income from the LA Partnership. The decrease in 2007 was due primarily to the sale of Midwest Wireless

10